Details of the economic calendar for March 30

The ADP report showed that jobs in the private sector in the United States increased in March by 455,000. The forecast was 450,000. February data, according to the revision, amounted to 486,000.

Meanwhile, the final data on U.S. GDP in the fourth quarter of 2021 totaled 6.9%, with expectations of 7.1%.

At the time of the publication of the statistics, the U.S. dollar stood still, even though ADP performance is by no means bad. About an hour after the publication, the U.S. dollar decreased in value against competitors.

Analysis of trading charts from March 30

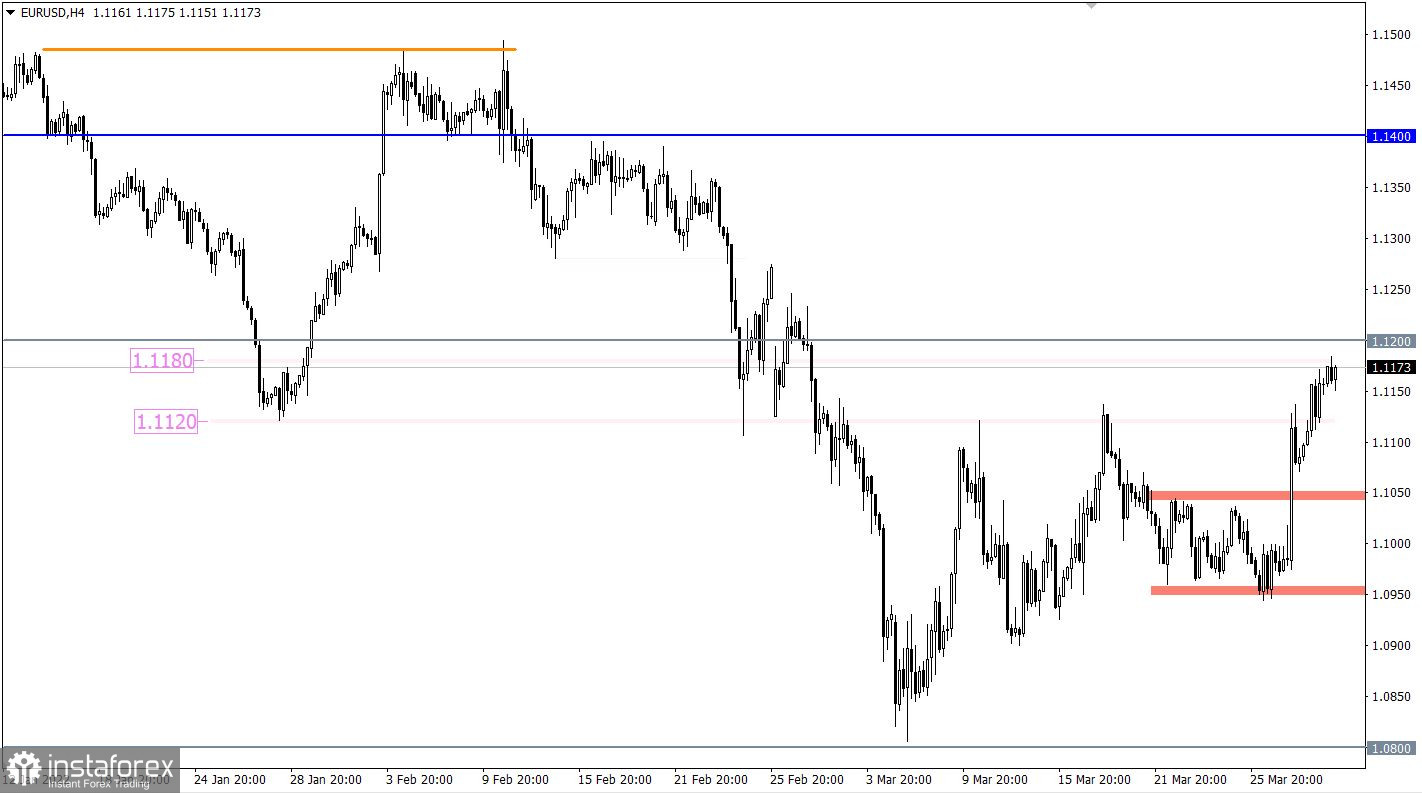

The EURUSD currency pair has grown by more than 200 points since the beginning of the week. The quote has reached the upper limit of the resistance area 1.1120/1.1180, without reducing the upward interest.

The GBPUSD currency pair, unlike its European counterpart, is in the process of recovery relative to the corrective move. Recently, the quote came close to the main pivot point in the form of a psychological level of 1.3000, where within its area there was a reduction in the volume of short positions and, as a result, a slowdown/pullback.

March 31 economic calendar

Today at 06:00 UTC, the final data on the UK GDP were published, which, although they reflected a slowdown in economic growth from 7.0% to 6.6%, the figures almost coincided with the preliminary estimate. Thus, the statistical indicator has already been taken into account by the market.

The European Union will publish data on the unemployment rate, which is likely to remain unchanged or with a slight decrease, which will be ignored by traders.

During the American trading session, the weekly data on jobless claims will be published, which is predicted to increase in volume. This is a negative factor for the U.S. labor market, which may have a negative impact on the dollar.

Statistics details:

The volume of initial claims for unemployment benefits may increase from 187,000 to 197,000.

Continuing claims may remain at the level of 1.350 million.

Time targeting

Unemployment rate in the EU - 09:00 Universal time

U.S. Jobless Claims - 12:30 Universal time

Trading plan for EUR/USD on March 31

In this situation, the resistance area of 1.1120/1.1180 still attracts sellers. This can lead to a reduction in long positions and, as a result, a slowdown in the upward cycle. If expectations coincide with time, a price rebound may occur with the subsequent restoration of dollar positions relative to the correction.

An alternative scenario considers the transition from a normal correction to an oblong one. In this case, holding the price above the value of 1.1200 in a four-hour period will lead to the subsequent strengthening of the euro.

Trading plan for GBP/USD on March 31

In this situation, the process of restoring dollar positions relative to the recent correction is still relevant. In order to receive a signal about the completion of the correction and prolongation of the medium-term downward trend, the quote needs to stay below the psychological level of 1.3000, followed by confirmation at the value of 1.2950. Otherwise, the existing recovery process may be replaced by a lateral amplitude.

What is reflected in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română