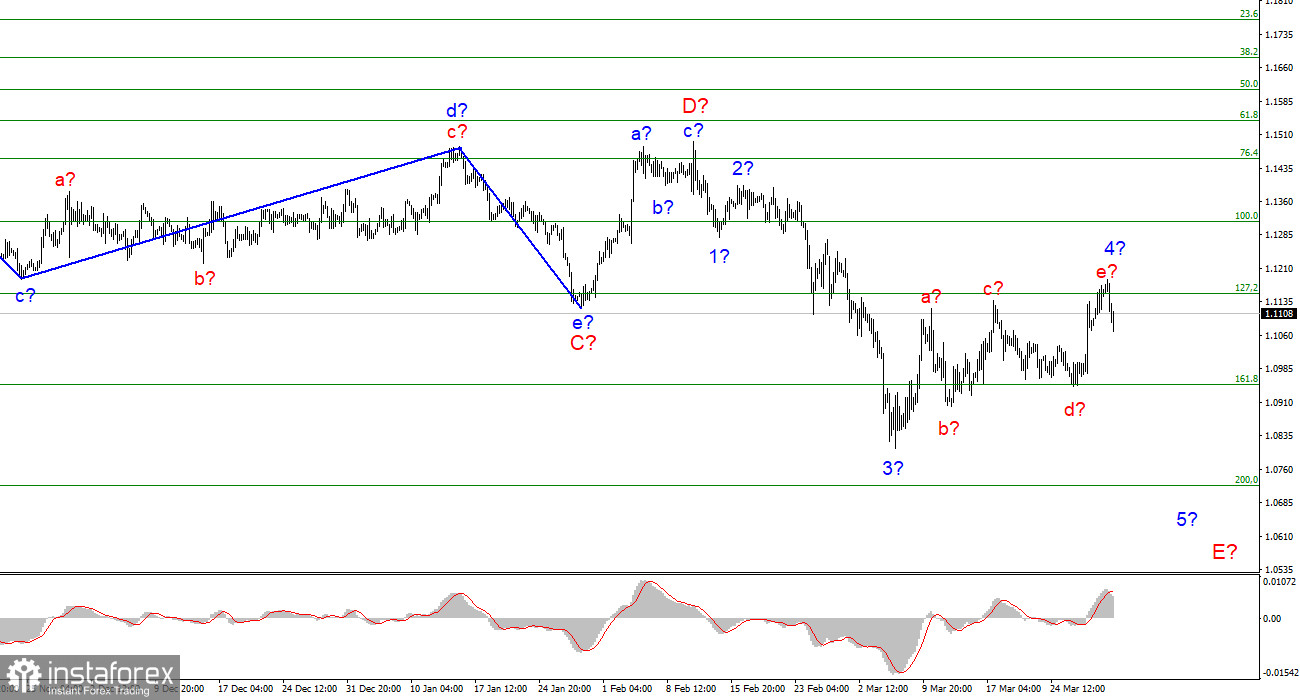

The wave marking of the 4-hour chart for the euro/dollar instrument is becoming more complicated due to a new increase in quotes. Now the assumed wave 4 has taken a five-wave form and fits very poorly into the current wave layout, in which wave 2 is very short. Nevertheless, the wave pattern still does not require drastic changes. If the construction of the proposed wave 4 still ends in the coming days, then the tool can still build the proposed wave 5 in E. If the increase in quotes continues, then the entire wave markup will require adjustments. I note that wave 4 looks like a correction in any case. That is, it cannot be the first wave of a new upward trend segment. The 127.2% Fibonacci level, near which waves a and c ended at 4, should not miss the instrument above itself. An unsuccessful attempt to break through it indicates that the market is ready for new sales of the instrument. If the decline in the quotes of the instrument ended on March 7, then the entire wave E will take one wave form. Geopolitics had a serious impact on the market on Tuesday, but by the end of the week, the markets calmed down somewhat about this.

The market is rushing from side to side.

The euro/dollar instrument fell by only 30 basis points on Thursday. It would be more accurate to say that at first there was a decrease of 100, and then an increase of 70. Thus, the activity of the market today was again on top. But the news background is not. Today, one report on the unemployment rate was released in the European Union, and one report on applications for unemployment benefits was released in the United States. This data did not affect the tool. Here I want to note that all markets in recent weeks have reacted only to top news. At the same time, they react almost indiscriminately. And if they don't react, they discuss it. A vivid example of this is Tuesday this week. As soon as there were ghostly chances that a peace agreement between Kyiv and Moscow would be signed, the market immediately rushed to buy the euro and pound, which it had been selling off in the last month. The market has not even tried to figure out how likely it is to reach an agreement between Ukraine and Russia, given the demands of both sides. The market did not take into account that the negotiating groups can agree, but only the presidents will make the final decisions. As a result, today the market has stopped blindly believing that the military operation will end soon. Against this background, the euro and the pound began a new decline, which is fully supported by the current wave markup. From my point of view, the missing waves will be built, but what will happen next is a big question. If the situation in Ukraine worsens over time, this may cause new declines in the euro and the pound, and, accordingly, complicate the downward trend sections. If the situation in Ukraine improves, it may lead to the construction of at least corrective sections of the trend for the euro and the pound.

General conclusions.

Based on the analysis, I still conclude that the construction of wave E is currently underway. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The current wave marking assumes the construction of a wave 5 in E. This option will be canceled in case of a successful attempt to break the 1.1153 mark, which equates to 127.2% Fibonacci.

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română