EUR/USD

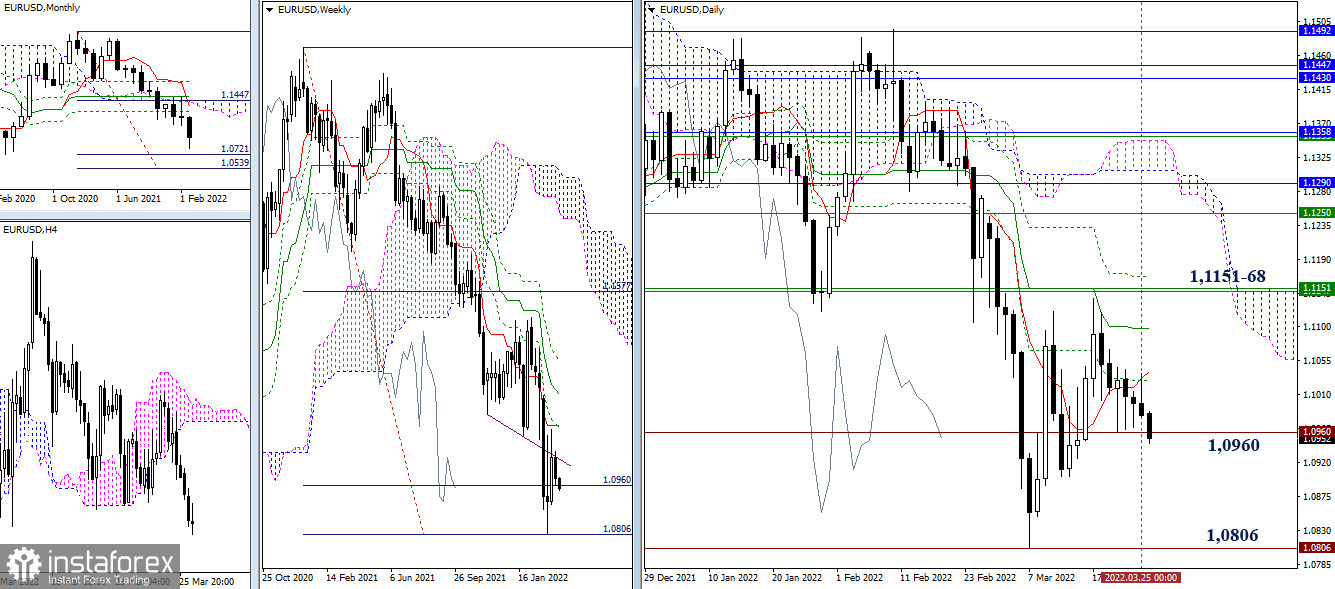

Last week did not clarify the priorities of the development of events. The uncertainty persists to this day. Support and attraction in the current conditions are provided by the level of 1.0960 (the first target of the weekly target for the breakdown of the Ichimoku cloud). The most important thing for the bears in this area is the 1.0806 milestone (the minimum extremum + 100% working out of the weekly target), which will help restore the downward trend. And for the bulls, resistance levels in the area of 1.1151–68 are of particular importance now, allowing bullish sentiment to restore weekly short-term support and eliminate the daily death cross. On the way to 1.1151, there are intermediate daily resistances 1.1029–41 and 1.1099.

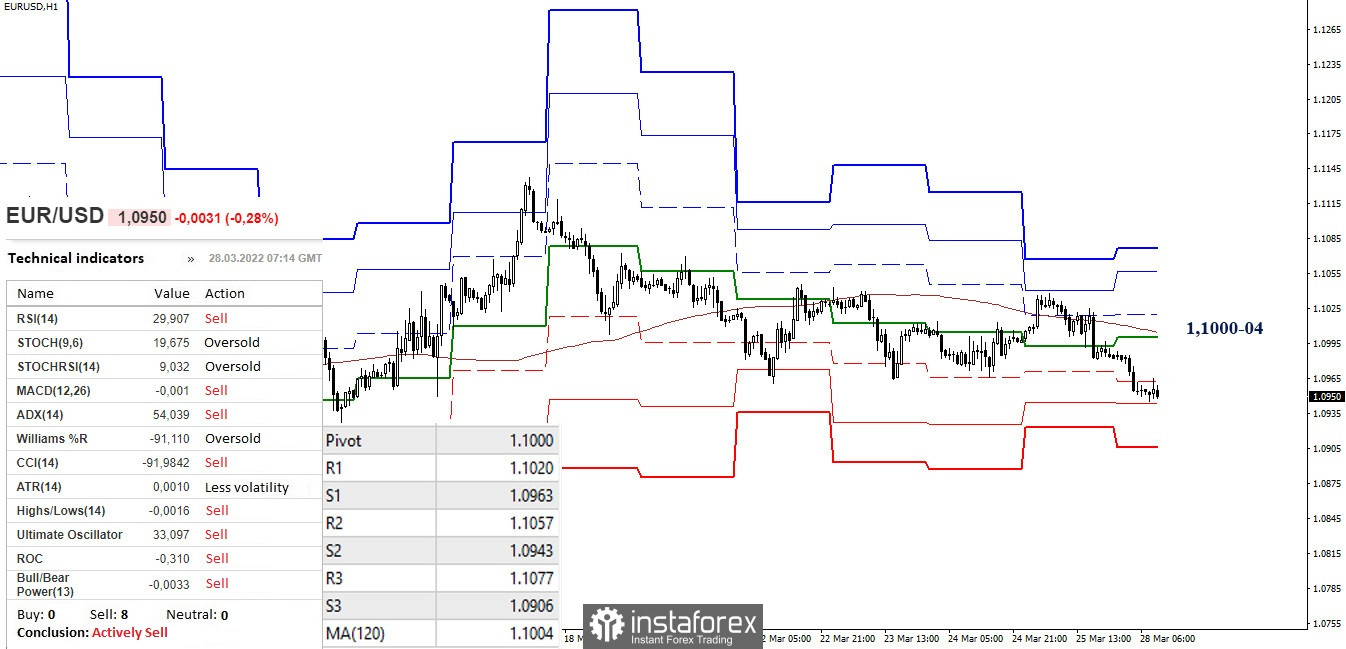

On the lower timeframes, the main advantage is now on the side of the bears. They are testing S2 (1.0943), then, if the decline continues within the day, they will find support at S3 (1.0906). The key levels today converged around 1.1000-04 (weekly long-term trend + central pivot point of the day). Breakdown and consolidation above the key levels will change the current balance of power of the lower timeframes. In this case, the resistance of the classic pivot points (1.1020 – 1.1057 – 1.1077) will become upward targets.

***

GBP/USD

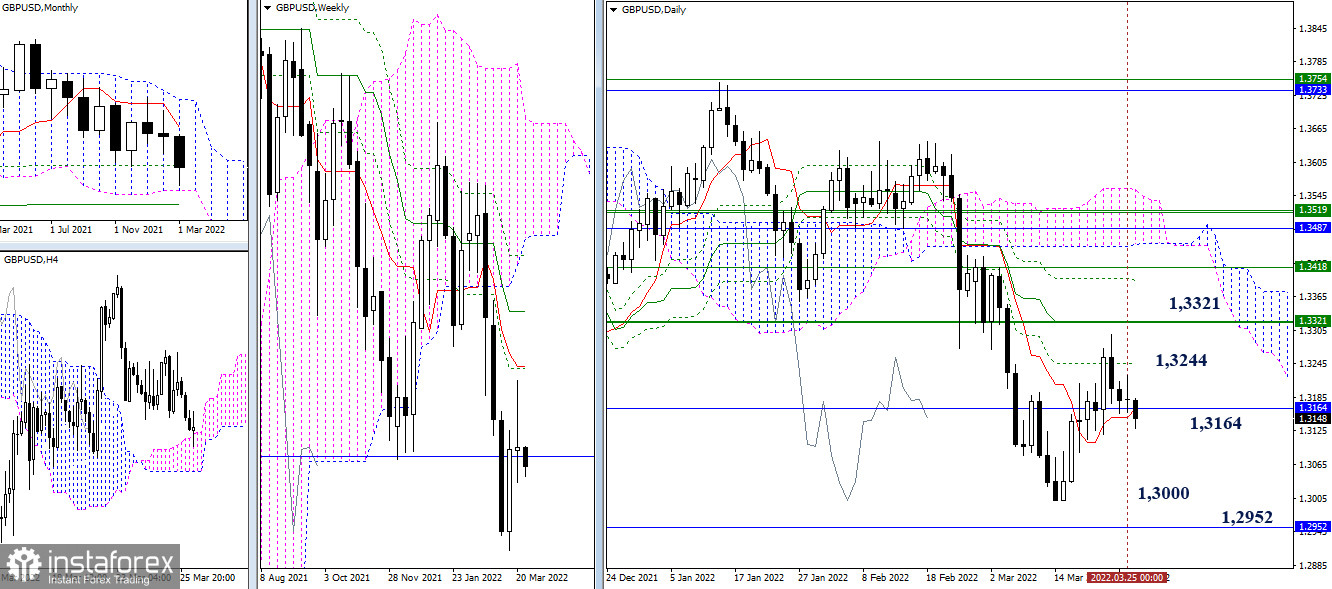

The weekly candle failed to support the optimistic development of the rebound indicated earlier. Instead, uncertainty prevailed. The attraction and influence on current actions are now exerted by the daily short-term trend (1.3165) and the monthly Fibo Kijun (1.3164). Updating the low (1.3000) and testing the lower boundary of the monthly cloud (1.2952) are still important downside targets. The bullish target is aimed at 1.3321, where there is a combination of weekly levels and the daily medium-term trend. Intermediate resistance in this area may be 1.3244 (daily Fibo Kijun).

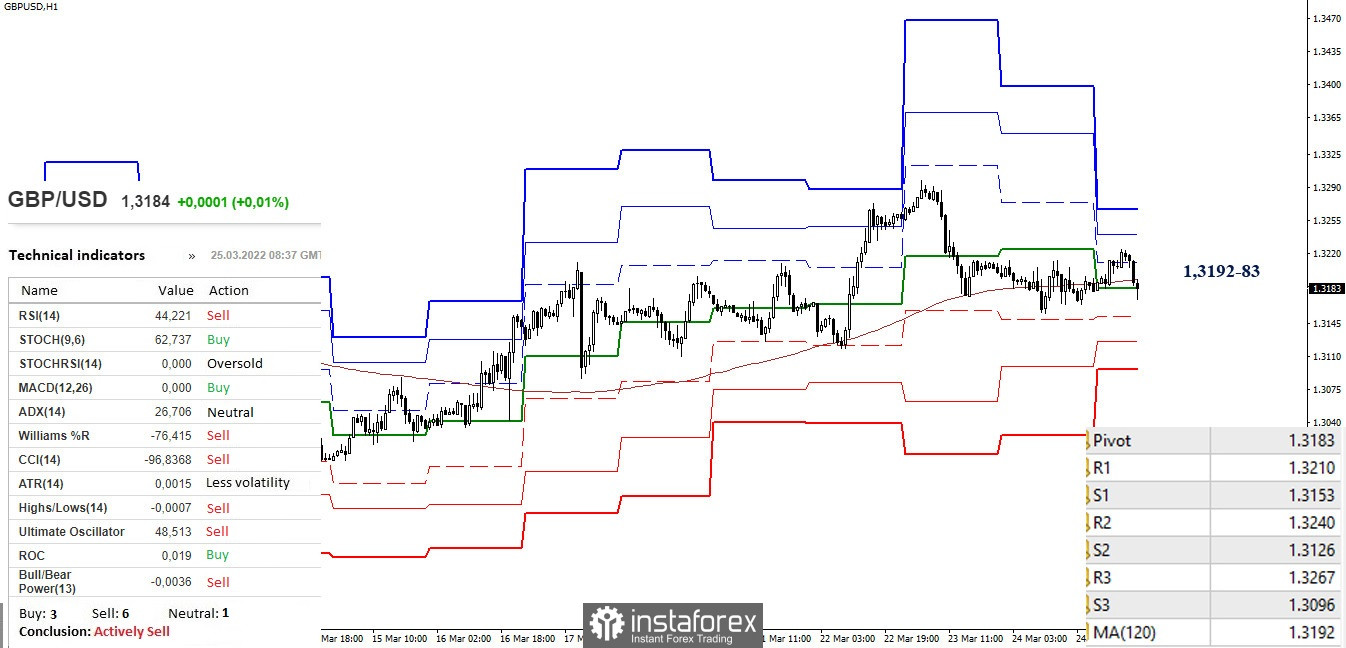

On the lower timeframes, the main advantage is now on the side of the bears. This state of affairs will continue as long as the pair works below the key levels, which are currently in the area of 1.3195–88 (central pivot point + weekly long-term trend). The downward targets within the day can be noted at the support of the classic pivot points 1.3122 and 1.3085, and the upward targets are located at 1.3217 – 1.3254 – 1.3283 (resistance of classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română