Market remains undecided

Hi, dear traders!

Most analysts are bearish on EUR and do not expect it to rise against the US dollar. However, technical analysis of EUR/USD suggests otherwise.

The Federal Reserve is poised to tighten its monetary policy and fight high inflation more aggressively and decisively, thanks to favorable economic conditions in the US. The European Central Bank, on the other hand, remains at the crossroads, despite elevated inflation in the eurozone. The regulator would need to increase interest rates to tackle high inflation, however it could backfire on the vulnerable EU economy. Resuming monetary stimulus could boost weak economic growth, but it could also push inflation even higher. Many market players expect the ECB to follow the Fed's example and hike interest rates twice this year.

The EU regulator has not sent any clear signals that it would tighten monetary policy. Traders await upcoming ECB meetings to find out more about the EU central bank's policy plans. The situation in Ukraine could also play a significant role. Before the war, Ukraine was a major exporter of food and grain into Europe. Heavy fighting between Russia and Ukraine threaten to derail the planting season, stopping agricultural exports from Ukraine. Furthermore, the EU would have to support the large number of Ukrainian refugees in its territory. Rising energy prices will also boost inflation in the eurozone. Overall, the fundamentals favor the US dollar. However, technical factors have not always matched fundamental ones recently.

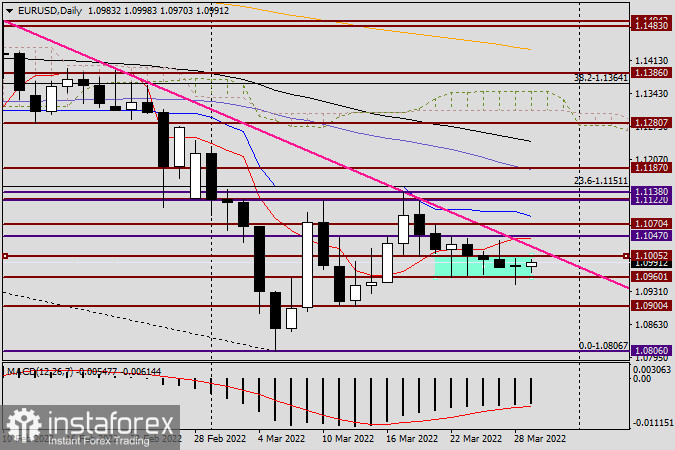

Daily

Yesterday, EUR/USD dived below the support at 1.0960 thanks to efforts by bearish traders but retraced afterwards towards the opening price, leaving a long lower shadow. This can be seen at the daily chart. The pair is unwilling to move downwards - it could likely break out of the 1.0960-1.1000 range and surge upwards. Such a narrow range indicates the pair is consolidating before a strong move into any direction. If EUR/USD manages to break above the red Tenkan-Sen line of the Ichimoku cloud, it could rise in the direction of 1.1070, 1.1100, 1.1122, and 1.1138. If the pair breaks through the support in the 1.0960-1.0945 area and settles below it, it could fall towards 1.0900, 1.0850, and the key support level of 1.0800.

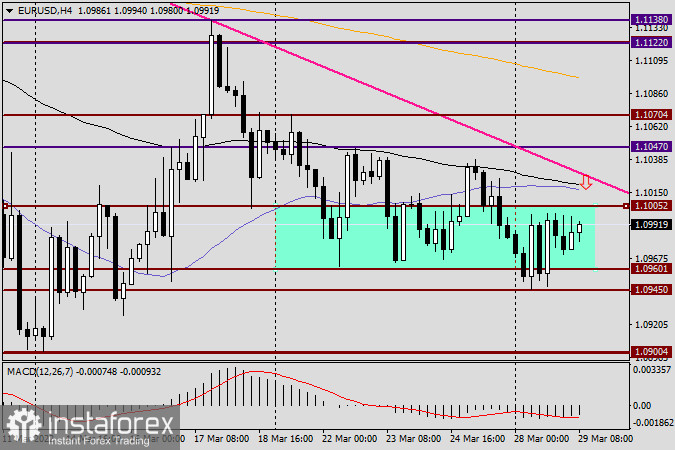

H4

According to the H4 chart, EUR/USD could move in both directions, allowing traders to open both long and short positions. Below the pink resistance level lie the 50-day MA and 89-day EMA lines, which could reverse the pair downwards. Short positions could be opened in the 1.1015-1.1025 area, as well as 1.1025-1.1050. Traders could open long positions if the pair falls into the 1.0960-1.0945 area, forming bullish reversal patterns at H1 or H4 charts.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română