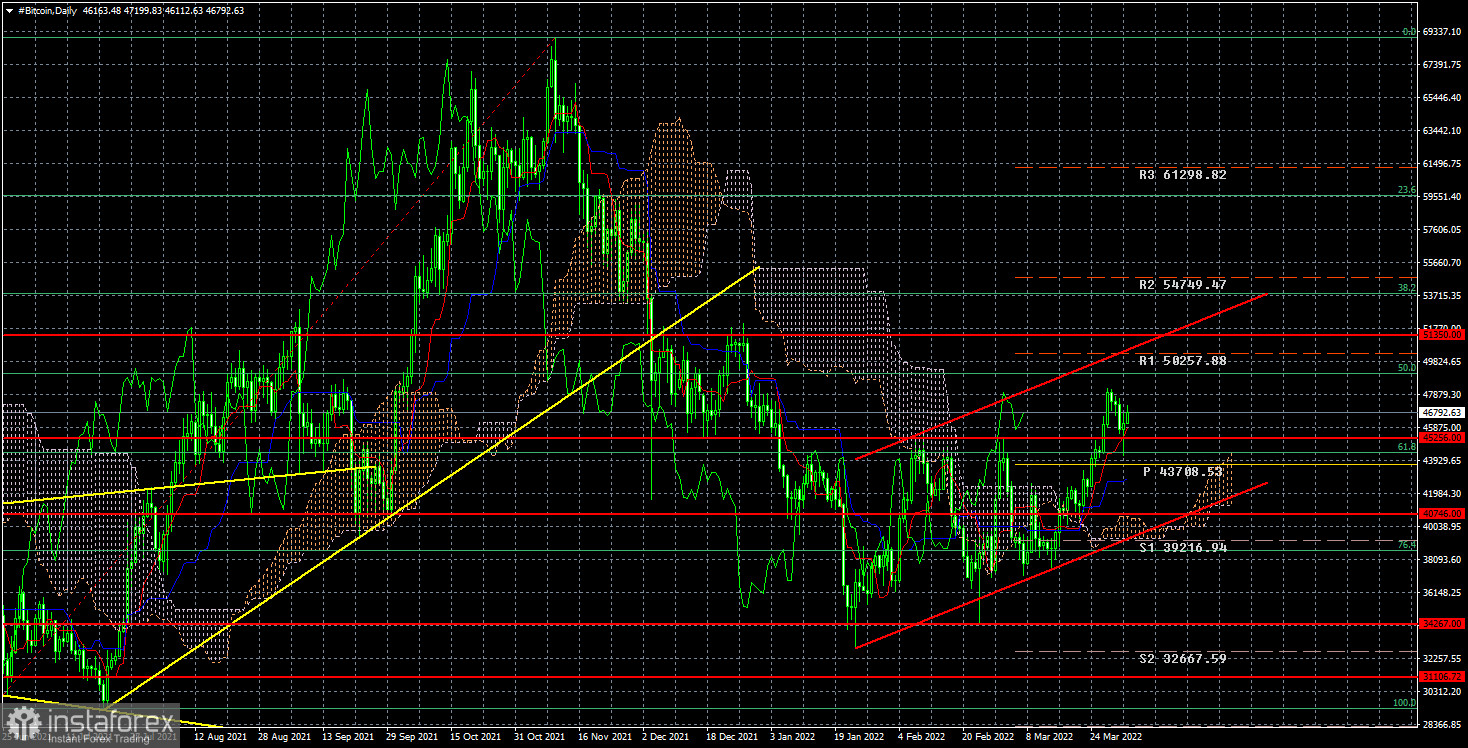

Over the past week, the first cryptocurrency in the world has managed to overcome the important level of $ 45,256, so we are now considering an option in which bitcoin will become more expensive for some time. It is difficult to say exactly how long this process will last. We believe that now we should pay attention to the fact that in the period from November to January, bitcoin has significantly decreased in value. If we assume that this movement was the beginning of a new downward trend, then at this time, an upward correction has begun, after which the fall will resume. If we try to compare this hypothesis with the fundamental background, then everything turns out very nicely. Recall that at this time, the fundamental background is not just what is happening right now. It can be more or less accurately predicted for the whole of 2022.

The first thing to remember is that the Fed will raise the rate throughout 2022. Mainly by 0.25%, but several times an increase of 0.5% may follow. Recall also that any tightening of monetary policy increases the demand for safe assets and reduces the risk. Risky ones are in demand when monetary policy is "ultra-soft", that is, as it was in 2020-2021 when bitcoin was actively growing. Now begins a long period when the policy will be tightened. By the end of this year, the rate may reach 2.5%, which is a neutral level. However, the Fed is already saying that 2.5% is not the end of it. The rate will be raised in 2023 until inflation returns to its target value of 2%. Given that inflation now stands at 7.9% and there are no signs of its beginning to slow down, the rate will have to be raised for a very long time.

Further, this summer the Fed may begin unloading its balance sheet, which is the reverse process of stimulation. Consequently, there will be less money in the economy, investments will decrease. With falling inflation (and this is exactly the goal pursued by the Fed), bitcoin will lose another demand factor, since in recent years many investors have used it as an inflation hedging tool. As a result, we have a picture in which 2022-2023 will be a time of tightening and it is difficult to imagine that at the same time bitcoin and the cryptocurrency market will ignore such serious changes in the economy and continue to grow and update the maximum value.

Someone may say: "but now bitcoin is growing". Yes, it can show growth from time to time. If the fundamental background is unfavorable, this does not mean that bitcoin will now fall constantly and recoilless. Now we can just observe such a correction. And fixing below the ascending channel can signal its completion. In this case, we will again wait for a fall to the level of $ 31,100, and then much lower. The bullish trend is over, and we are waiting for a fall of 80-90%.

In the 24-hour timeframe, the quotes of the "bitcoin" have overcome the level of $ 45,256 and are currently holding above it and inside the ascending channel. Thus, purchases are relevant now, but the current growth is corrective, it may end in the near future. Sales should be considered after fixing below the ascending channel with targets of $ 34,267 and $ 31,100.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română