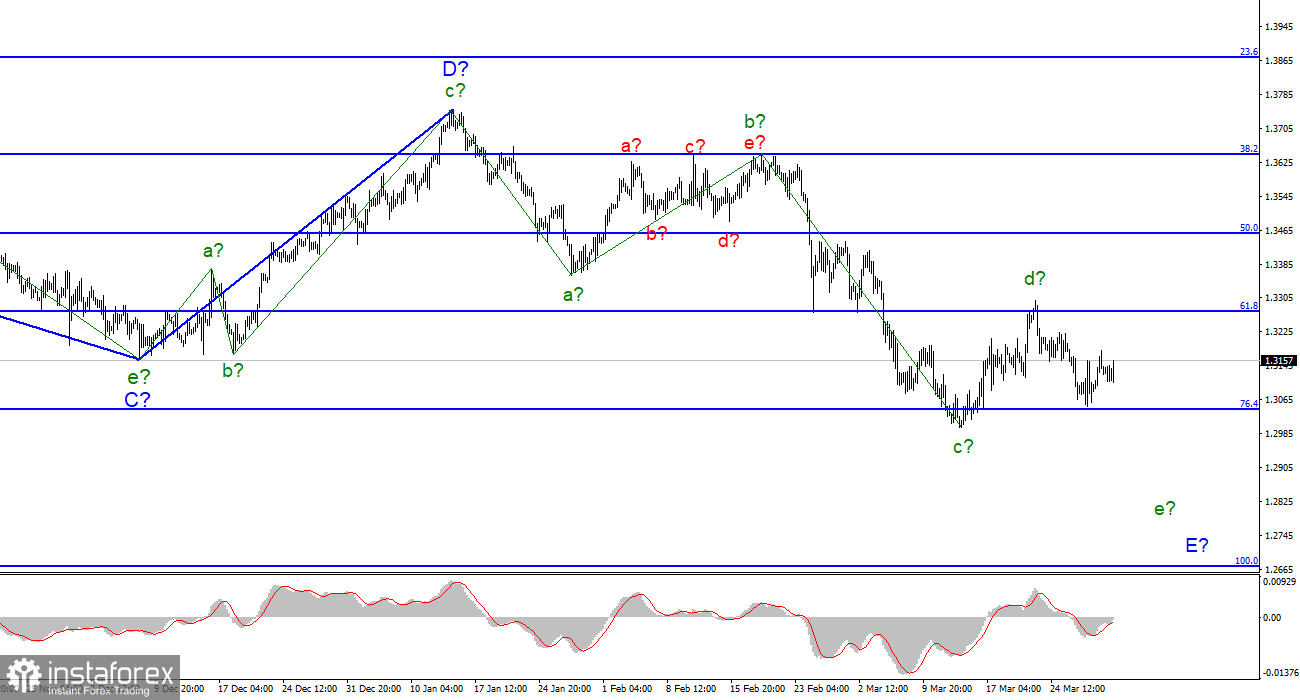

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The assumed wave d in E is completed, and there should be five waves in total inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time. The assumed wave d in E may take on a more extended, three-wave form. This is supported by the fact that wave b in E has taken a five-wave, extended form. Also in favor of this is the unsuccessful attempt to break the low wave c in E. Thus, the instrument simply could not break through the 76.4% Fibonacci level and now the construction of a new upward wave has begun. This wave can be corrective, internal in the composition of e in E, or it can be the beginning of the wave c-d-E. In the first case, the decline in the British dollar quotes should resume in the near future, in the second case, the instrument may return to the 1.3274 mark, which corresponds to 61.8% Fibonacci. But one way or another, I expect the construction of wave e in E.

The pound thought and thought and did not come up with anything.

The exchange rate of the pound/dollar instrument increased by 20 basis points on March 31, although market activity during the day was quite high. The activity was high, but the instrument did not have a clear direction of movement. In the UK, a report on GDP in the fourth quarter was released this morning, according to which growth was 6.6% y/y and 1.3% q/q, which is slightly higher than market expectations. And that was the end of all the news of the day. The market did not even consider it necessary to win back the GDP report, but still, at the American session, it found reasons to increase demand for the British. It was hardly related to the reports from America, as they were all weak to a single one.

But the "gas conflict" between Europe and Russia is developing. It has no direct relation to the UK and the pound sterling, but it has an indirect one. First, the UK continues to buy gas from Russia. Second, Boris Johnson is one of the most ardent critics of the Kremlin. Third, the complication of gas supplies to the European Union may affect its economy, which will be unable to function normally due to the lack or absence of "blue fuel". And the fall of the EU economy, which is already on the verge of stagflation, since economic growth is weak and inflation is high, will also affect the British economy since they are very closely connected. According to the latest information, the Kremlin decided to make a "knight's move" and force Europe to pay for gas in rubles. The leaders of Germany, France, and Italy immediately publicly rejected such an "attractive" option and indicated the existence of contracts. A little later, Olaf Scholz and Mario Draghi said that in a conversation with Vladimir Putin, they agreed that the payment would be made in euros, and the conversion by the Russian side into rubles would be carried out by Russia after paying for gas.

General conclusions.

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located near the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave E does not look completed yet. Wave d can take a three-wave form and lengthen - wave b turned out exactly like this, but in any case, we should consider the signals "down", and while wave b continues to build, the MACD indicator is mainly rising.

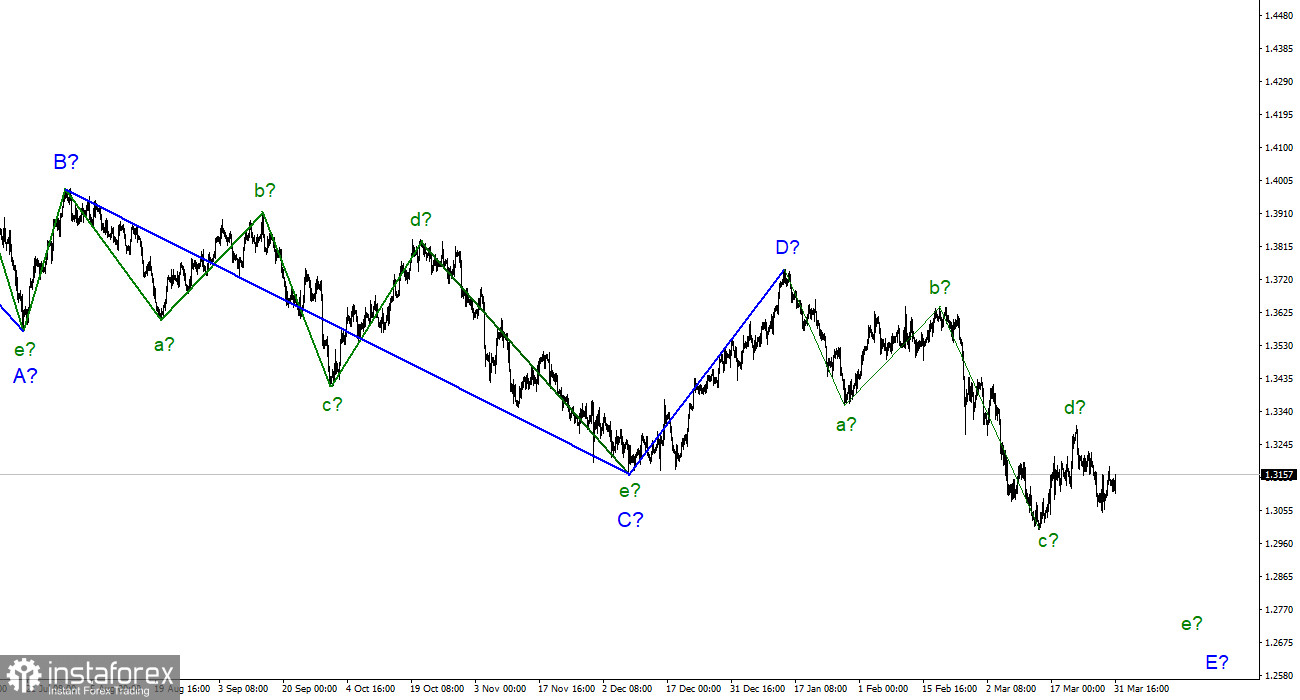

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the quotes of the British near the 27th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română