U.S. sovereign bonds fell on Monday as economic risks from inflation and monetary tightening hit sentiment.

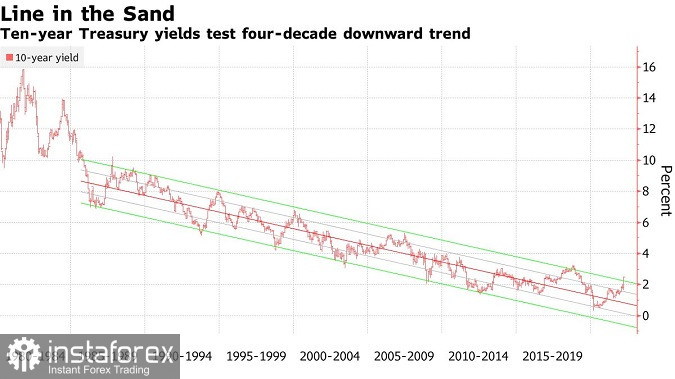

The yield on 10-year U.S. Treasury bonds rose above 2.5%, above the technical trend line that has served as a ceiling since the late 1980s.

Bonds fell in Australia and New Zealand, while Japan's 10-year rate reached 0.25% even as the Bank of Japan announced two unlimited buys to keep them below this level - the upper part of its permitted range.

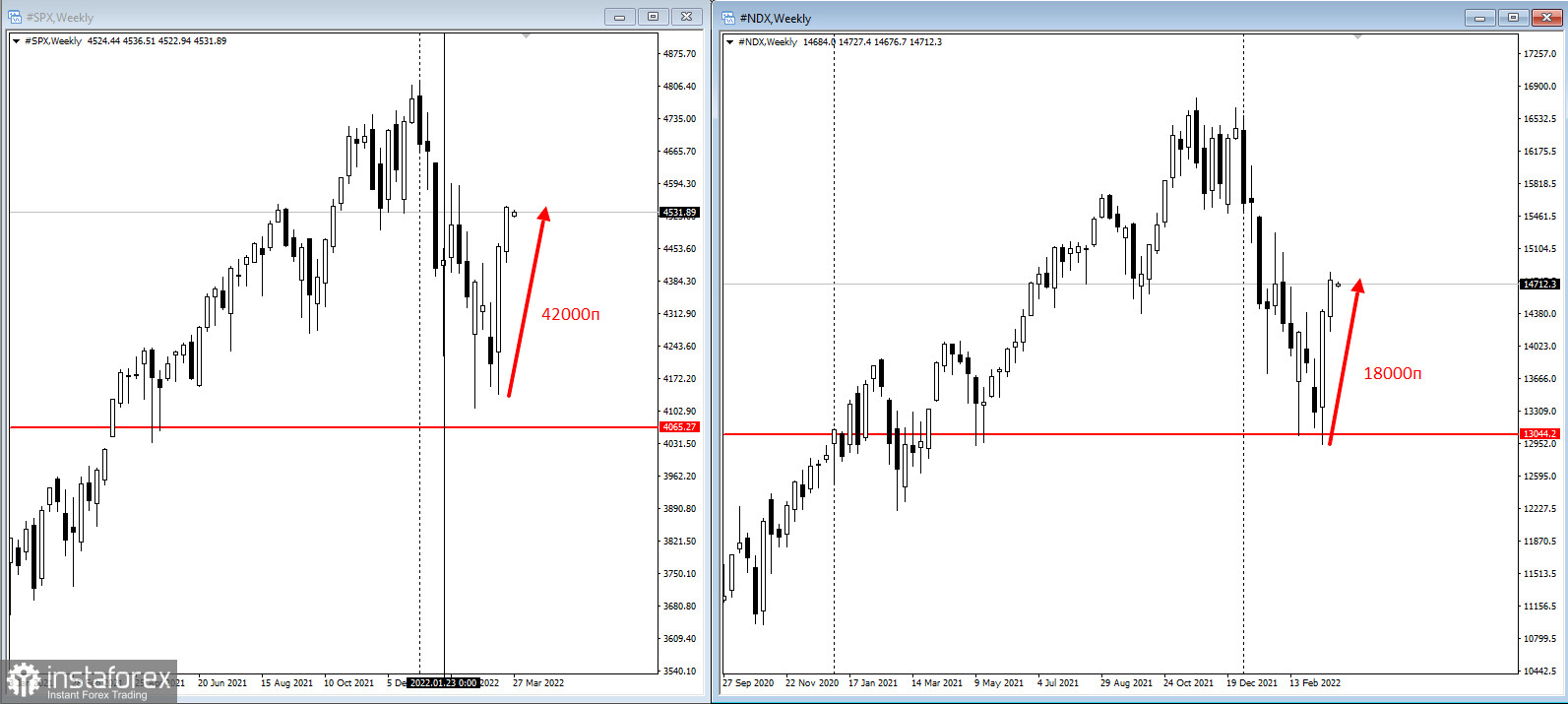

The S&P 500 and Nasdaq 100 contracts posted their biggest two-week gains this year, absorbing their monthly drop:

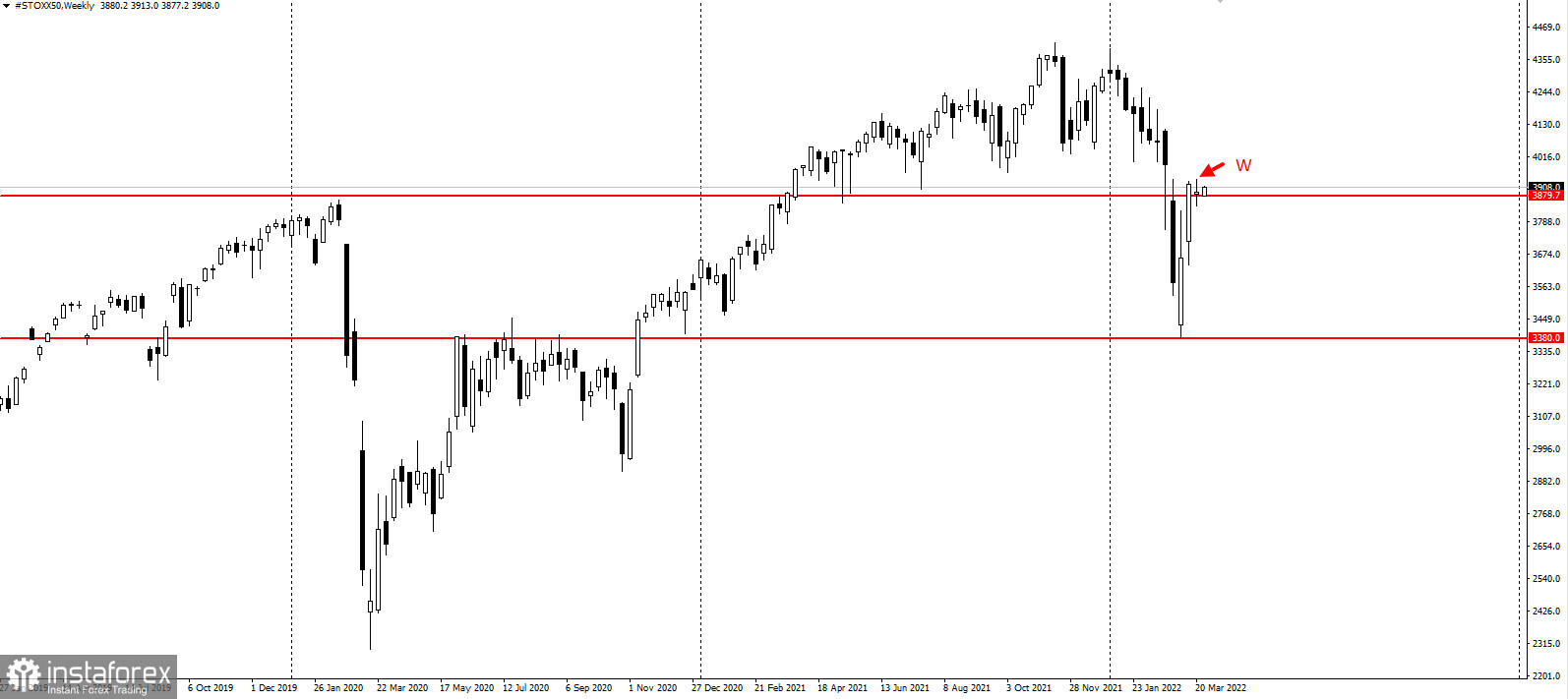

The European stock index STOXX50 closed last week neutrally. This is due to the impact of the sanctions war and the disruption of supply chains:

West Texas Intermediate slipped below $110 a barrel as a Covid-related lockdown in Shanghai sparked fears that a surge in the virus in China threatens oil demand.

The military operation continues to disrupt the supply of key commodities, fueling inflationary risks that contribute to expectations of a more aggressive Fed tightening. Traders estimate two full percentage points of a Fed rate hike during the remainder of 2022. Mobility restrictions in China may raise concerns about rising costs.

"What is happening with China, it adds to the concerns of — does this add to the supply-chain disruption?" Mary Nicola, a global multi-asset portfolio manager at PineBridge Investments.

Electric vehicle manufacturer Tesla Inc. plans to suspend production at its Shanghai plant for at least a day, people familiar with the matter said. Tesla has not yet told employees if it will extend the suspension, they said.

In recent geopolitical developments, Ukrainian and Russian negotiating teams intend to resume in-person negotiations this week. President Joe Biden has tried to soften comments calling for Vladimir Putin's removal, saying the U.S. is not seeking regime change in Moscow.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română