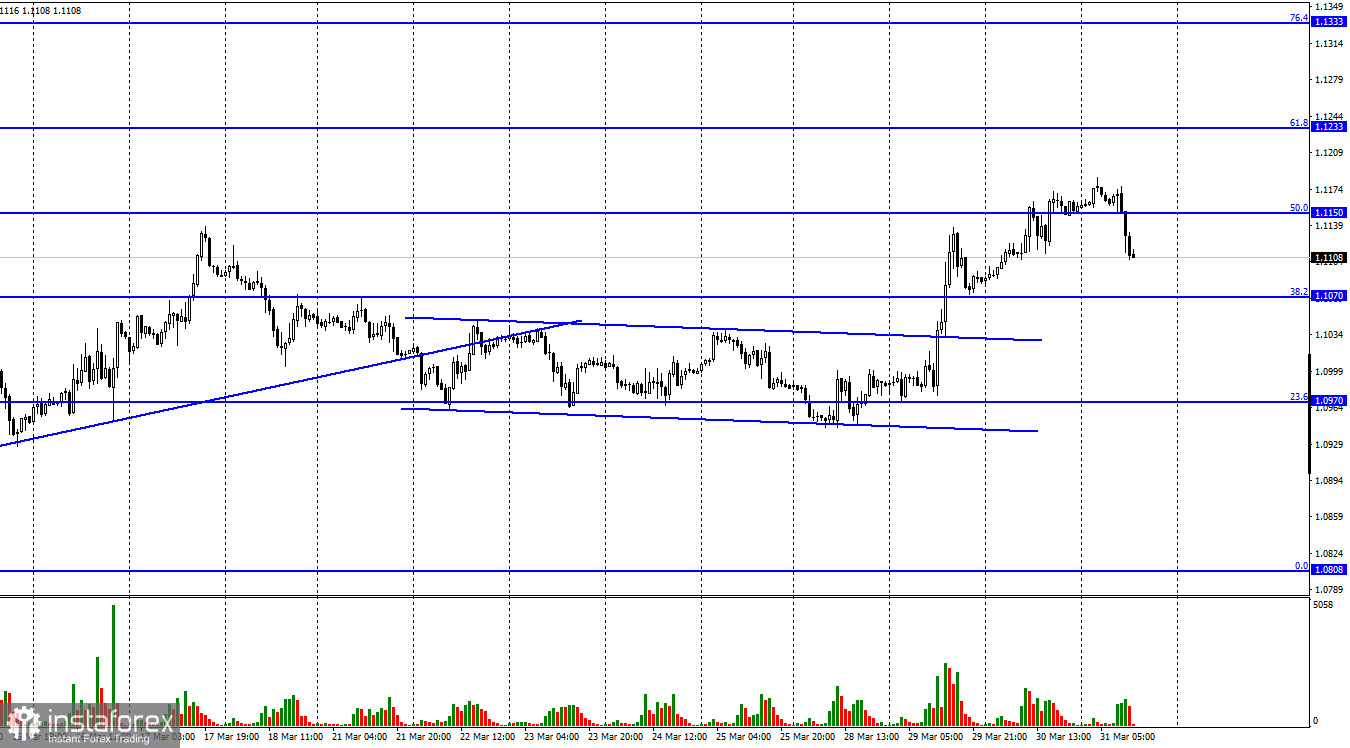

The EUR/USD pair continued the growth process on Wednesday and even secured above the corrective level of 50.0% (1.1150). However, today the consolidation was carried out under this level and a strong fall of the euro currency began in the direction of the corrective level of 38.2% (1.1070). The rebound of the pair's rate from the level of 1.1070 will work in favor of the euro and new growth in the direction of 1.1150. Fixing at 1.1070 will increase the probability of a further fall towards the next Fibo level of 23.6% (1.0970). Meanwhile, traders show that they are ready to react only to geopolitics. In the last two days, the European currency has shown strong growth, as on Tuesday it became known about successful negotiations between Ukraine and the Russian Federation in Turkey. The chances of peace have increased dramatically. It is thanks to these reports that the euro and the pound, which have been actively falling in the last month, began to grow. However, this growth did not last long, and traders' optimism dried up very quickly. Already on Wednesday, it became known that it was not about "significant progress", but simply about "progress" in the negotiations.

In other words, an agreement was reached only on some issues, but not on all. So far, Ukraine refuses to join NATO and deploy NATO bases on its territory. Russia will not object to Ukraine's accession to the EU. However, this is where progress ends. The issue of Crimea has not been resolved, the issue of Donbas has not been resolved. Russian troops are not retreating from Kyiv, they are not leaving the territory of Ukraine. Moreover, Moscow openly declares that "the first phase of the special operation was successful, and now the second phase begins." The second phase is the concentration on the Donbas and southeastern Ukraine. Thus, the negotiations may be moving forward, but Moscow does not abandon its geopolitical goals, and Kyiv will never recognize that Crimea and Donbas belong to Russia. Thus, this whole conflict may drag on for many months or even years. There is no real reason to think that it will be completed in the near future. Today, most traders seem to have realized this fact and started new euro sales.

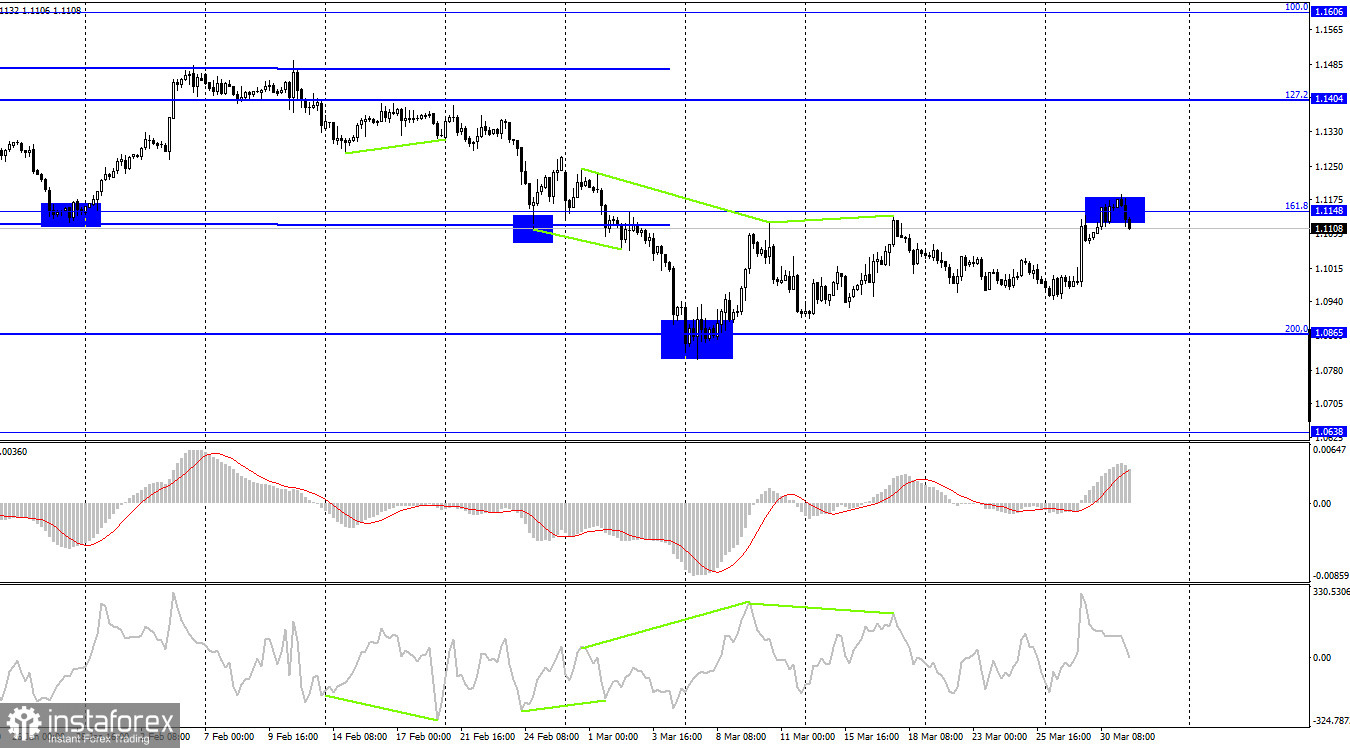

On the 4-hour chart, the pair performed an increase to the corrective level of 161.8% (1.1148), a rebound from it, and a reversal in favor of the US currency. The process of falling in the direction of the Fibo level of 200.0% (1.0865) has begun. Brewing divergences are not observed in any indicator today. Fixing quotes above the level of 161.8% will work in favor of the EU currency and the resumption of growth in the direction of the next corrective level of 127.2% (1.1404).

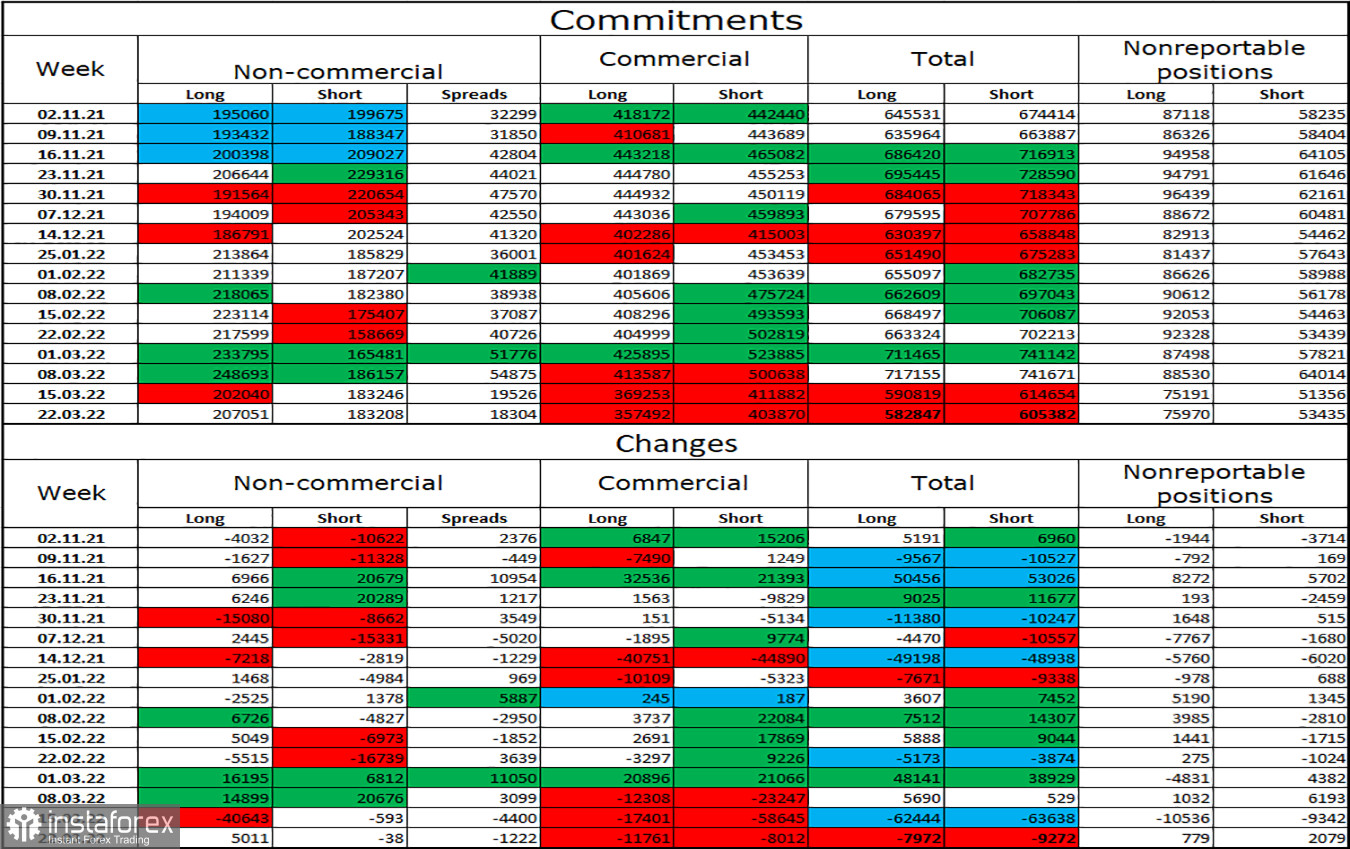

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 5,011 long contracts and closed 38 short contracts. This means that the bullish mood of the major players has slightly increased, but the changes are generally insignificant. The total number of long contracts concentrated on their hands is now 207 thousand, and short contracts - 183 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish". This would give an excellent opportunity for the European currency to count on growth, if not for the information background, which is now supported only by the dollar. We are now witnessing a situation where the bullish mood of major players persists, but the currency itself is falling. Thus, geopolitics is now a priority and the worse things get in Ukraine, the more the euro currency may fall.

News calendar for the USA and the European Union:

EU - unemployment rate (09:00 UTC).

US - change in the level of spending of the population (12:30 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

On March 31, the calendars of economic events of the European Union and the United States contain not the most important entries. Unemployment in Europe fell to 6.8%, but the euro currency still began to fall. I believe that today the information background will not affect the mood of traders.

EUR/USD forecast and recommendations to traders:

Sales of the pair are possible now with targets of 1.1070 and 1.0970 on the hourly chart, so the rebound from the level of 1.1148 was performed. I recommend buying the pair if the closing above the level of 1.1148 is performed on a 4-hour chart with targets of 1.1233 and 1.1333.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română