Markets are still driven by the military conflict in Ukraine. After a surge of unjustified optimism on Tuesday, disappointment came the next day because the negotiations did not lead to a peaceful resolution of conflict. As such, sales surged in the stock markets, followed by an increase in prices for commodity and raw materials. Dollar, although received support, was insignificant.

Looking at what is happening right now, together with the continued high inflation in the US, Europe and other economically developed countries, it is likely that market sentiment will slump, which will affect the value of assets.

In fact, Wednesday's data on consumer inflation in Germany, which showed an increase from 5.1% to 7.3% y/y in March, is a strong signal that the Euro area is already beginning to experience strong inflationary pressure. This means the ECB will have to start a cycle of raising interest rates, which would support euro in the forex market.

As for the US, ADP's report on employment showed that jobs in March rose 455,000. But this failed to inspire investors as the market is focused on the situation in Ukraine and on the results of negotiations between Moscow and Kiev.

Today, the focus of the statistical data will be the values of consumer inflation in the US, which is expected to grow to 5.5% y/y in February. On a monthly basis, some correction to 0.4% is projected. If the indicator shows a higher value both in monthly and annual terms, expectations of a more vigorous increase in Fed rates will grow, which will ultimately lead to a rise in the yield of treasuries and dollar.

Considering all this, volatility is likely to remain extremely high, especially since investors are not yet ready to fully form sustainable trends.

Forecasts for today:

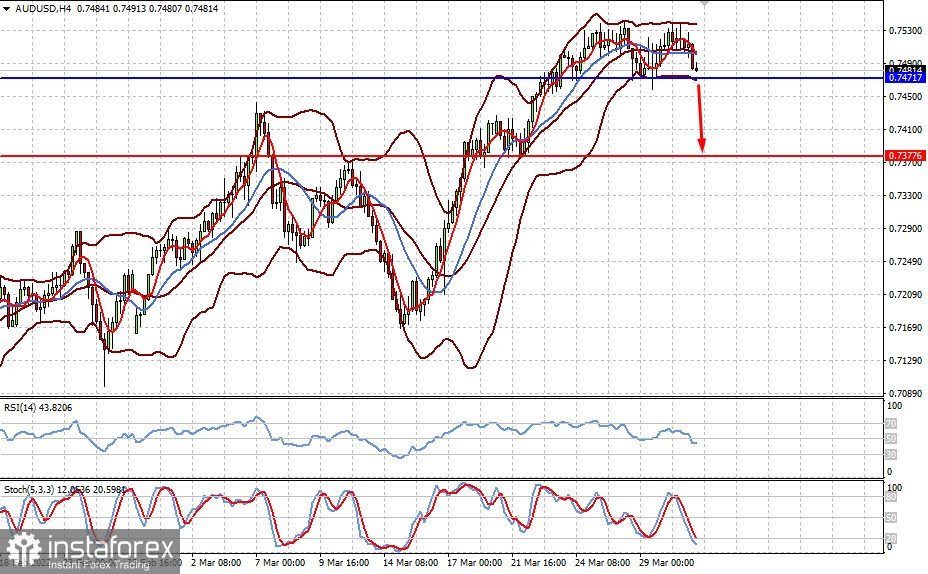

AUD/USD is trading above 0.7470. A decline below it may lead to a local fall to 0.7377

USD/CAD is currently consolidating below 1.2545. Lower crude oil prices and positive employment data from the US Department of Labor could push the pair up to 1.2780.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română