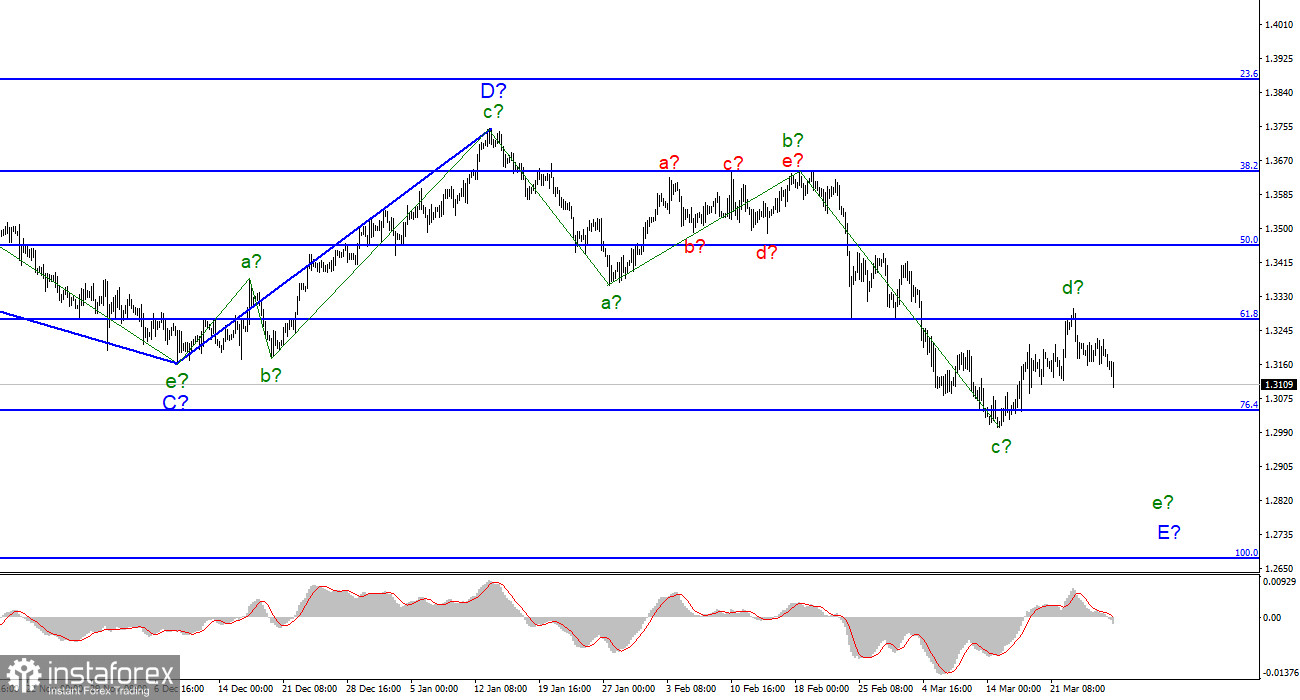

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The expected wave d in E is completed, and there should be five waves in total inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction for some time. The instrument made an unsuccessful attempt to break through the 61.8% Fibonacci level, so the probability of building a new downward wave is high. The decline in quotes may continue with targets located around the 27th figure within the wave e in E. I note that there are enough reasons for wave E to take an even more extended form. Or the entire downward section of the trend has taken a more extended form. It will depend on how bad the news background will be for the Briton. And the most important thing is the geopolitical background. If there are no questions about the British economy now, then the situation in Ukraine may harm the movement of the instrument for a long time. I have practically no doubt that the recent decline in the pound lies exclusively in the plane of the Ukrainian-Russian conflict. And this conflict is not over.

Joe Biden urges not to be afraid of anyone

The exchange rate of the pound/dollar instrument decreased by 75 basis points on March 28. At the same time, the euro currency lost only 30. And the wave markings of both instruments are very similar to each other. However, the rate of decline of a particular currency does not matter now. The main thing is that the wave pattern does not change, as it allows you to work on the tool and earn money. In the last few days, many European and Western leaders have made statements about the Ukraine-Russia conflict. The European Union indicated the possibility of abandoning Russian gas, Biden said that all Western countries should unite, not be afraid of anyone and oppose the aggressor. In Poland, they even said that the American president had declared a new "cold war" on Russia. There are frankly a lot of conversations now, but there is practically no economic information. What can explain the decline in demand for the British on Monday, if it started falling at night, and the only event of the day - the speech of Governor Andrew Bailey - was to take place at lunch?

However, in any case, I am not waiting for important information from the Bank of England or the Fed right now. Most recently, the central banks held meetings, announced the decisions taken, as well as the monetary policy courses that their ships will take in 2022. Even taking into account the fact that the British regulator has already raised the rate three times, the market is waiting for even more "hawkish" decisions in 2022 from the Fed. Thus, the rate of 0.75% does not help Briton much yet. Inflation is now a ubiquitous problem. No matter how banks complete their QE programs, do not raise rates, and do not declare that they will do everything necessary for price stability, inflation is still rising in the US, the EU, and the UK. Therefore, I do not believe that it is now possible to rely on inflation data when forecasting the dynamics of the instrument.

General conclusions

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. I continue to advise selling the instrument with targets located near the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave E does not look completed yet. I propose to consider Wave d in E completed, and I do not wait for the wave marking to become more complicated until the instrument makes a successful attempt to break through the 1.3273 mark, which equates to 61.8% Fibonacci.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the quotes of the British around the 27th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română