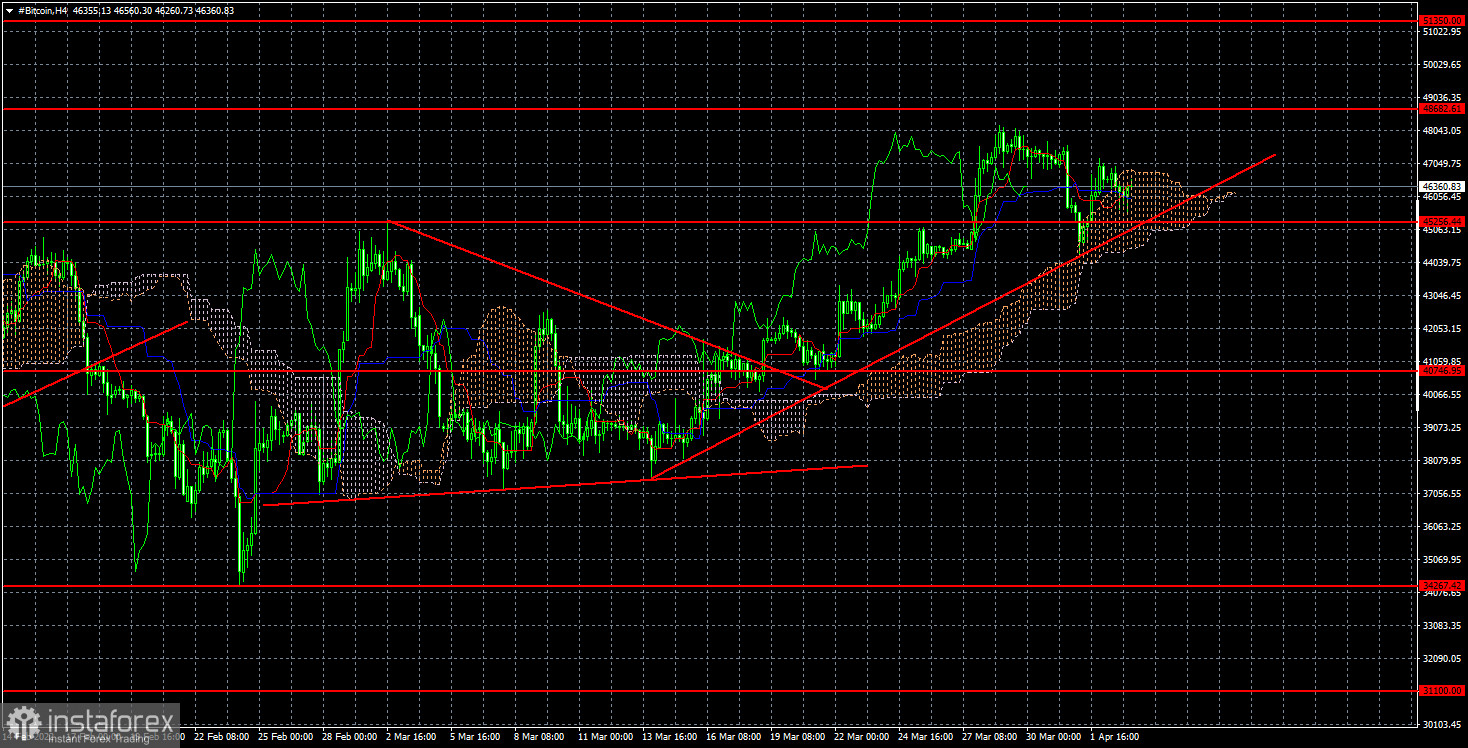

On the 4-hour TF, bitcoin continues to be located above the ascending trend line, so the short-term upward trend persists. It is short-term because it began its formation only on March 14. Moreover, despite overcoming the level of $ 45,256 and the subsequent rebound from above, the price is located only slightly above it. Therefore, at any moment, there may be a consolidation under the trend line, which will change the current trend to a downward one. If this happens, the fall will begin with the first target of $ 40,746. Thus, there is an upward trend, but it is very weak and not stable. It needs the support of a fundamental background, which is not and is not expected in the near future.

VanEck believes that $5 million for 1 coin can become a reality.

Meanwhile, the hit parade of crazy predictions on the future value of bitcoin continues. For example, the investment company VanEck from the USA believes that in the "foreseeable future" $ 4.8 million can be offered for 1 bitcoin coin. However, this will only be possible if bitcoin becomes the world's reserve currency and begins to displace the dollar. Similar forecasts began to appear after the assets and reserves of the Central Bank of the Russian Federation for about $ 300 billion were frozen. Some experts believe that this may be the beginning of the rejection of the "sanctioned" countries from the dollar and the euro, and they may eventually be joined by the countries of the "Eastern Bloc", which also do not much favor the West and their currencies. However, this forecast has so many "buts" that it cannot be considered a full-fledged forecast. First, China, as one of the largest opponents of the West, has already completely banned cryptocurrencies on its territory. Second, there are several countries under serious Western sanctions, such as Russia, Iran, Venezuela, and the DPRK. Even if these countries refuse to settle in dollars and euros, the losses are small, as they say. In addition, it should be understood that assets in cryptocurrencies can also be frozen, or the possibility of using them will simply become unavailable. After all, it's no secret that all cryptocurrency transactions go through exchanges, which can block the access of certain users from certain countries under pressure from the governments of other countries. If we are talking about securities and funds that are somehow based on cryptocurrencies, then such central banks are no different from classic central banks. They also have to be stored somewhere and can be frozen or confiscated.

It turns out that the point is not in what currency you have reserves, but in where they are located. Well, the idea of replacing the dollar with bitcoin now seems simply utopian. Bitcoin has not been able to conquer the $ 100,000 mark, although the absolute majority of experts gave such a forecast for 2021. And now, when a geopolitical military conflict is taking place in Europe, and the Fed is going to raise the rate to 2.5-3%, it is hardly worth counting on the powerful growth of the "bitcoin".

In the 4-hour timeframe, the quotes of the "bitcoin" came out of the triangle and after that continued to grow. It was not possible to gain a foothold below the level of $ 45,256, so now the upward trend continues. But we still do not believe that growth will last for a long time. We expect the cryptocurrency to consolidate below the trend line in the near future and begin a new round of decline. In this case, it will be possible to sell with a target of $ 40,746.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română