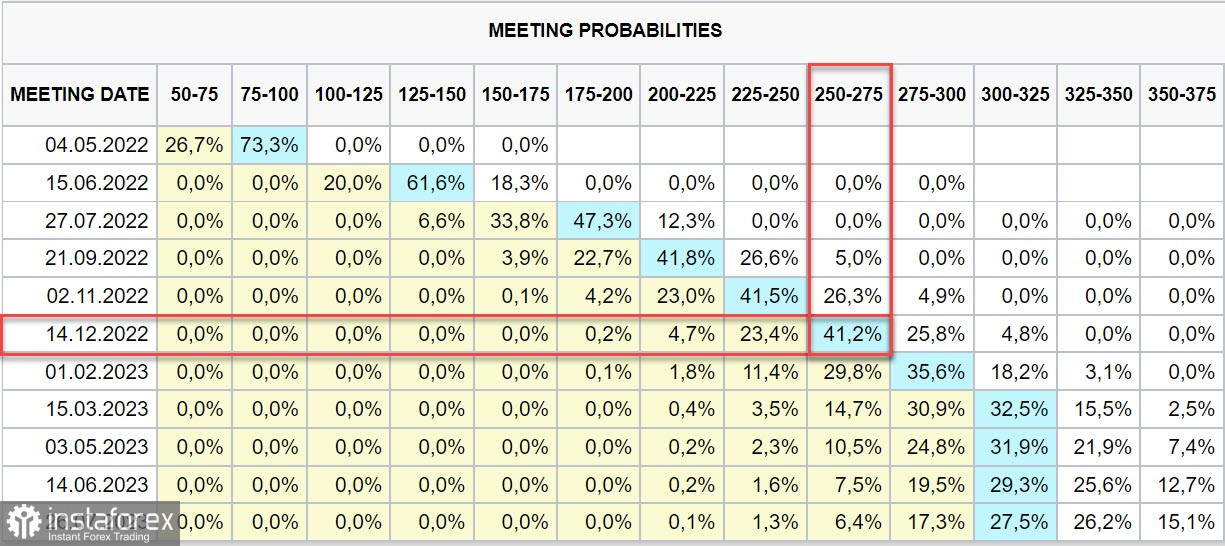

The trend towards forecasting a more aggressive pace of the Fed rate hike is impressive. A week earlier, futures at the rate gave a forecast of 2.25-2.50% by the end of the year, during the week the forecast shifted another quarter-point higher. In the next two meetings, the market sees increases of 0.5% in a row, that is, in June, the rate may reach 1.25-1.50%.

UST yields fell back slightly on Monday after an impressive rise on Friday amid hawkish comments by some major U.S. banks, but the pullback is shallow and in no way means a reversal. The yield of long-term bonds, in particular 10-year bonds, decreased, while 2-year growth continued, which means further smoothing of the UST yield curve and the approach of inversion. And inversion, as historical experience shows, is almost guaranteed to be a harbinger of recession.

It can also be noted that the U.S. goods trade deficit has slightly decreased after record growth in January to 106.6 billion, the contribution of foreign trade to GDP remains negative.

At the moment, the dollar remains the main favorite of the market, but its strength is based not on the strength of the American economy, but rather on the accelerating flight of capital from the euro. Europe is facing a difficult choice, since Russia's demand to convert gas payments into rubles is the strongest uncertainty factor. The denouement will come after April 1.

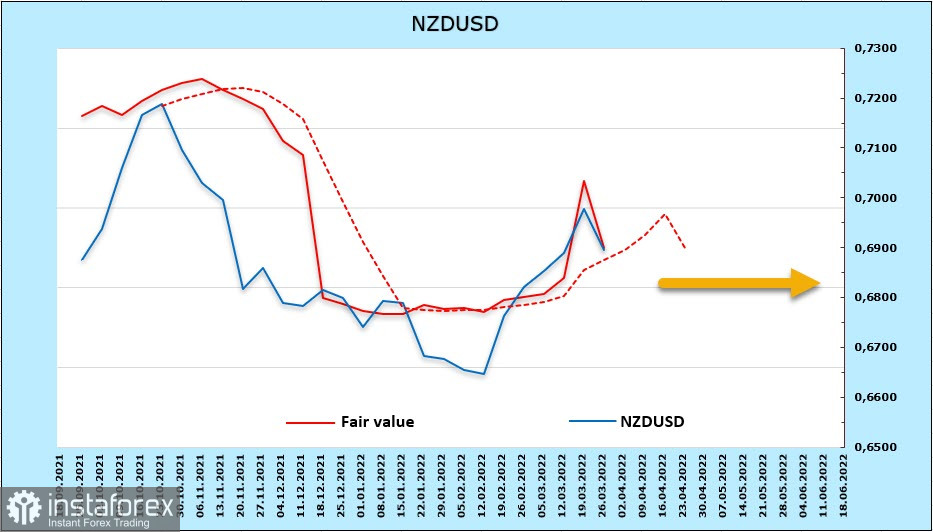

NZDUSD

Business reviews of New Zealand increasingly express concerns that a surge in inflation is becoming a threat to economic growth. In nominal terms, economic growth is still confident, but adjusted for inflation, it is necessary to take into account the fact that the real purchasing power of households is rapidly declining, wage growth is significantly lagging behind the growth of consumer prices. ANZ Bank has changed its GDP forecast for 2022 from +2.7% to 2.1%, which will put pronounced bearish pressure on demand for kiwi.

The RBNZ, just like the Fed and other central banks of developed countries, are stuck between the hammer and the anvil – the slow pace of rate hikes threatens increased inflation, and aggressive rate hikes worsen financial conditions and also inhibits economic growth. Most likely, the RBNZ will choose the way to fight inflation, that is, the rate growth rate will remain high, in April the rate is expected to rise by 0.5% immediately.

The weekly change in speculative positioning for NZD, as follows from the CFTC report, has changed little (-72 million), the bullish preponderance of +175 million is insignificant. The estimated price is still higher than the long-term average, but the dynamics are clearly negative.

We assume that the upward momentum weakened greatly, the kiwi went up a little, but failed to reach the border of the 0.7050/70 channel. Another attempt to go higher is possible, but it is more likely to go into the side range of 0.6850/6980, there are practically no reasons for a strong movement in one direction or the other.

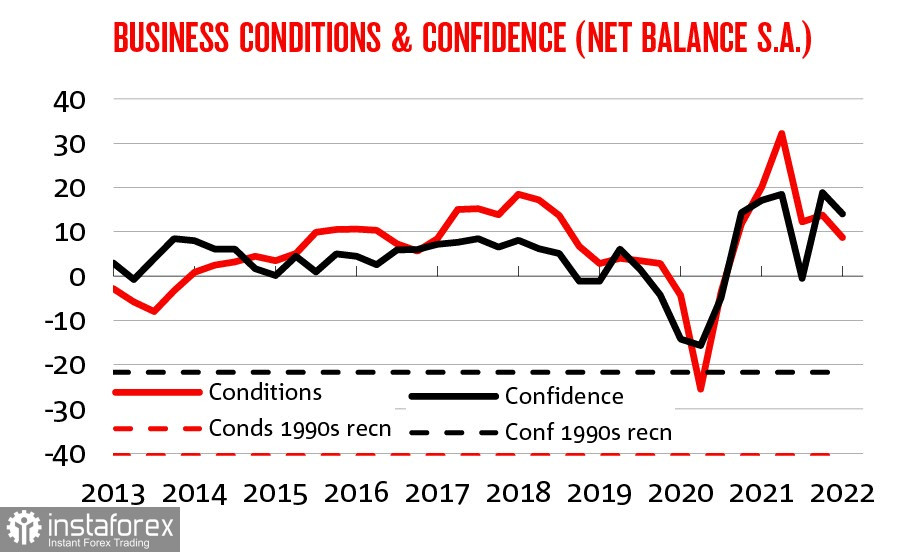

AUDUSD

NAB's quarterly business review showed a slowdown in the momentum of the post-covid economic recovery, confidence decreased by 5 points, business conditions also by 5 points, but so far both components remain above the long-term average, which means business conditions continue to be considered good.

Among the main reasons for the slowdown in momentum are still difficulties in supply chains, increased price pressure, plus we need to add a new factor that was not taken into account in the surveys, namely a large-scale covid lockdown in China, which will inevitably lead to a decrease in demand for raw materials.

Nevertheless, the picture remains optimistic. A slight increase in the short position for the reporting week (-596 million) could not cover the positive from the repositioning a week earlier (+2.456 billion), the inflow of investment capital does not decrease, which allowed the estimated price to maintain a strong upward momentum.

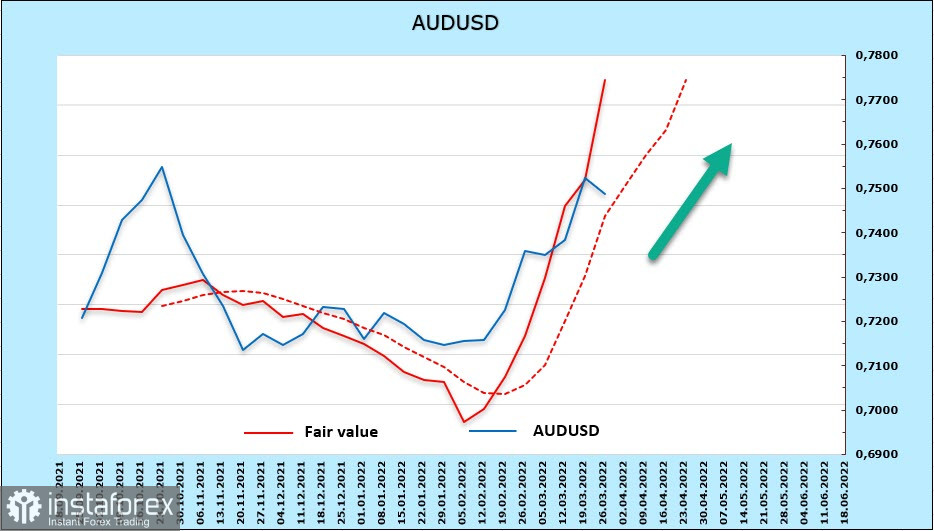

It suggests that the Australian dollar has a better chance of continuing growth than its New Zealand counterpart. AUDUSD was able to gain a foothold above the resistance of 0.7460/80, which we designated as the first target a week earlier, we expect an attempt to test the strength of the resistance of 0.7560, and then 0.7620.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română