The last trading week formally ended in favor of the bulls of the EUR/USD pair. On Monday, trading started at 1.0985, and on Friday it closed at 1.1042. But the events of recent days suggest that the dollar has started to gain momentum again, taking advantage of the current situation. On the side of the greenback is the continuing geopolitical instability, a decrease in unemployment in the United States (against the background of rising inflation) and the weak position of the European currency. All this makes it possible for EUR/USD bears to dictate their conditions for the pair.

It is indicative of the fact that traders this week were unable to settle in the area of the 11th figure, although they not only overcame the 1.1100 mark, but also tested the resistance level of 1.1150 (the upper line of the Bollinger Bands indicator on the D1 timeframe). However, bulls could not keep the height. Moreover, the downward pullback looked swift and confident – it is likely that if not for the weekend, bears would have been able to return to the area of the 9th figure, confirming the strength of the trend.

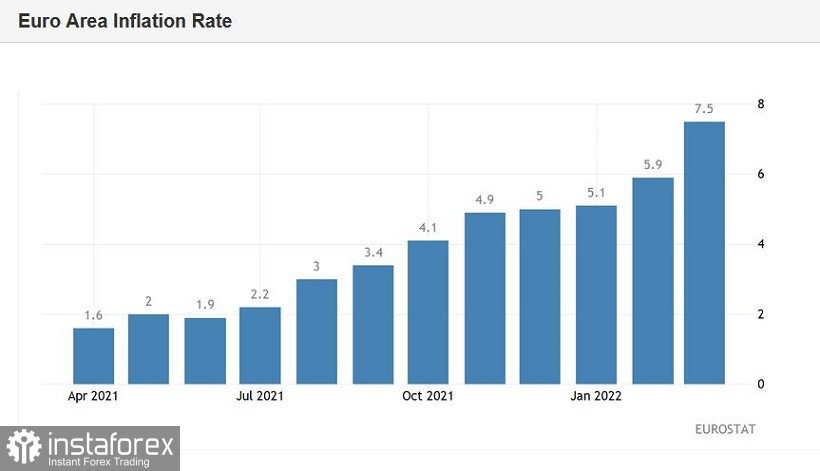

Another fact is also noteworthy: the euro was actively losing its position against the background of a record increase in European inflation. Friday's data exceeded even the wildest expectations. The overall consumer price index reached 7.5% in March, while in February it was at 5.9%. We are talking about another historical record. According to the statistical service, this is the highest value of the indicator for the entire history of observations, that is, since 1997. Core inflation also came out in the green zone, exceeding the forecast values.

But at the same time, the euro reacted to the release very modestly. The EUR/USD pair impulsively rose by literally two dozen points, but almost immediately turned down. This is an indicative moment, which suggests that the pair can grow confidently only if the US currency weakens. The euro did not have its "own" arguments, and it does not. To be more precise, traders simply ignore many fundamental factors. And it's not just about the inflation release. The market, for example, ignored the "conditionally hawkish" comments of the European Central Bank's chief economist Philip Lane, who said that "the central bank may rethink the timing of the completion of the quantitative easing program." I note that Lane is a representative of the dovish wing of the ECB, so such statements should have strengthened the position of the single currency. But they didn't strengthen it. The euro is moving in the wake of the dollar, which, in turn, this week reacted to the geopolitical news flow and Nonfarm.

The optimism associated with the results of the "Istanbul meeting" gradually faded. This allowed the safe greenback to remind itself again. It should be noted here that geopolitical factors a priori need constant "feeding". The negotiations in Turkey did indeed consolidate some progress – representatives of both sides admit this – but then the negotiators fell silent again, creating a "vacuum information shell". On the one hand, according to the majority of specialized specialists, this is how it should be – "negotiations like silence." On the other hand, investors' optimism cannot be based only on declarative intentions (which were indicated in Istanbul) and expert assumptions (and very contradictory ones). That is why the dollar began to gain momentum again at the end of the trading week. It is obvious that without additional informational "recharge" (of an optimistic nature), the craving for risk will continue to decrease.

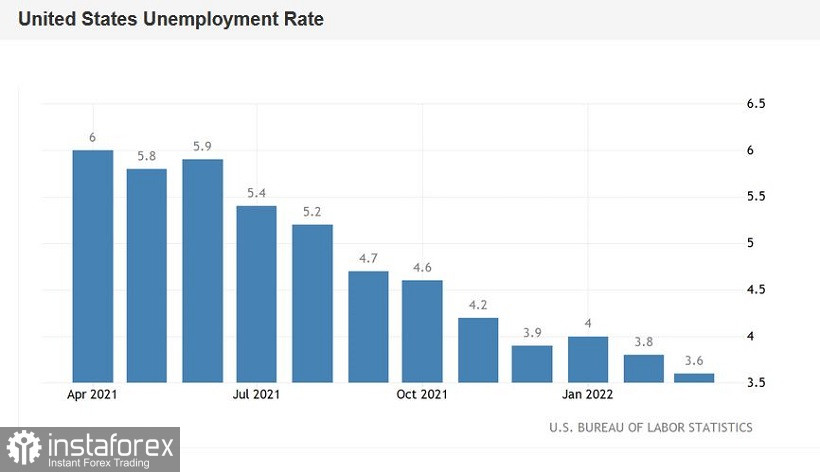

In addition, the dollar has recently been receiving strong signals from macroeconomic statistics. For example, the core PCE index jumped to 5.4% in annual terms. This is the strongest growth rate since June 1983. The indicator has been consistently and steadily growing for six months. And the Nonfarm report was published on Friday, which also reflected certain trends. The unemployment rate fell again (this time to 3.6%), and the average hourly wage rose to 5.6% in annual terms.

Overall, recent reports have reinforced hawkish expectations. The market is increasingly saying that the Federal Reserve may decide on a 50-point rate hike not only in May, but also in June. Some representatives of the Fed already publicly support such a scenario. In particular, the head of the Federal Reserve Bank of Chicago, Charles Evans, said that he "does not see any big risks in raising the rate by 50 points several times."

Thus, the dollar received support from many fundamental factors last week. The "silence" around the negotiation process between Russia and Ukraine, the strengthening of US inflation and a decrease in unemployment in America, the increase in the yield of 10-year treasuries and the growth of hawkish expectations regarding the Fed's further actions. All these factors put pressure on the EUR/USD pair at the end of last week, and, apparently, they will put pressure on next week. Therefore, short positions remain a priority: it is advisable to use any more or less large-scale upward pullbacks to enter short positions. The first downward target is the 1.1000 mark (the average line of the Bollinger Bands on the D1 timeframe). The main goal is the 1.0950 target. This is a fairly powerful level of support, which the bears could not overcome in March, despite numerous attempts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română