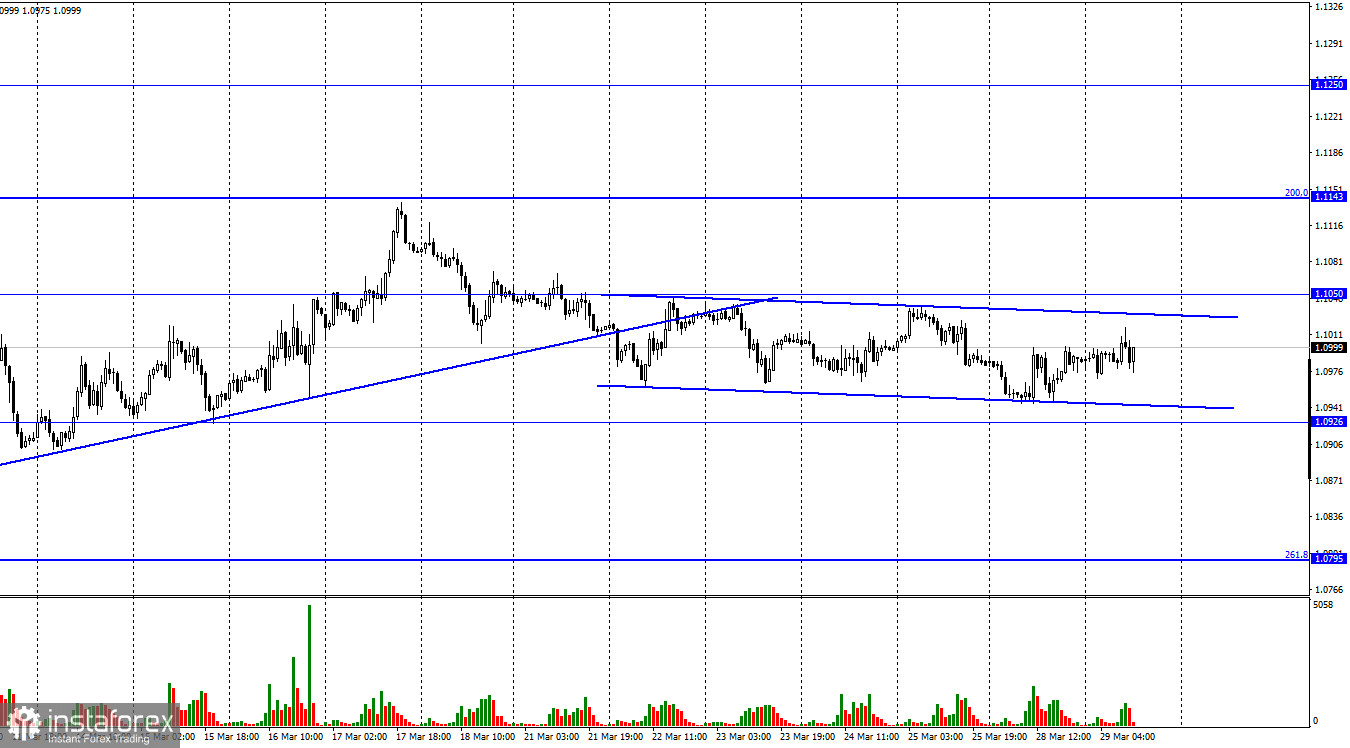

The EUR/USD pair continued to move very sluggishly on Monday. There was very little economic news and reports at the end of last week and the beginning of this one, so traders decided to wait. A new downward trend corridor has been formed, which characterizes the mood of traders as "bearish". However, the degree of its slope is very low, so it is not necessary to count on a strong fall in the euro currency yet. The focus is now on the Ukrainian-Russian negotiations in Turkey, which should last two days, as well as the energy conflict between the Russian Federation and the European Union. I have already written about the latter earlier, but only in the context of the crisis that may develop in Europe due to the rejection of Russian oil and gas. And if there is no talk of abandoning oil in the coming years, then the situation around gas is heating up.

It all started with the fact that in response to the "unfriendly and illegitimate" sanctions of the European Union against Russia, President Vladimir Putin announced that from now on Europe will pay for gas in rubles. There was an immediate response from the authorities of the EU countries, saying that the contracts clearly state the currencies of payment for the supply of hydrocarbons and no one will buy rubles to pay for gas with them. Vladimir Putin immediately replied that in this case, gas supplies to Europe would stop. At the moment, it is difficult to understand who is right in this situation. On the one hand, the contracts do contain such items as the currency of payment. On the other hand, perhaps the President of the Russian Federation is referring to future contracts and future deliveries. This issue should be investigated in more detail. It should also be noted that neither the Russian Federation nor the European Union benefits from the termination of cooperation. The EU continues to say that during this year they will reduce gas supplies by 2/3, and in the future, they are ready to buy gas in the USA. Perhaps Russia understands that gas contracts will end anyway, so finally, they want to hit Europe harder. One way or another, there will be problems with gas in Europe. At best, this will cause an internal energy crisis, at worst, a new acceleration of inflation, and a contraction of the economy.

On the 4-hour chart, the pair continues the process of a slow decline in the direction of the corrective level of 200.0% (1.0865) after the formation of a bearish divergence at the CCI indicator. The rebound of quotes from the level of 1.0865 will work in favor of the EU currency and some growth. The consolidation of quotes below the level of 1.0865 will increase the likelihood of a further fall in the direction of the level of 1.0638.

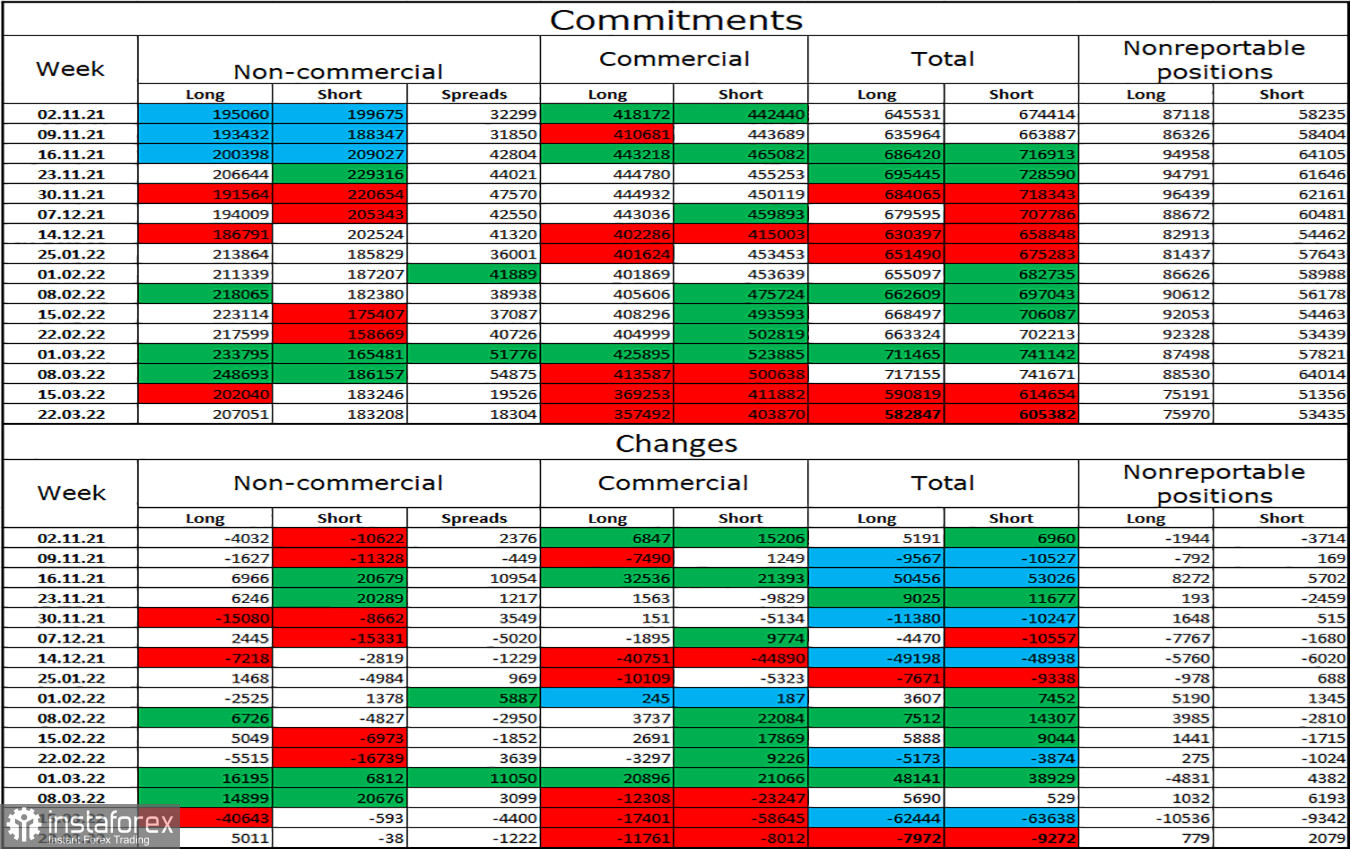

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 5,011 long contracts and closed 38 short contracts. This means that the bullish mood of the major players has slightly increased, but the changes are generally insignificant. The total number of long contracts concentrated on their hands is now 207 thousand, and short contracts - 183 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish". This would give an excellent opportunity for the European currency to count on growth, if not for the information background, which now supports only the dollar. We are now witnessing a situation where the bullish mood of major players persists, but the currency itself is falling. Thus, geopolitics is now a priority and the worse things get in Ukraine, the more the euro currency may fall.

News calendar for the USA and the European Union:

US - an indicator of consumer confidence (14-00 UTC).

On March 29, the calendars of economic events of the European Union and the United States contain one, not the most important entry for two. I believe that today the information background will not affect the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair with a target of 1.0926 on the hourly chart if a close is made under the trend line. Now, these trades can be kept open until they are fixed above 1.1050. I recommend buying a pair if there is a rebound from the 1.0865 level on a 4-hour chart with targets of 1.0926 and 1.1050.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română