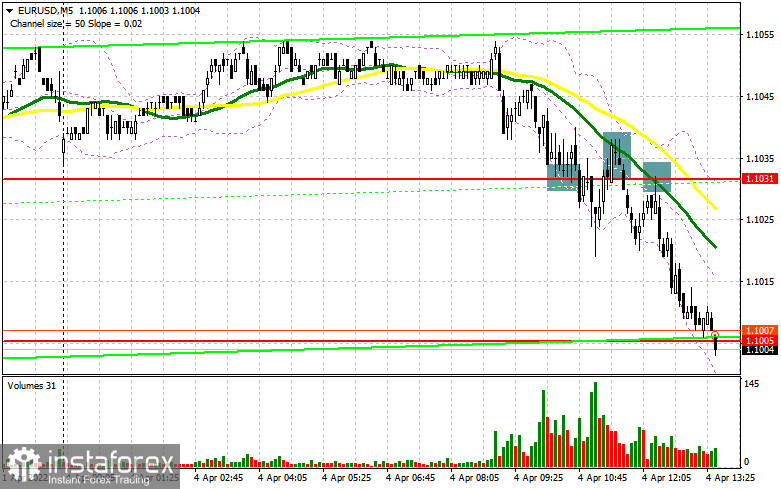

In my forecast this morning, I drew your attention to the level of 1.1031 and recommended entering the market from it. Let's have a look at the 5-minute chart and analyze what happened. The pair's decline towards that level and formation of a false breakout there created a buy signal for the euro, but it did not result in the uptrend. A sharp decline in investor confidence in the Eurozone led to the breakthrough and a bottom/top test of 1.1031. This allowed traders to close long positions at a breakeven point and sell the euro according to a new signal. Those who did not manage to do that were given a second opportunity after the pair tested 1.1031. As a result, the pair went down by more than 30 pips and hit the support at 1.1005.

Long positions on EUR/USD:

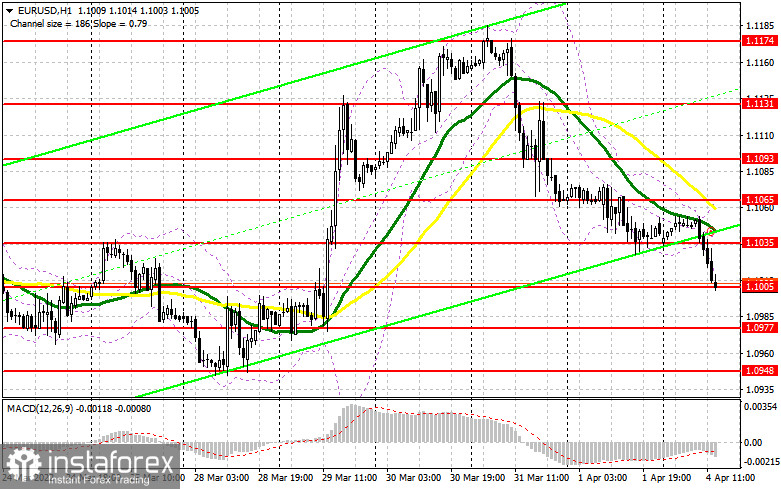

As I have previously noted, the sharp decline of the Sentix Investor Confidence indicator for April to -18 points put pressure on the pair and sent it to the area of 1.1005. Most likely, in the absence of bulls' activity at this level, the decline is likely to continue, as there is no more optimism on the geopolitical stage. European countries are preparing new sanctions against Russia and Belarus, which puts pressure on a number of risky assets. Rumors that Europe may completely refuse to import Russian gas, put pressure on the euro. This afternoon, only the data on Factory Orders in the US is published, which will not provide much support for either bulls or bears. However, strong readings are likely to put more pressure on the euro, which may cause the pair to retest the area of 1.1005. Only a false breakout at this level may give a first entry point into longs. To slow down the bearish trend, the pair needs some rallies and some more action from bulls near 1.1035, where the moving averages are located, which are playing on the bears' side. If the US data appears to be weak, bulls are unlikely to buy the euro. On the contrary, if the most positive scenarios come true, a breakthrough and a top/bottom test of 1.1035 cannot be ruled out. This scenario can create another buy signal, which is likely to open the way to the pair's recovery to the area of 1.1065 and 1.1093, where traders can lock in profits. If the pair shows a further decline and there is a lack of bulls' activity at 1.1005, it would be better to postpone the opening of long positions. A false breakout of the low at 1.0977 would be an optimal buy scenario. Traders can also open long positions on a pullback only from 1.0948, or lower near 1.0903, allowing an upward intraday correction of 30-35 pips.

Short positions on EUR/USD:

After weak eurozone data was released, clearly hinting at problems in the economy in the near future, bears showed their presence in the market. Notably, it is gradually coming under their control. As rumors of Ukraine dragging on negotiations, and it's been more than a week since the last meeting between the parties, the market sentiment is getting negative, which puts even more pressure on the Euro. Bears need to close today's trading session below resistance of 1.1035. In order to do that, they need to hold the price below this resistance. A false breakout at this level, and strong US data are likely to increase the pressure on the euro and create a sell signal. The price may continue to drop to the major support at 1.1005. A breakthrough and a reverse test bottom/top of this level can form an additional sell signal, which may send the pair to lows of 1.0977 and 1.0948, where traders are advised to lock in profits. If the euro rises and there are no actions from bears at 1.1035, which is an unlikely scenario for today, bulls will try to regain control over the market. In this case, it is better to postpone selling the pair. If a false breakout at 1.1065 occurs, short positions can also be opened. Selling the EUR/USD pair on the rebound is possible from 1.1093, or higher near 1.1131, allowing a downward correction of 20-25 pips.

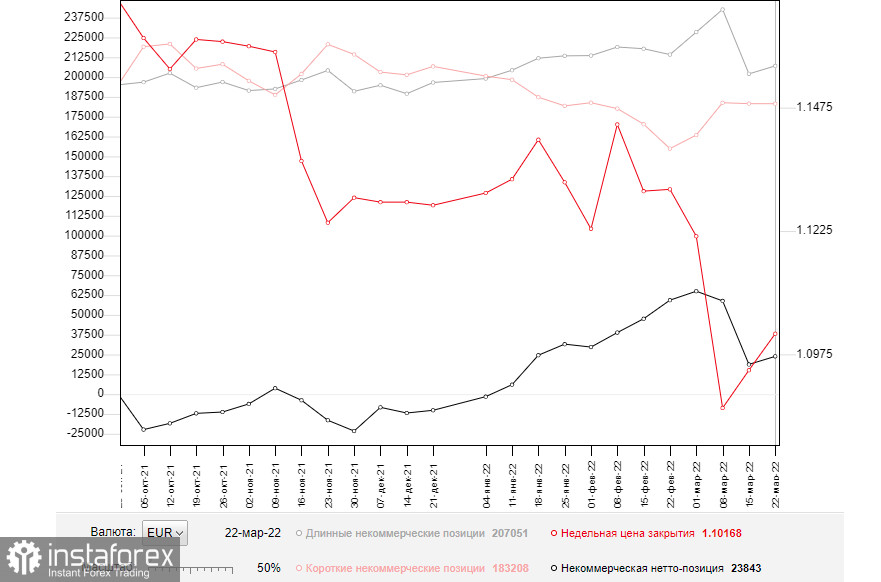

The COT (Commitment of Traders) report for March 22 showed a reduction in short positions and a sharp increase in the long ones. The pair reached yearly lows and major support levels which were positive for the euro. However, if we take a look at the numbers, you can see that there was a slight contraction in short positions. The pressure on EUR/USD returned after Fed Chairman Jerome Powell sharply changed his stance last week to more aggressive rhetoric. The chairman said on Monday that he expected a 50-point hike in key interest rates at the following meeting. Other representatives of the Federal Reserve made similar statements, which made market participants revise their forecasts. The risk of higher inflation in the US is the main reason for changes in the central bank's policy. Meanwhile, the European Central Bank also held a meeting where President Christine Lagarde announced plans for a more aggressive tapering of economic support measures and raising of interest rates. It appeared to be good for the medium-term outlook of the euro, which is already heavily oversold against the US dollar. The positive outcome of the Russia-Ukraine meeting and decrease of geopolitical tensions will play on the side of bulls. The COT report indicates that long non-commercial positions rose to 207,051 from 202,040, while short non-commercial positions declined to 183,208 from 183,246. At the end of the week, total non-commercial net positions were up to 23,843 against 18,794. The weekly close price rose slightly to 1.1016 from 1.0942.

Indicators' signals

Moving averages

The pair is trading below the 30- and 50- day moving averages, which indicates a further decline of the euro.Note: Period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands

In the case of the growth of the pair, the middle boundary of the indicator at 1.1035 will act as resistance.

Description of indicators

- Moving average defines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average defines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20.

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total number of open long positions of non-commercial traders.

- Short non-commercial positions represent the total number of open short positions of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română