GBP/USD going through hard times

Yesterday, the main event for the GBP/USD pair was the speech of the Bank of England's Governor, Andrew Bailey. However, he did not give any new hints to the market. Bailey talked about uncertainty and increased risks when describing further steps in the monetary policy. Obviously, these risks are the same for everyone. High inflation hitting developed economies, the military conflict in Ukraine, which brings more new sanctions against Russia, including a ban on its oil and gas imports, andsoaring energy prices are the main problems that everyone is facing now. But life goes and, and institutions have to adjust to new circumstances. To be honest, the position of the Bank of England and the comments of its governor are a bit surprising. It is clear that risks and uncertainty have increased in the current situation. But since the central bank has already embarked on the path of monetary tightening, this policy should be continued. What is the point of stopping halfway and trying to change your mind? Judging by the technical picture, market participants had the same thoughts and reacted negatively to Andrew Bailey's speech.

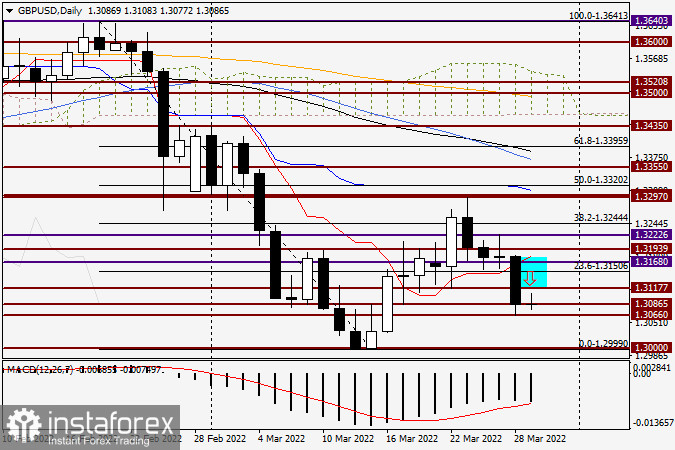

Daily chart

At the close of yesterday's session, the pound/dollar pair depreciated notably, ending the trade at 1.3087. At the same time, the support of 1.3086 was strong enough to resist the pressure. In an attempt to break through this level, the pair touched 1.3066 and then immediately rebounded from it. At the moment of writing, the pair is making weak attempts to move higher. This may be either a correction against yesterday's strong decline and a pullback towards the support levels broken the day before or a resumption of the upward scenario. The latter is very unlikely judging by the daily chart. The pound has been under bearish pressure for more than a day now, and any attempts of the bulls to change the situation in their favor have failed so far. If bears gain full control over the GBP/USD market today and close the trade below yesterday's lows at 1.3066, this will open the way towards the key psychological level of 1.3000. This level serves as the major support for now. A bullish scenario will be possible if the price moves higher to close the session at least above 1.3117. The upward scenario will become more evident when the quote returns above 1.3168 and passes the red Tenkan line of the Ichimoku indicator located at 1.3181. As I see it, the daily time frame mostly indicates a downtrend, which implies selling the pair from the price zone marked on the chart.

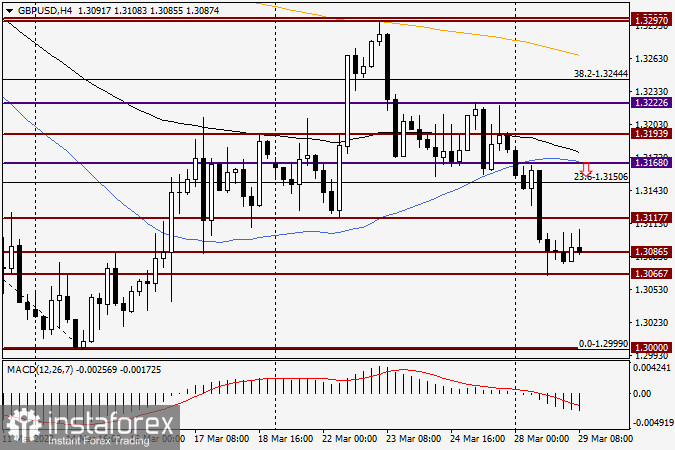

H4 chart

On the four-hour time frame, the pound/dollar pair is in a clearly uncertain state, which is confirmed by the wave-like movements of the quote. Personally, I prefer to sell the pound/dollar pair. You can consider the price zone of 1.3140-1.3170 for opening short positions. In a more aggressive scenario, try to sell the pound after it pulls back to the level of 1.3117 and attempts to return above this mark. If reversal bullish candlestick patterns appear in the support zone of 1.3186-1.3166 on this or the H1 chart, you can try to open long positions on the pound with close targets at 1.3100-1.3120.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română