The outcomes of the EU and NATO summits were predictable

Hello, dear colleagues!

The EUR/USD pair completed another trading week on Forex. However, last week did not cause any dramatic changes to the current balance of forces. Moreover, major events, determining the external background, were predictable. But first things first.

During the EU summit, the leaders tried to work out a new energy concept for the EU in response to the constantly rising energy prices. According to President of the European Commission Ursula von der Leyen, it is necessary to create a mechanism of total demand for gas and significantly increase gas storage facilities. It is evident that the summit also addressed the need to considerably reduce the EU's dependence on Russian gas and oil. Therefore, now the European market, which accounts for 75% of the world's gas, will be unified. This means that 27 EU countries will jointly implement the new energy policy and buy the fuel. However, it is difficult to predict the possible consequences of this policy as all EU countries are dependent on Russian oil and gas in a different way. Some countries are more and other countries are less dependent on Russian energy. It is entirely unclear how to develop a common strategy in this situation. Although it sounds reasonable, it is stressed that every EU country has its own objectives.

I think that Ursula von der Leyen's plans to fight Russia as well as her support of US President Joe Biden will be unveiled in the coming months. Moreover, Joe Biden visited Brussels to force EU leaders to strengthen sanctions against Russia. A key outcome of the NATO summit was the decision to deploy four new combat groups on the eastern borders of the EU, including Romania, Slovakia, Hungary and Bulgaria. Notably, the results of EU and NATO summits were predictable. Now, it is advisable to discuss the technical picture of the EUR/USD pair. Besides, it is better to start the traditional Monday analysis from the weekly chart, summing up the outcomes of the past trading week.

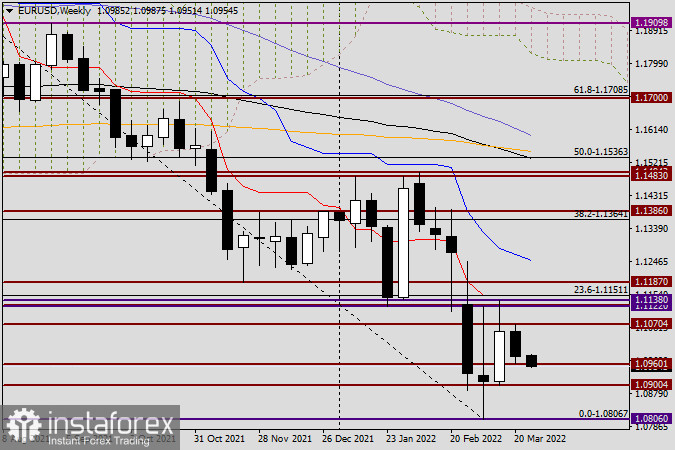

Weekly

The EUR/USD pair declined during the trades on March 21-25, closing at 1.0982. Consequently, euro bulls failed to close the weekly session above the most significant psychological and historical level of 1.1000 despite the fact that during the weekly trading the pair EUR/USD rose to 1.1070. Moreover, bears failed to push through strong support at 1.0960. Therefore, the trading is currently carried out in the range of 1.1070-1.0960. Besides, exit from this range may indicate the pair's further direction. If the pair breaks through the support level at 1.0960, it may reach a strong and important level at 1.0900. Moreover, breakout of this level will aim sellers to 1.0800. In case of a bullish scenario and a breakout of the sellers' resistance at 1.1070, the next targets for euro bulls will be the levels of 1.1100, 1.1122, and 1.1138. Overall, the technical picture on the weekly chart is not clear. I believe both trading scenarios are possible. They will depend on the geopolitical situation, market sentiment as well as the incoming macroeconomic indicators and the tone of the ECB and Fed high-ranking officials.

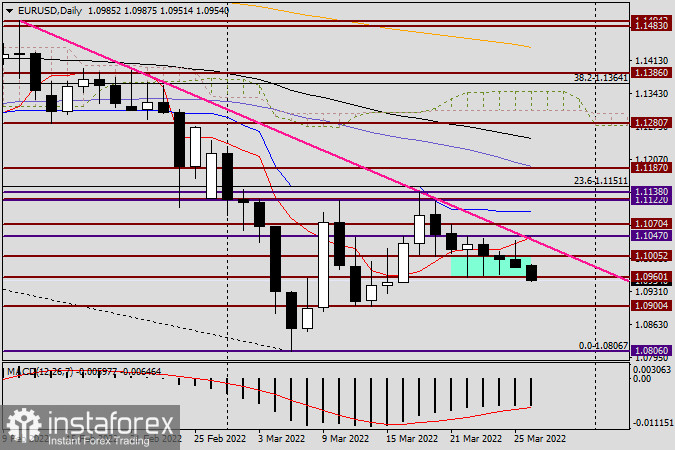

Daily

The EUR/USD daily chart shows little change. The red Tenkan line of the Ichimoku indicator prevents the price from rising. Besides, the support at the marked area of this timeframe continues to repel bears' attacks near 1.0960. Moreover, at the time of completing the article, the pair has already been under pressure and has tried to hit the level of 1.0960. Notably, two candlesticks in a row closed below the key level at 1.1000. Besides, this aspect is also favorable to euro bears. However, it is likely that bears will try to return the trades above 1.1000 again.

As for trading recommendations, selling the EUR/USD pair is currently the best option due to the complicated geopolitical situation, a significant divergence in the Fed and ECB monetary policy as well as strong US economy. It is recommended opening short positions in the EUR/USD pair after it tries to return above 1.1000, 1.1015 and 1.1045. However, the market is so unstable that the pair is expected to rise from 1.0965 and (or) the price range of 1.0920-1.0900. In case of choosing either of the two options, it is better to await formation of the corresponding Japanese candlesticks near the marked one or smaller timeframes. Moreover, they will be discussed in tomorrow's article on EUR/USD.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română