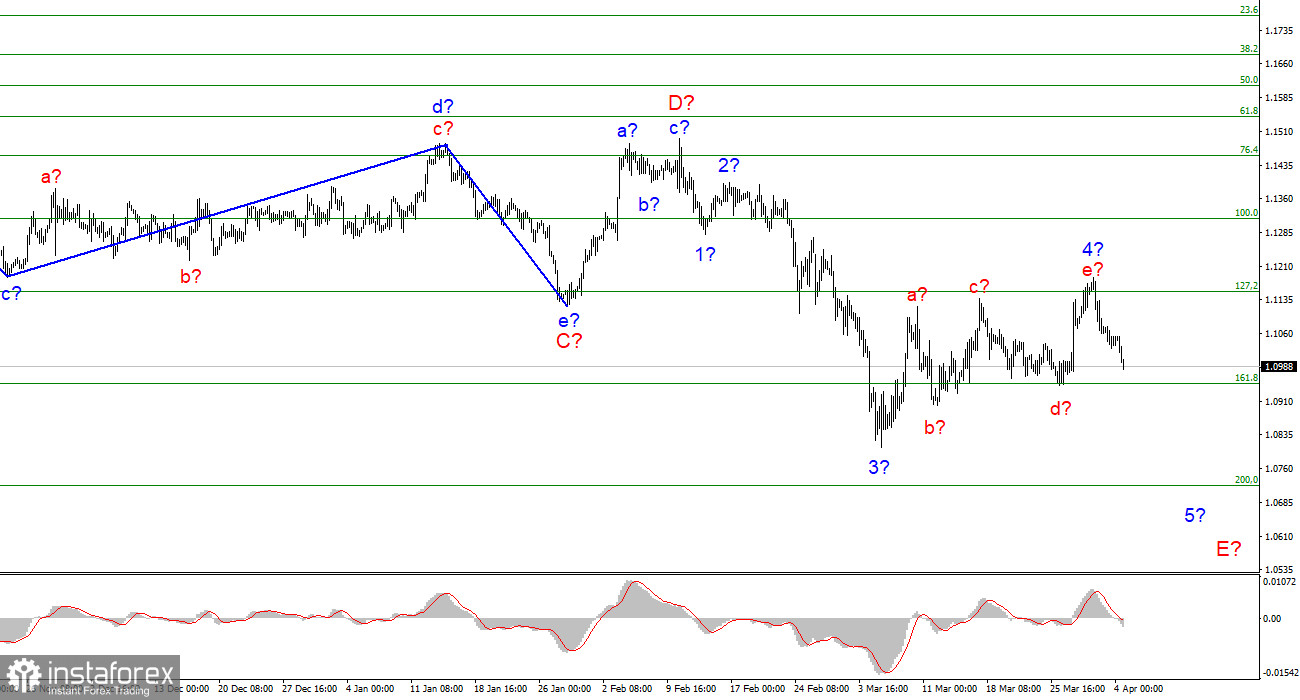

The wave marking of the 4-hour chart for the euro/dollar instrument has become more complicated due to the latest increase in quotes. Now the assumed wave 4 has taken a five-wave form and fits rather poorly into the current wave layout, in which the corrective wave 2 is very short. Nevertheless, the wave pattern does not require drastic changes right now. If the construction of the proposed wave 4 has ended after all (the wave can no longer take a more complex form), then the tool has started building the proposed wave 5 in E. If the increase in quotes resumes again, then the entire wave marking will require adjustments. I note that wave 4 looks like a correction in any case, and, accordingly, it cannot be the first wave of a new upward trend segment. The 127.2% Fibonacci level, near which waves a and c ended at 4, did not miss the instrument above itself. An unsuccessful attempt to break through it indicates that the market is ready for new sales of the instrument. Thus, at this time, the wave marking remains, and the demand for the US dollar is rising again due to the difficult geopolitical situation in Ukraine.

The euro currency has no other options but to decline

The euro/dollar instrument fell by 50 basis points on Monday. Important statistics from America on Friday were ignored, but this does not spoil the current wave markup in any way, since the demand for the US currency is still increasing, which is required. Thus, geopolitics and good statistics from America somehow increase the demand for the dollar. And there is no difference in which of these factors has a greater impact. The main thing in wave marking is its simplicity. If the wave markup is too complicated, then it will also be difficult to trade on it. Now the wave marking is almost unambiguous, and if no new factors interfere, it will continue to be executed.

Unfortunately, in the military conditions prevailing in Ukraine, new factors may appear. The market has already shown that it is ready to abandon dollar purchases if Ukraine and Russia sign a peace agreement and cease hostilities. Last week, such information was leaked in the media, but by the end of the week, it became clear that it did not correspond to reality. Kyiv and Moscow said that they had made progress in the negotiations, but this progress turned out to be insignificant. If there are, figuratively speaking, five issues on the agenda at the talks, then there should be progress on all five issues. If two were solved and three were not, then there is no point in this progress. This is exactly the situation that has developed now at the Ukrainian-Russian negotiations. There is no consensus on the issues of Crimea, Donbas, and a ceasefire, at least for the period of negotiations. Negotiations continue by themselves, military actions - separately. Consequently, the geopolitical background has not changed. And since it was he who pushed the euro/dollar instrument down in recent weeks, nothing has changed now and he will continue to push the euro down. Experts believe that in one way or another, the "military operation" may end in the coming weeks or months, but it is unlikely that it will end with a truce. In one form or another, the conflict will persist for many years. And Europe is already severing all ties with the Russian Federation.

General conclusions

Based on the analysis, I still conclude that the construction of wave E is currently underway. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave marking assumes the construction of a wave 5 in E. This option will be canceled in case of a successful attempt to break the 1.1153 mark, which is equivalent to 127.2% Fibonacci.

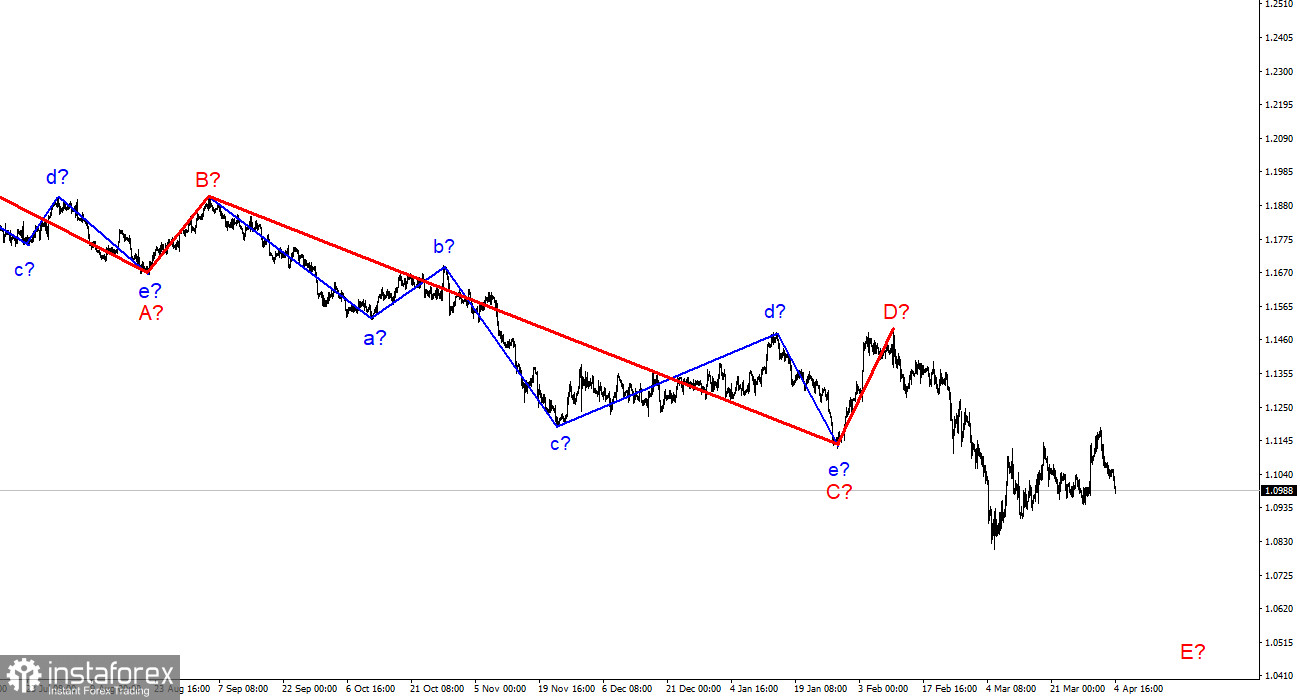

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română