U.S. stocks rose in a broad rally on Tuesday amid optimism about progress in talks between Russia and Ukraine. Most Treasury yields have pulled back.

The S&P 500 rose for the fourth day, closing above the 4,600 level for the first time since mid-January. All 11 industry groups rose, with the exception of energy stocks after the decline in oil prices. The Nasdaq 100 is up more than 1.5% and Apple Inc. is up for the 11th day in its longest winning streak since 2003. The dollar declined, while the euro rose the most in almost three weeks. After hours, Micron Technology Inc. received after the memory chip maker forecast adjusted third-quarter revenue that beat estimates. Robinhood rose by 40% after the news that traders will trade 4 hours longer on the weekend.

In general, U.S. stock indices are rising for the 11th day in a row:

The prospect of a war reduction in Ukraine has boosted risk sentiment. Talks between Russia and Ukraine failed to reach a ceasefire agreement, but offered a potential path to a meeting between Vladimir Putin and Volodymyr Zelensky. Russia has said it is reducing military activity near the capital Kyiv and the city of Chernihiv, and its chief negotiator has said Moscow will take steps to "de-escalate" the conflict.

European indices are already trading above their monthly openings and continue to rise higher to update their historical extremes:

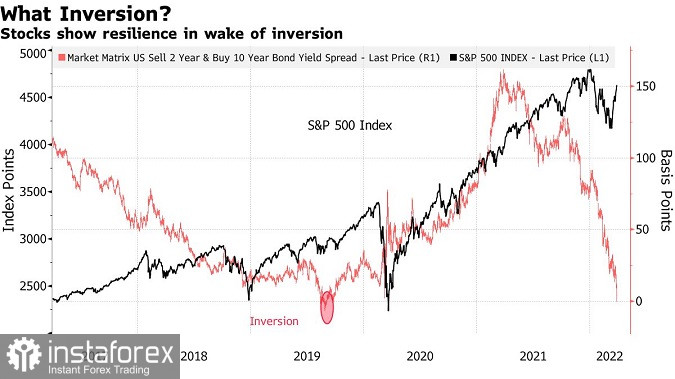

The sell-off in Treasury bonds stalled and yields declined on most maturities. The five-year break-even rate on inflation-protected Treasuries fell as much as 12 basis points to 3.52% after hitting record highs last week. Meanwhile, two-year yields briefly topped 10-year yields for the first time since 2019, reinforcing the view that a Federal Reserve rate hike could trigger a recession.

Global stocks rose from the lows reached after the start of Russia's special military operation in Ukraine. Such resilience contrasts with inverting yield curves that are shaking economic confidence as investors brace for the Fed's tightening of monetary policy to contain inflation at its fastest rate in four decades. The two- to 10-year inversion is the latest in a series starting in October when 20-year returns surpassed 30-year returns.

Philadelphia Fed President Patrick Harker said he expects a series of "deliberate, methodical" rate hikes this year, but said he's confident of a half-point rise in May if short-term data show more inflation.

On the U.S. economic front, consumer confidence rose in March, suggesting that robust job growth has offset American fears of accelerating inflation, according to a report Tuesday. Government data on Friday is expected to show that the economy likely added about half a million jobs in March as the unemployment rate fell to 3.7%.

Some key events to watch this week:

- U.S. GDP, Wednesday

- Richmond Fed President Thomas Barkin's speech, Wednesday

- China Manufacturing, Non-manufacturing PMI, Thursday

- Meeting of OPEC and non-OPEC ministers to discuss production targets, Thursday

- New York Fed President John Williams' speech, Thursday

- U.S. Employment Report, Friday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română