The GBP/USD currency pair, after attempting to form a new upward trend, returned to the moving average line and has been near it for two days. Of course, two days is not too much, plus the volatility of the pair is still not zero, but you quickly get used to the good. In the last month, volatility on both major currency pairs was quite high, so there were quite a lot of good days with a good trend movement that allowed you to earn. It's not just about volatility, but the combination of volatility and trend movement. However, all good things come to an end sooner or later. And now, it seems, the trend movement for the pound/dollar pair has come to an end. However, of course, this is too loud a conclusion, given the situation in which the whole world is now.

The current geopolitical situation is such that in addition to the Ukraine-Russia conflict, a good five more conflicts may break out in the world. Yesterday, information was received that Azerbaijani troops occupied several villages in Nagorno-Karabakh, where Russian peacekeepers were previously located, and this territory itself is "local Transnistria." Japanese officials have already stated that the Kuril Islands are native Japanese lands. Poland and Germany are looking at the Kaliningrad region. And even Finland suddenly discovered that part of its territory is now under the Russian flag. In addition, Finland is openly beating around the bush about joining NATO. So are Bosnia and Herzegovina. Poland declares that it is necessary to supply any weapons, air defense, military aircraft to Ukraine, as well as to introduce peacekeeping armies. Slovakia has already given the go-ahead to transfer its air defenses to Ukraine in exchange for NATO air defenses. It is unlikely that the Kremlin will like all of the above, which means that it is quite possible to expect a tightening of rhetoric, new threats, new warnings, and, in general, a complication of the geopolitical situation around the world. And every new conflict or expansion of the old one (especially those that occur in the center of Europe) is a new threat to risky currencies and risky assets.

Macroeconomic events, but everything will depend on the mood of the market.

There will be a few macroeconomic and fundamental events in the UK in the new week. The week will begin with the fact that the Chairman of the Bank of England, Andrew Bailey, will give a speech on Monday. Recently, he has not given any important comments, even immediately after the meeting of the regulator. There is little chance that on Monday he will give the markets important information. On Thursday, the last and final value of GDP for the fourth quarter will be published, which, most likely, will not differ from the previous ones and will amount to 1% q/q. And these are all the events that are planned in the UK.

Things will be much more interesting in the States. Even if we omit the Nonfarm report on Friday, many secondary reports will be published, which in conditions of low volatility can affect the movement of the pair. The ADP report on the level of employment in the private sector, GDP for the fourth quarter in the final estimate, personal income and expenses of the American population, applications for unemployment benefits, unemployment rate, and wages are just the most important reports in the States this week. Of course, most of them will probably be ignored. However, some may be followed by a market reaction. Thus, the week can be frankly boring. If the market decides to "take a break", there may be movement inside the side channel. And it can be quite fun and active, especially if the geopolitical background will supply important information. We would recommend initially starting from the flat and low-volatility movement and changing the approach if volatility increases and the pair shows a desire to trade differently than at the end of last week.

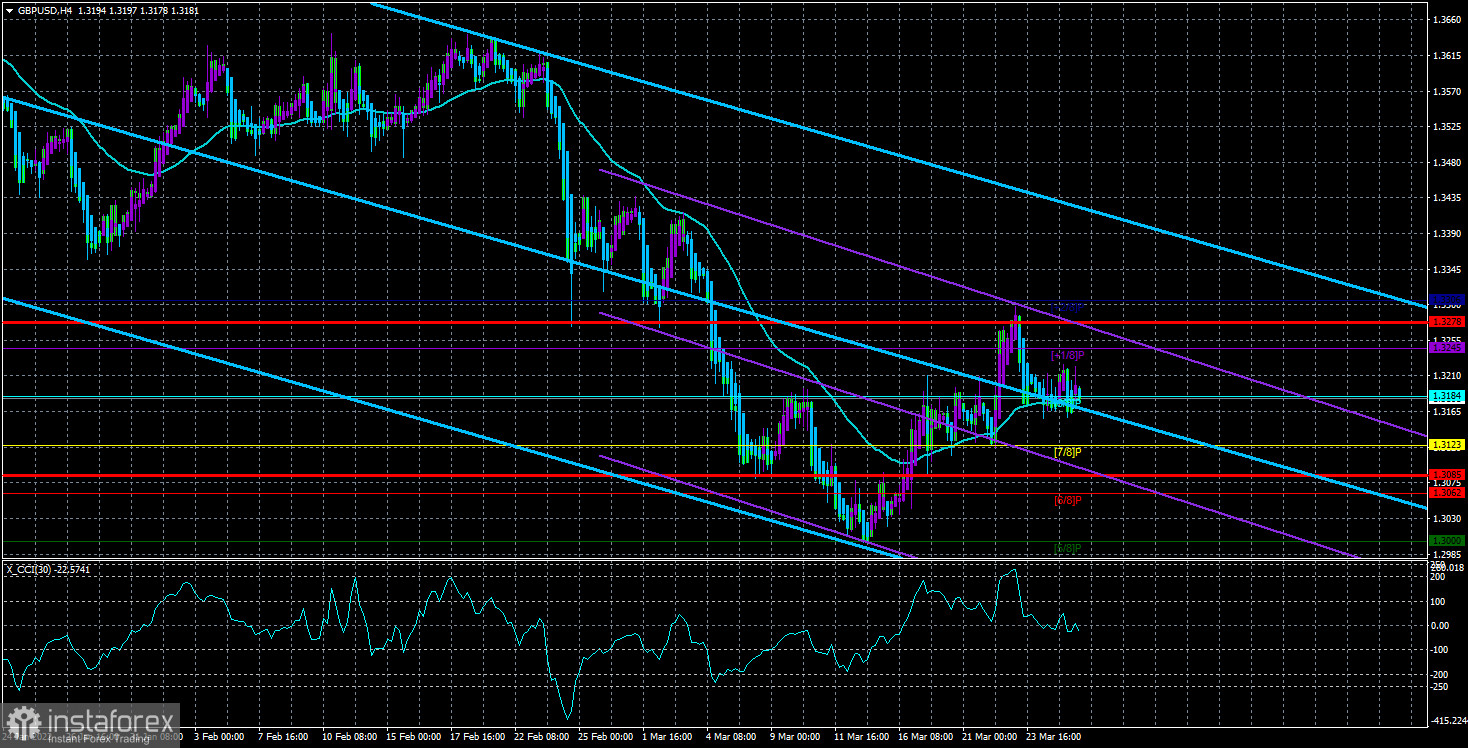

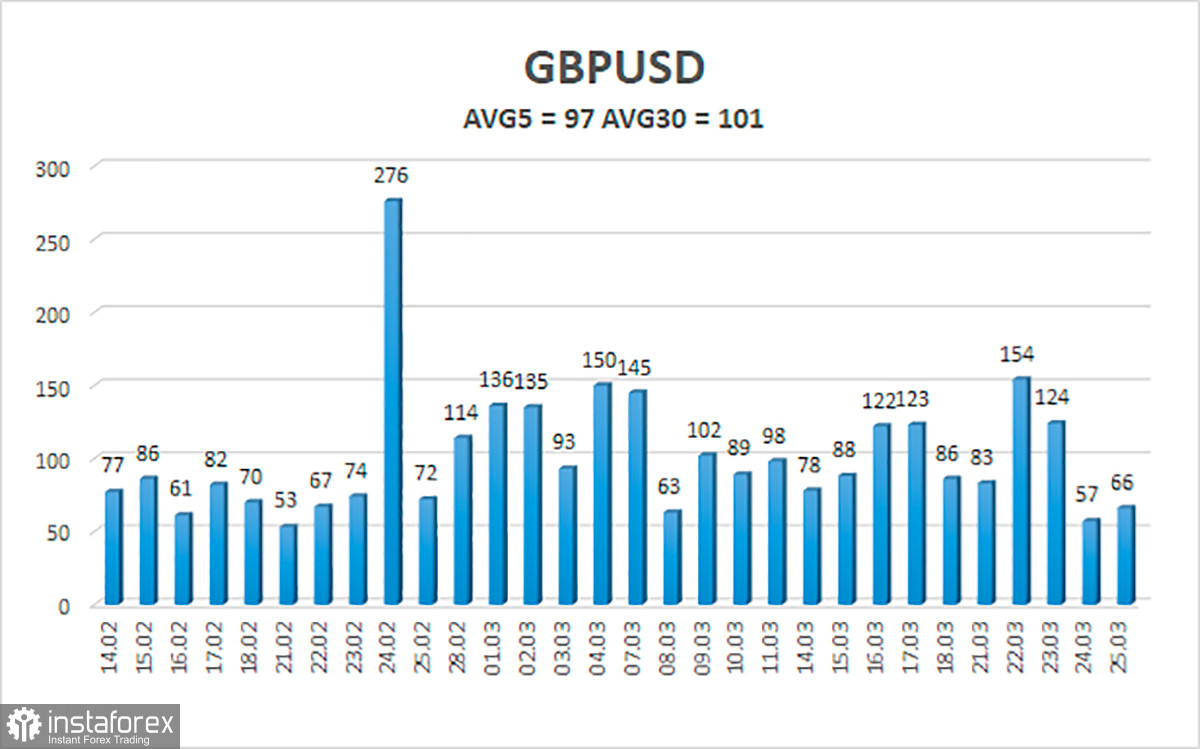

The average volatility of the GBP/USD pair is currently 97 points per day. For the pound/dollar pair, this value is "average". On Monday, March 28, thus, we expect movement inside the channel, limited by the levels of 1.3085 and 1.3278. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.3184

S2 – 1.3123

S3 – 1.3062

Nearest resistance levels:

R1 – 1.3245

R2 – 1.3306

Trading recommendations:

The GBP/USD pair has started a new round of corrective movement on the 4-hour timeframe. Thus, at this time, it is possible to consider new purchase orders with targets of 1.3245 and 1.3278 in the event of a price rebound from the moving average. It will be possible to consider short positions no earlier than fixing the price below the moving average with targets of 1.3123 and 1.3076. In any case, the probability of a flat is high now and the pair have spent the last two days in a flat.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română