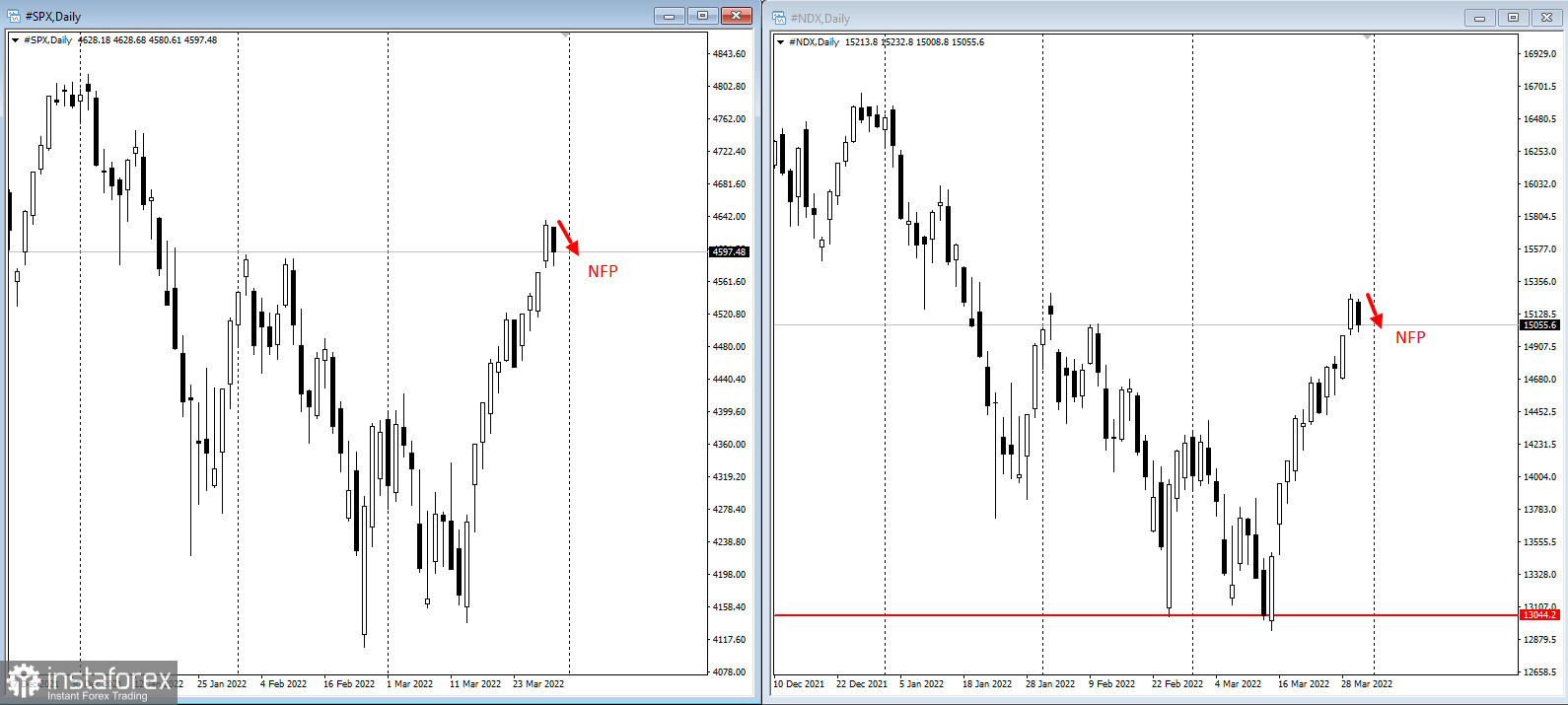

US stock indices have retreated for the first time in five days as hopes for de-escalation in Ukraine faded. Investors assessed risks to economic growth from accelerating inflation, and also possible partial locking in profits by closing long positions after the rally before today's US unemployment data.

The S&P 500 declined for the first time this week and the high-tech Nasdaq 100 dropped by 1.1%. Apple Inc. fell, ending its longest rally since 2003. US Treasuries rose.

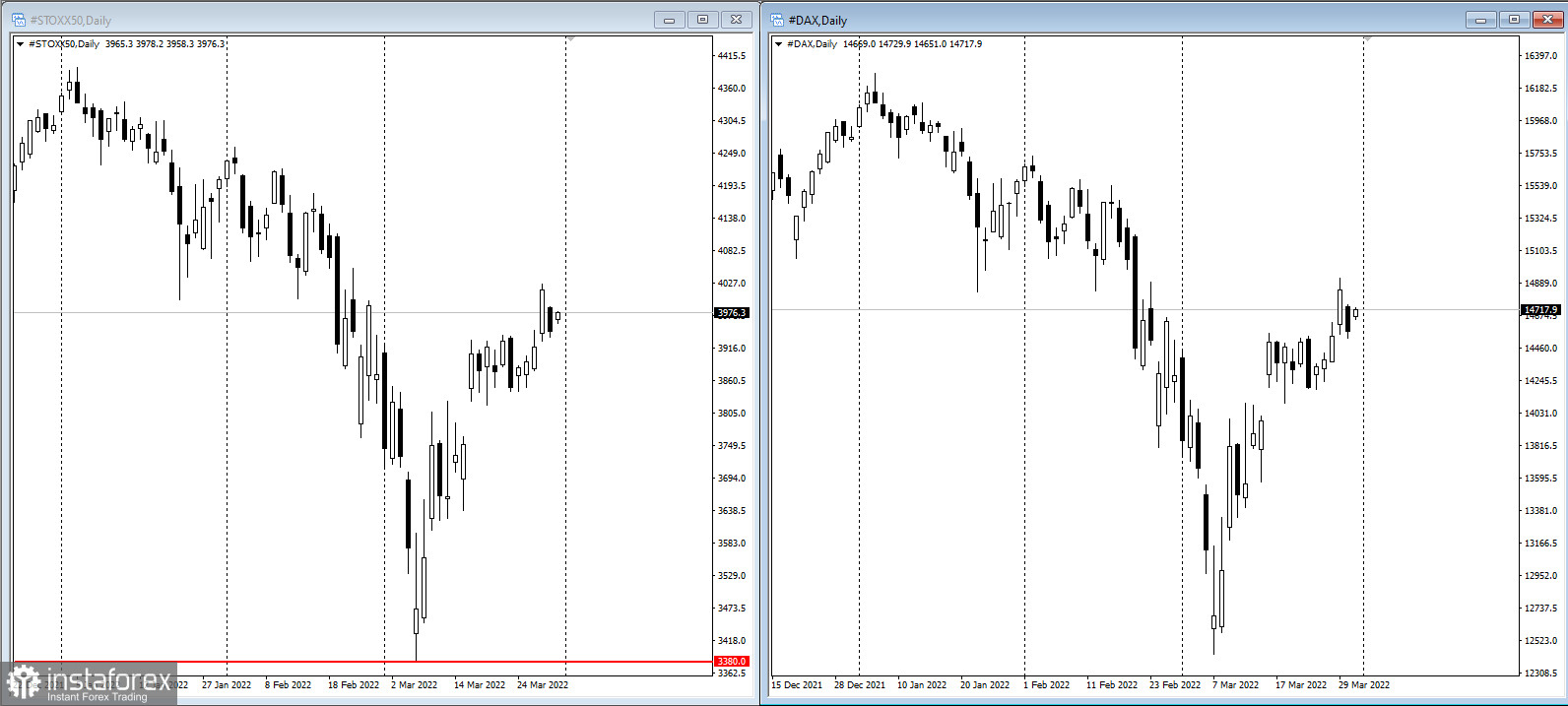

European indices also showed small sell-offs as traders believe that higher-than-expected inflation may force regulators to taper their negative interest rates policy.

The Russian government states that negotiations with Ukraine have yielded no breakthroughs and that it is regrouping forces to complete its takeover of eastern Donbass. The White House believes that Russian President Vladimir Putin understands that he has been misled by his military advisers. Reports that the Covid-19 cases in New York were on the rise again also affected the sentiment of the governor.

Economic damage from the geopolitical turmoil, worsening across Europe, and already-record inflation continue to rise, and the German economy faces the danger of recession because of its dependence on Russian energy. Germany has called for an emergency plan to prepare for a potential Russian gas shutdown, as President Vladimir Putin insists that crucial fuel must be paid for in rubles. Russia may expand the list of goods for which it demands payment in rubles to include grain, oil, metals, and others.

As for the economic news, US companies added 455,000 jobs in March after a revised increase of 486,000 in February, according to the ADP Research Institute. The data are consistent with the Federal Reserve's view that the labor market is robust and precede the government's monthly employment report on Friday, which is now projected to show that private-sector employment increased by about 500,000 in March.

Federal Reserve Bank of Richmond Thomas Barkin said he was open to raising interest rates by 0.5% at the Fed meeting in May, depending on how strong the US economy would be at that time.

Key economic releases of this week:

- China Manufacturing PMI, Non-Manufacturing PMI, Thursday

- OPEC-JMMC Meetings to discuss production targets, Thursday

- FOMC Member John C. Williams Speaks, Thursday

- US jobs market reports, Friday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română