The EUR/USD currency pair showed absolutely nothing on Friday. Although there were a lot of macroeconomic statistics on the last trading day of last week, the volatility of the day was 48 points. From our point of view, this is an inexplicable fact. Moreover, it cannot even be said that the macroeconomic statistics were unimportant, or that the actual values of the published data were "neutral". That's not so. The most important consumer price index in the European Union, Nonfarm in the USA - only this was enough for the market to trade very actively. Let's take a closer look at the most important report - inflation in the European Union. It has grown to a completely unthinkable 7.5% y/y, although a month ago it was 5.9%. This means that inflation continues not just to grow, it continues to accelerate. In recent weeks, ECB President Christine Lagarde has repeatedly stated that stagflation does not threaten the European economy. However, it is stagflation that we are already seeing right now. Recall that this term refers to the combination of high inflation and recession.

In the fourth quarter of last year, GDP showed an increase of only a few tenths of a percent, and inflation has already risen to 7.5%. This is the highest inflation rate in the last 25 years. Thus, the ECB and the entire European Union are now in a position where there is simply nothing to extinguish inflation. Moreover, the ECB continues to pour billions of euros into its economy under the APP program. It was only at the last meeting that it was announced that this program would be reduced and would end this summer. However, summer is still far away, and the end of summer is even further away. Consequently, ignoring even the growing oil and gas and the geopolitical conflict in Ukraine, the ECB itself provokes a rise in prices, as it increases the money supply. What kind of fight against inflation can we talk about? Therefore, at this time, there is not only any reason to reduce inflation, there are very real reasons for its further growth. And this growth does not mean that the ECB will start raising rates, which would mean tightening monetary policy, which usually leads to a strengthening of the national currency. More precisely, the ECB openly declares that it will not raise rates in 2022. With such a fundamental background, how can we expect the strengthening of the euro currency? And even if the ECB changes its position and starts raising rates towards the end of the year, at that time rates in the States will already be about 2%. That is, the ECB will still be in the role of catching up.

What the new week is preparing for the Euro currency?

The European currency has been experiencing great difficulties in the last few weeks, but it is showing growth. This growth is corrective, as can be seen from deep pullbacks and corrections against the main movement. At the moment, a new pullback has begun, during which the price has already consolidated below the moving average. And this means that the trend has changed to a downward one. The geopolitical background remains complex, the fundamental one is even worse, the Eurozone is on the verge of a food and energy crisis. Therefore, we believe that the euro will resume falling against the dollar in the near future. Macroeconomic statistics are now somewhere at the very end of the list of significant factors for traders. This was perfectly demonstrated on Friday when the market ignored both inflation and Non-Farm.

There are extremely few important planned events in the EU this week. On Tuesday, the index of business activity in the service sector. On Wednesday, the index of business activity in the construction sector. Thursday - retail sales. That's all. Who is interested in business activity indices in the market right now? What could be the reaction to these reports if traders did not consider the inflation report important? Thus, we believe that all these reports will pass by the market. And if so, then traders will pay attention to geopolitical news, and they will trade following the general fundamental background, which, as we found out above, remains extremely negative for the euro. Moreover, now it can be stated that the euro currency has adjusted, which means that it has the technical capabilities for a new fall.

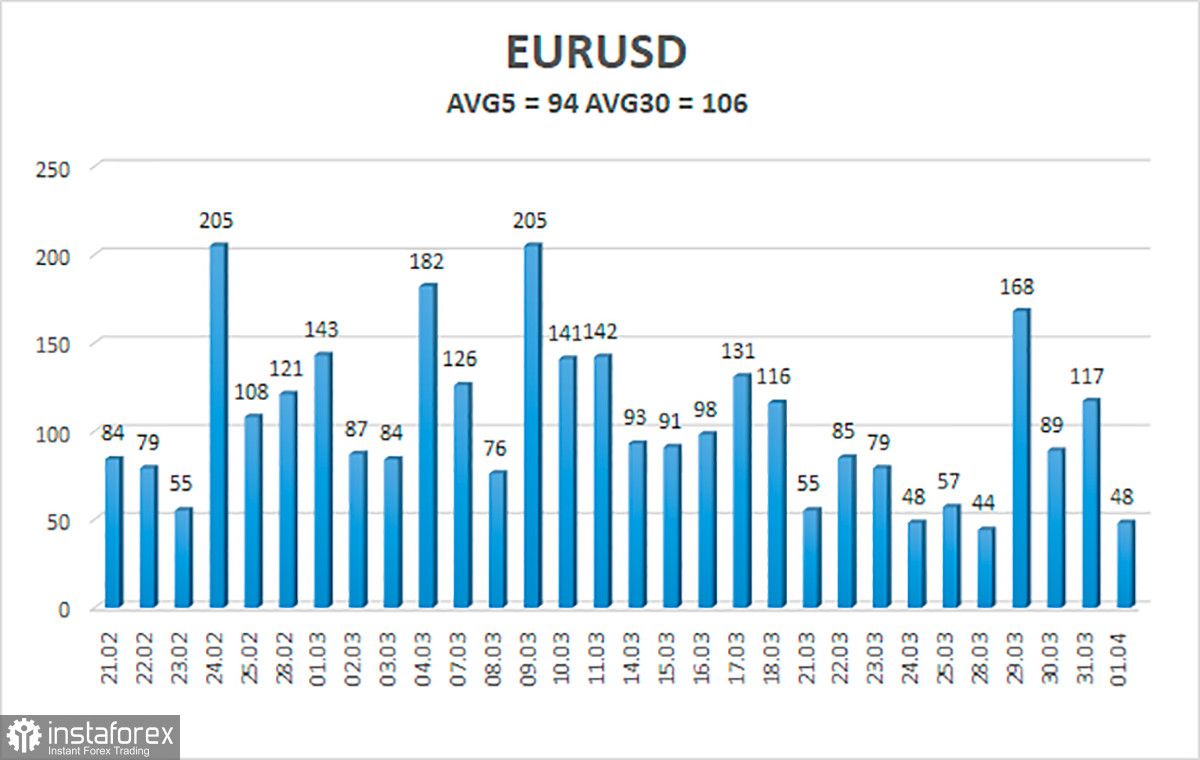

The volatility of the euro/dollar currency pair as of April 4 is 94 points and is characterized as high. Thus, we expect the pair to move today between the levels of 1.0952 and 1.1141. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.0986;

S2 – 1.0864;

S3 – 1.0742.

Nearest resistance levels:

R1 – 1.1108;

R2 – 1.1230;

R3 – 1.1353.

Trading recommendations:

The EUR/USD pair has consolidated below the moving average line. Thus, now you should stay in short positions with targets of 1.0986 and 1.0952 until the Heiken Ashi indicator turns up. Long positions should be opened with targets of 1.1108 and 1.1141 if the pair is fixed back above the moving average.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română