Analysis and tips on how to trade EUR/USD:

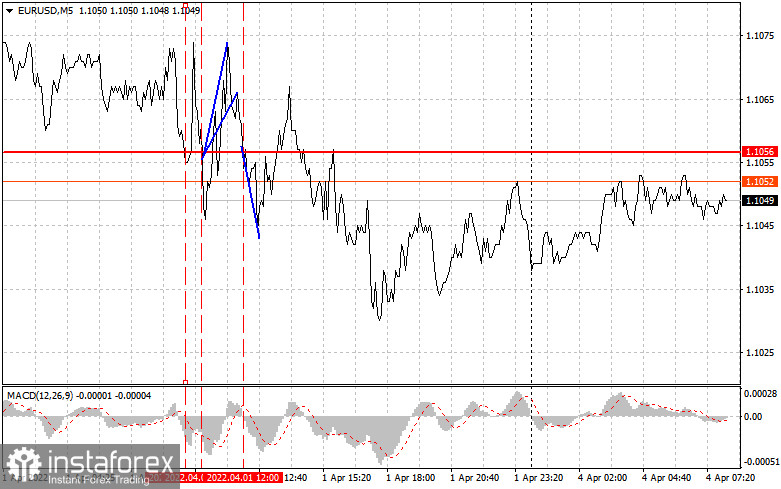

The price tested the 1.1056 mark when the MACD was far below the zero line, which limited the pair's downside potential. In this light, I decided not to sell the euro and expected BUY Scenario 2 to unfold. A retest of the 1.1056 level with the MACD being in the oversold zone had produced a buy signal, and the price rose by 15 pips. The quote retested the 1.1056 mark one more time by the middle of the trading day. Back then, the MACD just started to move down from the zero line. Eventually, the euro fell by about 15 pips. Ahead of labor market data in the US, sentiment drastically changed and no more good entry points were created.

Disappointing PMI data in Germany, France, and the eurozone exerted pressure on the euro during the European session. Meanwhile, labor market statistics in the US came in mixed, logging a decrease in unemployment and a steep fall in NonFarm Payrolls. Today, the eurozone Sentix investor confidence index will attract the attention of market players during the European session. The expected drop in the indicator is likely to weigh on the euro in the first half of the day. Therefore, the right option today would be to sell the instrument. No significant macro events able to trigger market jitters are expected during the North American session. US factory orders will be of little interest to traders.

Buy signal

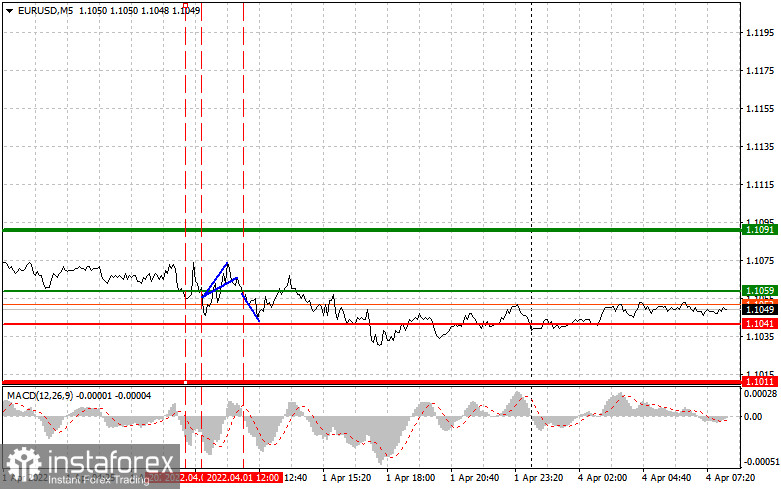

Scenario 1: You could go long today when the price reaches 1.1059 (the green line on the chart), with the target at 1.1091 where you should consider closing your positions and selling the euro, allowing a 20-25 correction. The euro is unlikely to show steep growth today. Important! Before buying the instrument, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: Likewise, long positions could be opened today if the quote touches 1.1041 when the MACD is in the oversold zone. This could limit the pair's downside potential and lead to an upward reversal in the market. The price may head either towards 1.1059 or 1.1091.

Sell signal

Scenario 1: You could go short today when the price hits 1.1041 (the red line on the chart), with the target at 1.1011 where you should consider closing your positions and buying the euro, allowing a 20-25 pips correction. Pressure on the euro could return if the eurozone data come in disappointing. Important! Before selling the instrument, make sure the MACD is below zero and just starts to move down from this level.

Scenario 2: Likewise, short positions could be opened today if the price reaches 1.1059 when the MACD is in the overbought zone. This could limit the pair's upside potential and lead to a downward reversal in the market. The quote may go either to 1.1041 or 1.1011.

Indicators on the chart:

The thin green line indicates a buy entry point.

The thick green line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to grow above this level.

The thin red line indicates a sell entry point.

The thick red line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to fall below this level.

MACD. When entering the market, it is important to pay attention to the overbought and oversold zones.

Remember that novice forex traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure to always place a stop-loss order to minimize losses. Without it, you may quickly lose your entire deposit, especially if you do not use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română