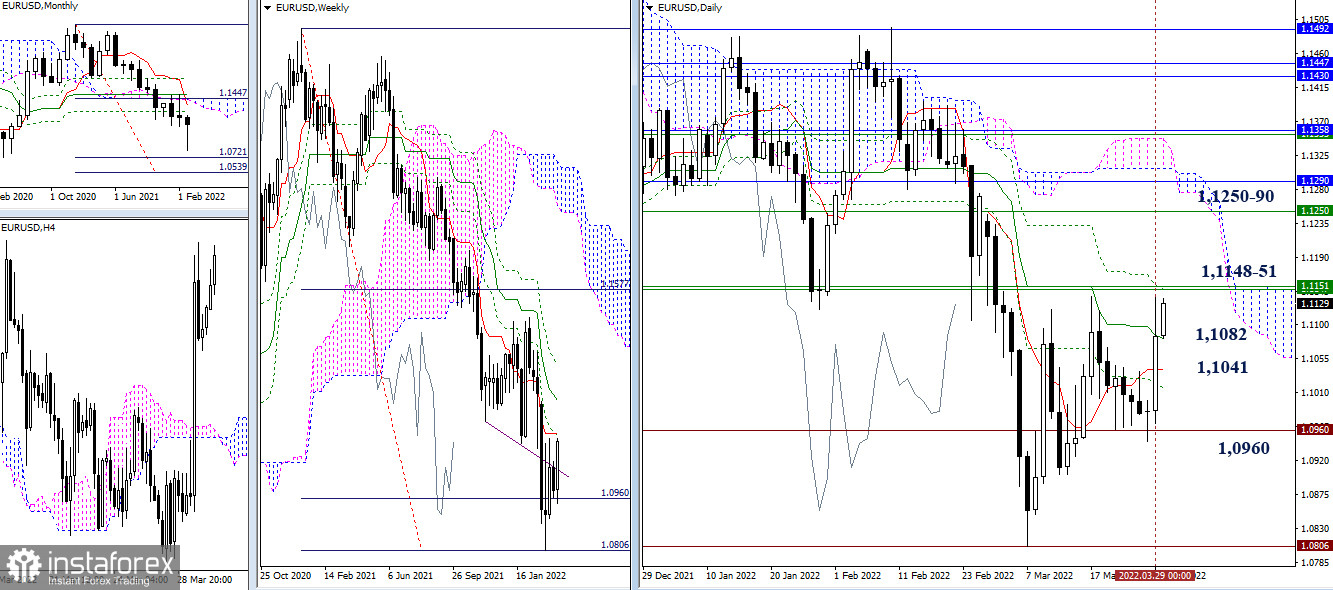

EUR/USD

The euro again rushed to the resistance after standing at the support of 1.0960, which will be able to provide weekly short-term support (1.1151) to the interests of the bulls, as well as help eliminate the daily death cross (1.1148). The end of the month is approaching, so the last days will determine the preferences of the whole of March, and the formation of a long lower shadow of a monthly candle in history may determine the priorities and preferences for April.

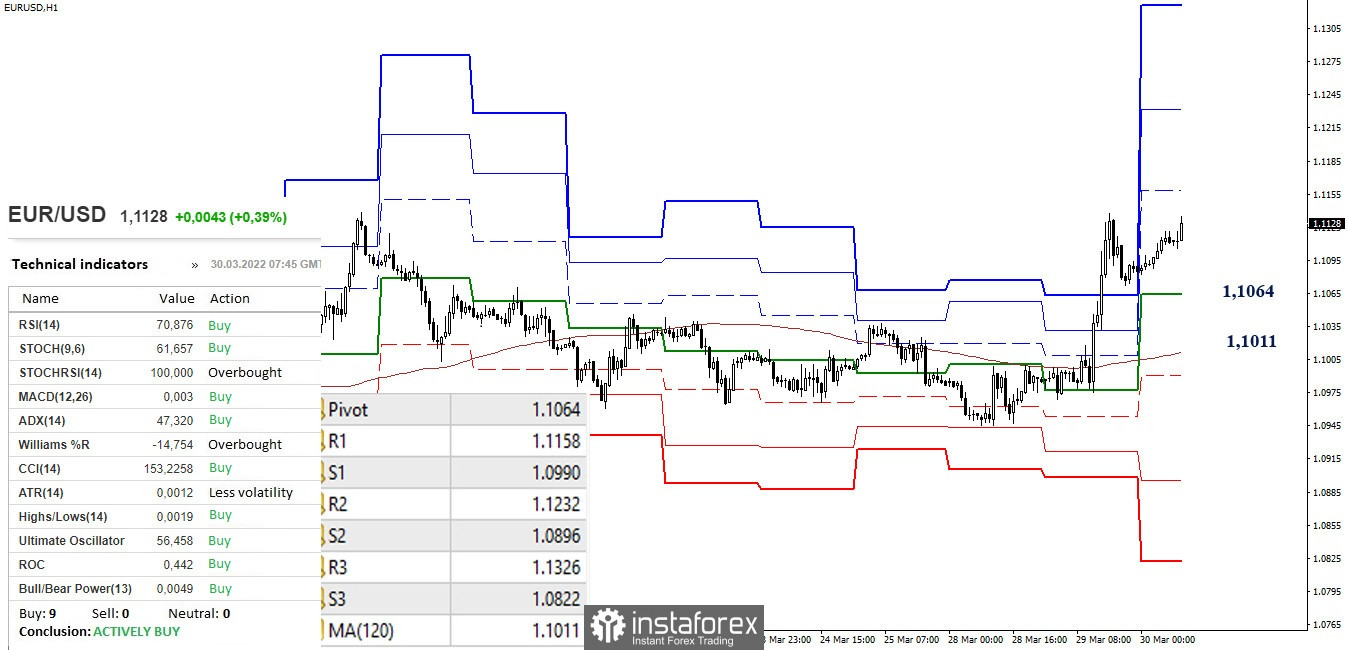

On the lower timeframes, the main advantage is now on the side of the bulls. They are close to leaving the zone of corrective decline and continue to rise. Upward reference points within the day will be the resistance of the classic pivot points (1.1158 - 1.1232 - 1.1326). The key levels in the current situation form support and are located at 1.1064 (central pivot level of the day) and 1.1011 (weekly long-term trend). These levels are responsible for the current balance of power, so their loss can lead to a change in mood. Supports of the classic pivot points today are located at 1.0990 – 1.0896 – 1.0822.

***

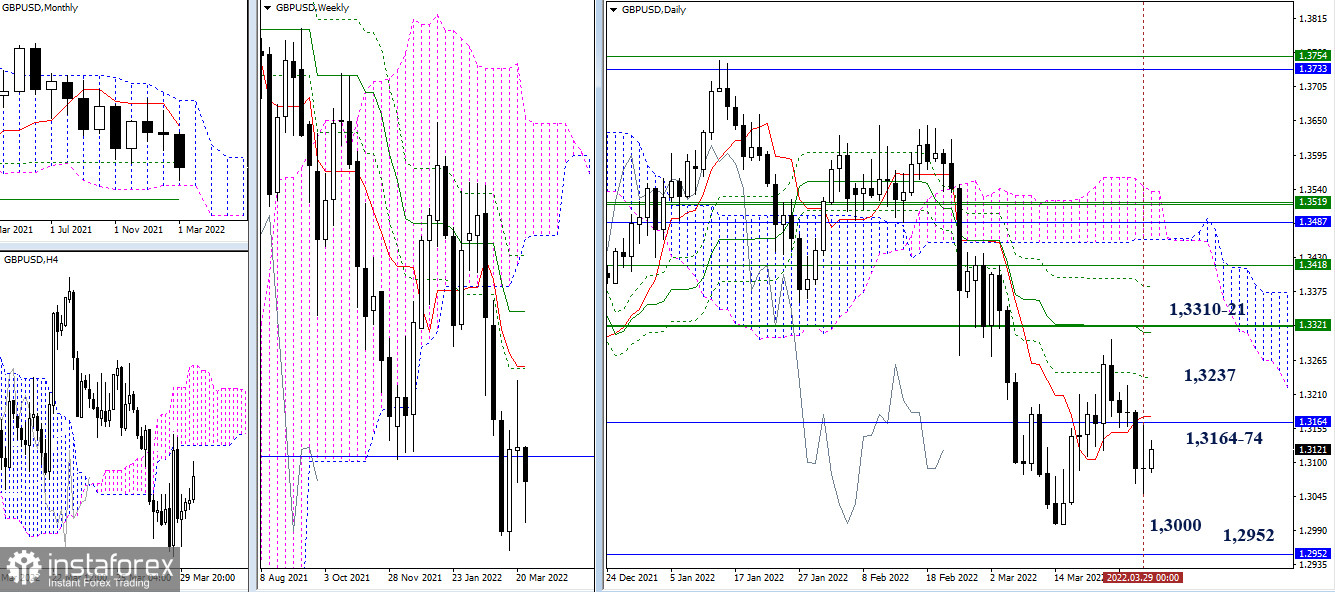

GBP/USD

The bearish activity demonstrated on Monday was halted and replaced by yet another uncertainty. Testing of downward reference points 1.3000 (minimum extremum) and 1.2952 (lower boundary of the monthly cloud) is again put on standby. At the same time, the union of the levels of the daily short-term trend (1.3174) and the monthly Fibo Kijun (1.3164) retains its significance. Consolidation above these levels will strengthen the opportunities for the bulls, the main reference in this case will be the area of 1.3310-21 (weekly levels + daily medium-term trend), intermediate resistance can be identified at the line of 1.3237 (daily Fibo Kijun).

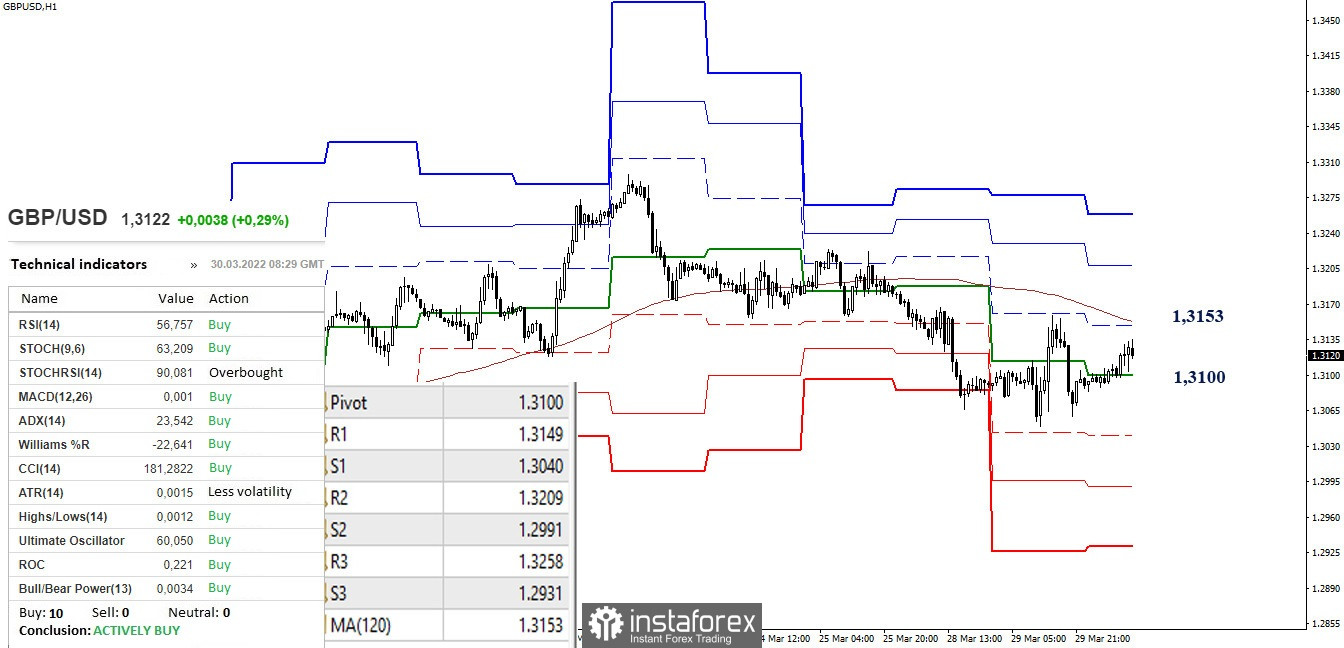

With the support of some of the analyzed technical instruments, an upward correction is currently developing on the lower timeframes. Ahead is a test of key resistance - the weekly long-term trend. Further upward references may be the resistance of the classic pivot points 1.3209 and 1.3258. If the correction (1.3050) is completed and the decline continues, the relevance will return to downward reference points - the support of the classic pivot points (1.3040 - 1.2991 - 1.2931).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română