Wall Street analysts and retail investors have not given up on their prediction that gold will hit $2,000 an ounce anytime soon. Noting that the precious metal will be supported by the demand for safe-haven assets due to the ongoing geopolitical tensions in Ukraine, as well as rising inflation. Concerns in the global market are helping gold prices counter rising bond yields and hawkish comments from Federal Reserve Chairman Jerome Powell.

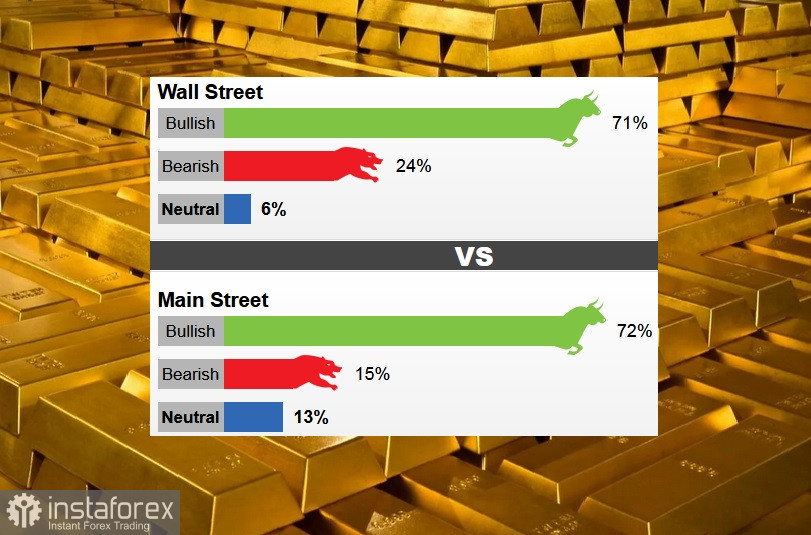

Last week, 17 Wall Street analysts took part in the gold review. Of these, 12 analysts, or 71%, voted for the growth of gold this week. Four analysts, or 24%, were bearish. And only one analyst or 6% was neutral.

There were 1,034 votes cast in Main Street online polls. Of these, 743 respondents, or 72%, expect gold prices to rise this week. 158 voters, or 15%, announced price cuts. And 13% voted for neutrality.

The unbelievable thing is that gold is holding up well against rising bond yields. On Friday, the yield on 10-year bonds rose to 2.5%, the highest level in three years.

Many analysts believe bond yields could rise as the Federal Reserve looks to tighten interest rates faster than anticipated. On Tuesday last week, Powell shocked markets by saying that inflation is now too high. And he made it clear that the U.S. Central Bank admits the possibility of raising interest rates in May by 50 basis points. And maybe in June too. However, the gold market does not take these threats too seriously.

Despite the aggressiveness of the Federal Reserve, economists are confident that the interest rate will not be raised more than 2%. Annual inflation is currently 7.9%. Some economists believe that by the end of the year it may fall to 4-6%. But the bottom line is that real interest rates will still remain negative.

But not only monetary policy stimulates investment demand for gold. A significant role is played by the geopolitical situation, which supports the demand for the precious metal as a safe-haven asset.

Until the geopolitical situation defuses, the humanitarian crisis in Eastern Europe will continue. At the moment, more than 3.7 million refugees have left Ukraine, and about 6.5 million people have moved within the country.

According to the forecasts of many geopolitical analysts, the conflict will not be resolved in the near future. Therefore, in financial markets, market uncertainty and volatility will remain noticeable.

However, there is a new element to the conflict as Western economic sanctions kick in and the U.S. dollar becomes a weapon. Gold may establish itself as the new world currency.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română