Today's macroeconomic releases did not help either the bulls or the EUR/USD bears. The bears could not significantly strengthen yesterday's success, and bulls, accordingly, could not turn the situation in their favor. In general, the mood for the pair remains bearish, although conflicting reports did not allow traders to impulsively go to the base of the 10th figure with a subsequent aim at 1.0950.

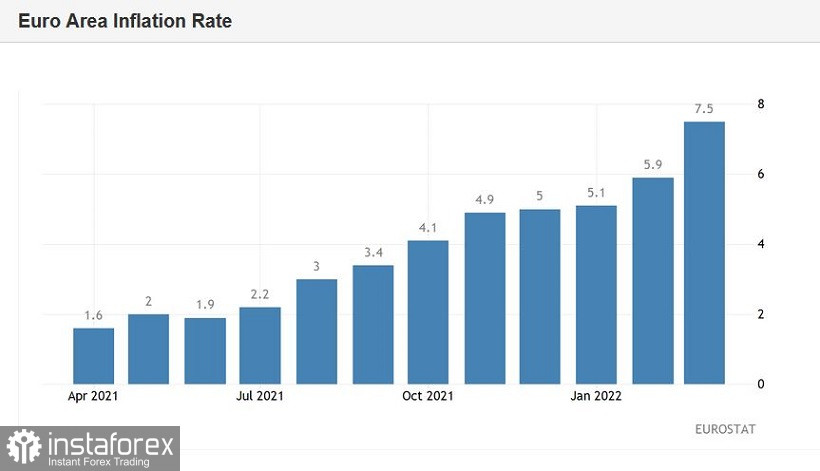

So, in the first half of today, EUR/USD bulls were pleased with European inflation. The consumer price index was again in the green zone and again distinguished itself with record growth. Thus, the overall CPI in March shot up, reaching 7.5% (it was at 5.9% in February). This is another historical record, that is, the highest value of the indicator for the entire history of observations (since 1997). The result was higher than most experts' forecasts: analysts polled by Reuters expected it to come out at 6.7%. The core consumer price index (excluding volatile energy and food prices) also showed good dynamics, rising to a three percent mark. Analyzing the structure of the release, we can conclude that energy prices have increased the most in the eurozone countries. Last month they increased by 44.7%. Prices for food, alcohol and tobacco products increased by 5%. The cost of services increased by 2.7% compared to 2.5% in February.

Reacting to this data, the EUR/USD pair updated the intraday high, but almost immediately fell. By and large, the market was ready for such results, especially after the release of data on the growth of German inflation. Let me remind you that in Germany, the consumer price index also showed a fairly strong growth: in annual and monthly terms, the indicators also came out in the green zone, signaling similar trends on a pan-European scale.

In addition, as already mentioned above, the growth of the pan-European consumer price index was mainly due to an increase in energy prices. Despite the impending (probable) energy crisis, representatives of the European Central Bank are still confident that the situation will normalize this year, and volatility will decrease. In this context, it should be noted that there was information that Russia will not stop gas supplies to Europe from April 1. According to the Russian president's press secretary Dmitry Peskov, the transition to payment in rubles for Russian gas exports "does not mean that in the absence of such payments, supplies will be stopped from today." At the same time, he added that the decree on the new payment system for Russian gas could be canceled if "other conditions" come.

Returning to European inflation, it is worth saying that the market showed a very modest reaction to the record release for another reason: traders do not expect the ECB to tighten its rhetoric or (especially) monetary policy in the foreseeable future. It is worth recalling that a month ago, the eurozone similarly surprised investors with a record increase in inflation, but the members of the ECB actually ignored this fact, demonstrating passive-expectant behavior at the next meeting. At the moment, the rhetoric has changed somewhat, but only in the context of QE. For example, ECB chief economist Philip Lane said that if the inflation forecast worsens, "the ECB will rethink the timing of the end of quantitative easing." At the same time, he pointed to a relatively weak growth in the level of wages.

Actually, for this reason, EUR/USD bulls did not uncork the champagne on Friday. The single currency briefly strengthened its position, but then followed the greenback, which reacted to the published Nonfarm.

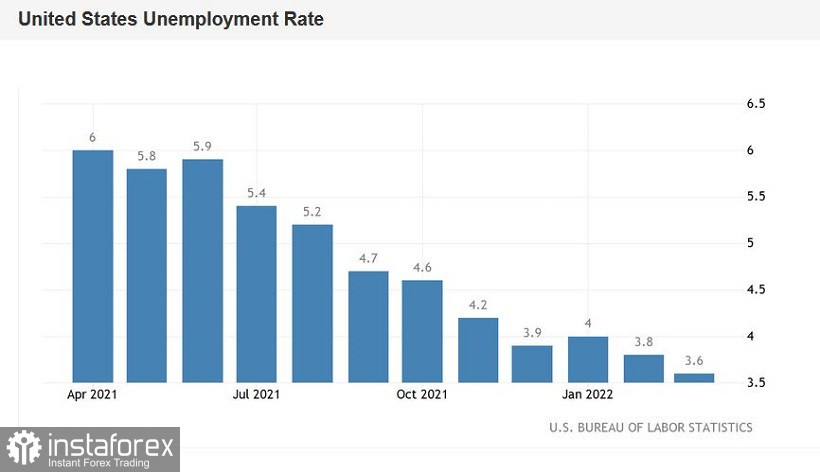

Thus, the unemployment rate in the United States fell to 3.6% in March. This is the best result since March of the year before last. Before the coronavirus crisis, this indicator for several years – from November 2017 to March 2020 – fluctuated in the range of 3.5% -4.1%. This suggests that unemployment has now de facto returned to the area of pre-crisis values. Dollar bulls and salaries were also pleased. The average hourly wage rose to 5.6% (in annual terms) and to 0.4% (on a monthly basis). Both components came out in the green zone.

On the reverse side of the coin is a weak increase in the number of people employed in the non-agricultural sector. This indicator increased by 430,000, with a forecast of growth to 510,000 and the previous value of 750,000. 426,000 jobs were created in the private sector of the economy (forecast – 490,000), 38,000 in the manufacturing sector. In other words, the rate of job growth decreased relative to the previous reporting period.

And yet, despite the flaws of Nonfarm, the mood remains bearish. Indeed, in general, the key data on the labor market reflected positive trends – the unemployment rate is declining, wages are rising. Such dynamics suggest that the Federal Reserve will continue to pursue a course of tightening monetary policy. The ECB is less "mobile" in this regard, given the risk of an energy crisis, geopolitical instability in Eastern Europe and weak wage growth in the eurozone.

Thus, for the EUR/USD pair, short positions are still relevant for any more or less large-scale upward bursts. The first target of the downward movement is the 1.1000 mark (the average line of the Bollinger Bands indicator on the daily chart). The main goal is 0.0950. This price barrier has been on the defensive for two weeks in March, so it is a fairly strong support level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română