The EUR/USD currency pair continued to slide down slowly but surely on Monday. We have already said in previous articles that formally, the downward trend is now maintained since the price is located below the moving average line. At the same time, both linear regression channels are directed downward. Therefore, all technical indicators now indicate a downward movement. In yesterday's articles, we suggested that a pause is vital for the market since the last month has been very active and volatile. Nevertheless, the European currency did not intend to stand still on Monday, and even without important fundamental and macroeconomic events, it still rushed down. Therefore, it seems that the further development of events for the pair will be somewhat different. In particular, it can now be assumed that the European currency will continue to be under market pressure, but it will not fall as fast as before. Although even this conclusion may need to be adjusted since now a lot depends on geopolitics.

Although there is not much really important news concerning the Ukrainian-Russian conflict right now, the market understands that the situation has not changed dramatically and for the better. Yes, the euro and the pound have slightly adjusted upwards, since no movement is complete without corrections, but then what? Europe is on the verge of a new "pack" of crises. Moreover, the ability of the European Union to resolve these crises and come out of them with honor is lame. Recall that after the "coronavirus" crisis, the States have fully restored their economy, but everything is bad in the European Union. Christine Lagarde has repeatedly stated that the European economy can stand on its feet only with the help of two crutches: low rates and monetary stimulus. Her words are confirmed by the GDP report for the fourth quarter, which recorded a value of +0.3% q/q. A new crisis could hit the economy even harder, as oil and gas prices are rising, and if Joe Biden presses Europe on the issue of refusing to import Russian hydrocarbons, it will also be a shock. After all, it's no secret that even the transition from some hydrocarbons to others will take time. This means that the EU oil and gas industry will have to completely adapt to the new conditions. New contracts will have to be signed, and the ways of delivering oil and gas to EU countries will also be different.

The food crisis. What threatens?

The most banal thing that immediately comes to mind is the shortage of many foods. If products are in short supply, it means that prices for them will also rise. Consequently, Europe is not only not on the threshold of a phenomenon called "slowing inflation". It is in a position where this inflation can accelerate even more. In Europe, they do not deny that the share of imports of grain and other food raw materials from Ukraine is very large. However, there is a war going on in Ukraine now, so the sowing campaign is under threat of disruption, and Kyiv has already announced that it will suspend the export of some products since now it does not know how long it will have to live on those stocks that were formed in previous years. Food shortages are not the only problem the EU may face. The burden on its budget is growing, as more than 3 million refugees have already left Ukraine for the EU countries, who need to pay benefits, feed, and provide housing. Well, rising oil and gas prices will only make almost all goods and services more expensive. Therefore, we believe that inflation will only grow, and there is nothing to stop it. If we start raising rates, then European GDP may slide into negative territory. And there is nothing to stimulate the economy either - there is nowhere to lower rates further, and introducing new QE programs means stimulating inflation, not the economy. In general, the situation for Europe is really difficult, so the European currency is and may continue to be under pressure for a long time. And in the US, at this time, they will raise rates and fight inflation. Indeed, some countries benefit from war.

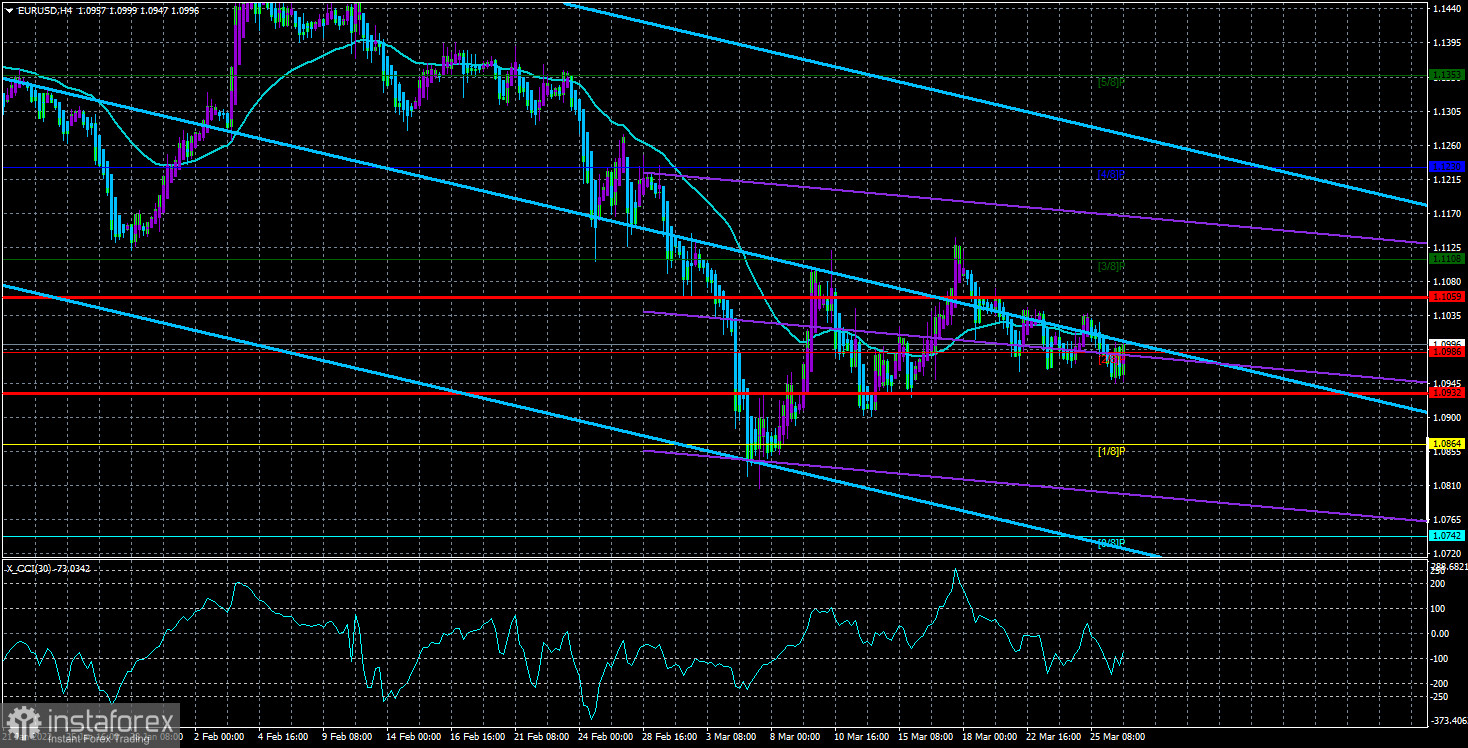

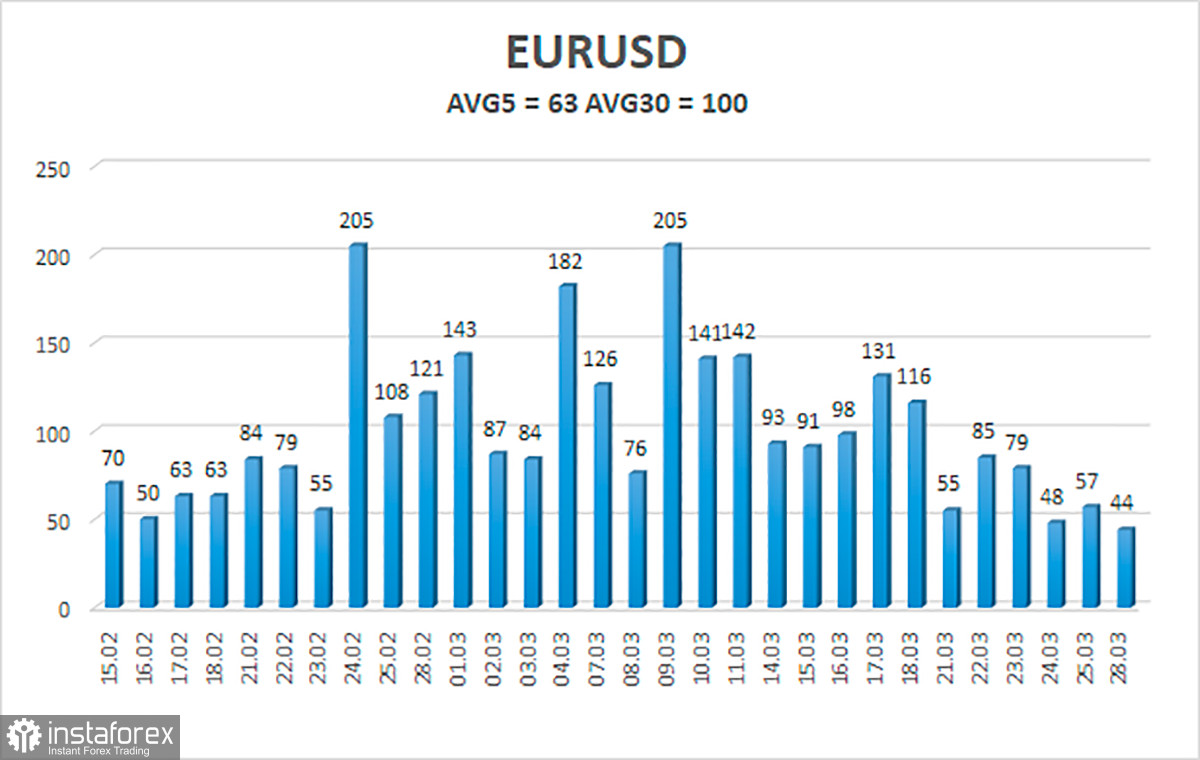

The volatility of the euro/dollar currency pair as of March 29 is 63 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0932 and 1.1059. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair continues to be located near the moving average. Thus, it is now possible to consider long positions with targets of 1.1059 and 1.1108 if the price is fixed above the moving average. Short positions should be maintained with targets of 1.0932 and 1.0864 until the Heiken Ashi indicator turns upwards. In both cases, there is a high probability of a flat.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română