Hi, dear traders!

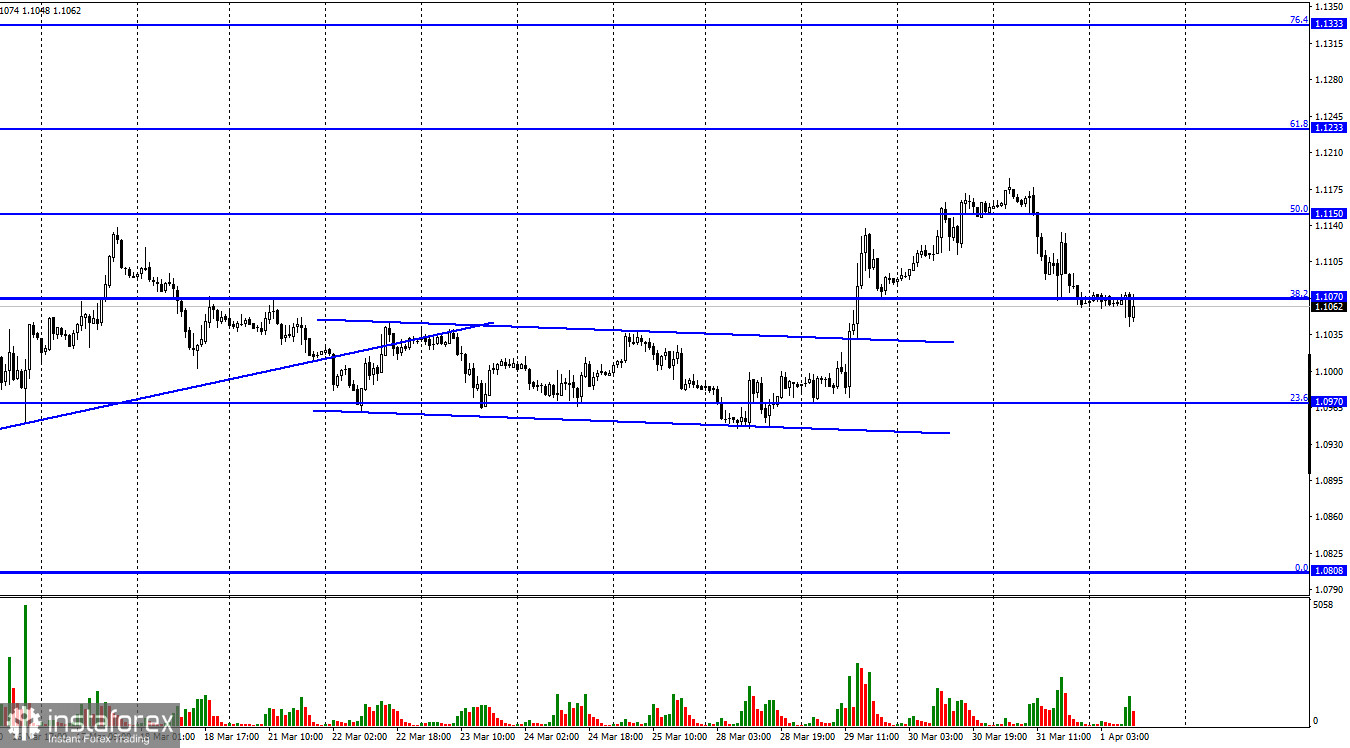

On Thursday, EUR/USD reversed downwards and fell towards the retracement level of 38.2% (1.1070). On Friday, the quote settled below this level - it could decline further towards the next Fibo level of 23.6% (1.0970). If the pair closes above 1.1070, it could increase slightly towards the retracement level of 50.0% (1.1150). According to the latest EU data, unemployment in the eurozone has slightly decreased to 6.8% from 6.9% in February, which is still 2 times higher than in the US. Several US data releases failed to attract the attention of investors yesterday. In the meantime, EUR is sliding down due to geopolitical factors.

Early this week, reports suggested there was a diplomatic breakthrough in peace talks between Ukraine and Russia in Turkey. As a result, traders began actively going long on EUR. However, reports on Thursday suggested this was not the case, and negotiations between Putin and Zelensky were not scheduled at that point. Peace talks are ongoing, while the Russian army continues combat operations in Ukraine. The peace treaty is now unlikely to be signed in the near future. In the meantime, Russia and the EU remain at loggerheads over payments for Russian natural gas exports. The latest reports suggest EU would have to transfer payments in EUR to Gazprombank, which would then convert euros into Russian rubles and transfer RUB to Gazprom.

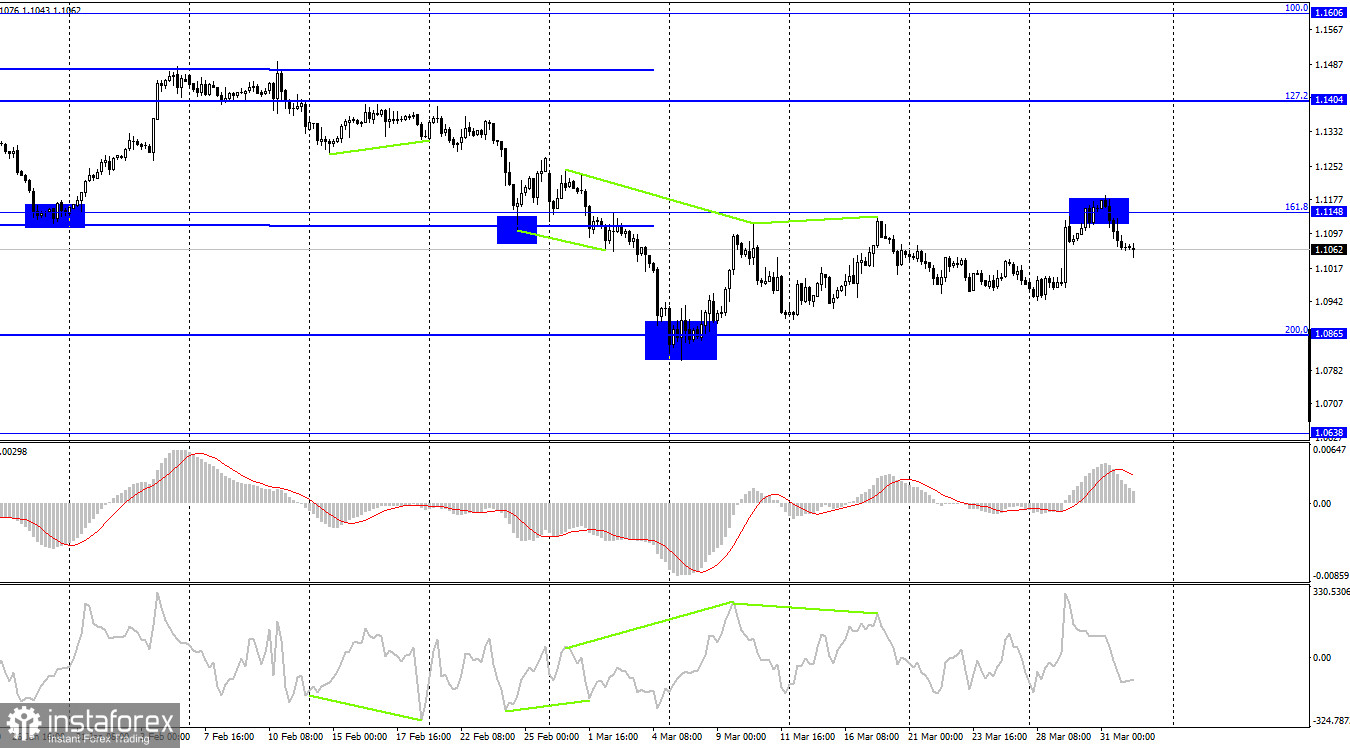

According to the H4 chart, the pair bounced off the retracement level of 161.8% (1.1148) downwards. EUR/USD is now falling towards the Fibo level of 200.0% (1.0865). Indicators show no signs of emerging divergences today. If the quote settles above the 161.8% level, it could reverse upwards towards the next retracement level of 127.2% (1.1404).

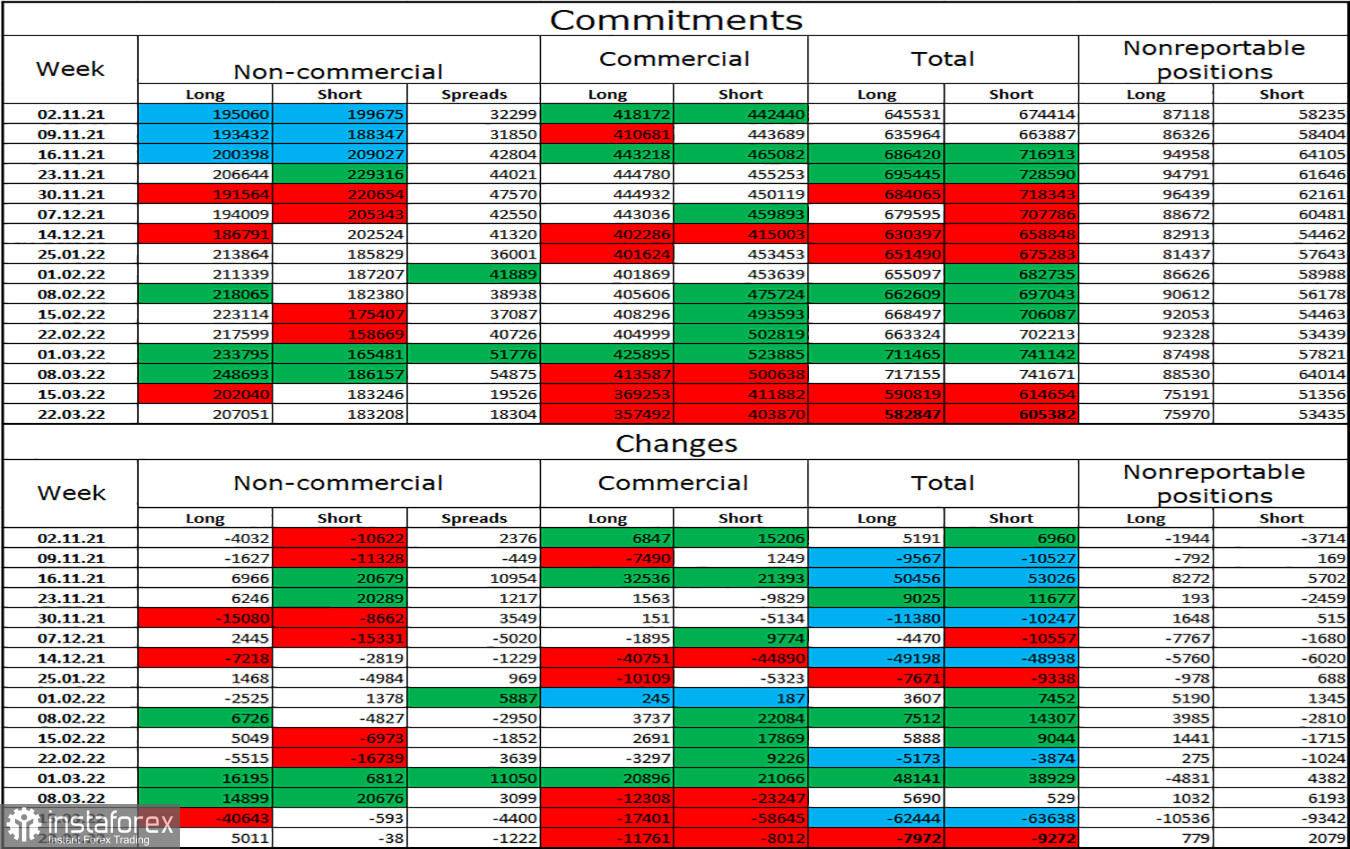

Commitments of Traders (COT) report:

During the last week covered by the report, traders opened 5,011 Long positions and closed 38 Short positions, indicating that the bullish sentiment of major market players has increased slightly. The total number of open Long positions is now 207,000 against 183,000 Short positions. The mood of Non-commercial traders remains bullish. It could have given support to EUR, however latest events favor USD. Despite market players being bullish on EUR, the euro itself is tumbling. Geopolitical factors now take top priority - the worse the situation in Ukraine is, the lower EUR could drop.

US and EU economic calendar:

EU: CPI data (09-00 UTC).

US - Unemployment data (12-30 UTC).

US - Non-Farm Payrolls (12-30 UTC).

US - Average hourly earning data (12-30 UTC).

US - ISM Manufacturing PMI (14-00 UTC).

There are plenty of notable data releases on the economic calendar today in both the EU and the US, such as EU inflation data, as well as US unemployment data and non-farm payrolls.

Outlook for EUR/USD:

Traders can open short positions at this moment, with 1.0970 at the H1 chart being the target - EUR/USD has settled below 1.1070. Long positions can be opened if the pair closes above 1.1148 on the H4 chart, with 1.1233 and 1.3333 being targets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română