The EUR/USD currency pair ended last week "for the repose". We have already said that volatility has sharply decreased in the last few days, and the movement itself is now more and more like a flat. On the 4-hour TF, the narrow range in which the price has been in the last few days is even better visible. Thus, at this time, the downward trend is formally maintained, as the price continues to be located below the moving average line, but at the same time, there is a high probability that the pair will go flat for several days or weeks. Judge for yourself, all the most important events that traders were waiting for took place (we are talking about the meetings of the ECB and the Fed), there have been a lot of speeches by Jerome Powell and Christine Lagarde recently and they were quite informative. The current economic situation in the US and the EU is as clear as day. That is, by and large, the market now should not have a single question that would not have an answer. With geopolitics in the last two weeks, too, everything has become dramatically simpler. The longer the "military operation" continues, the more everything moves towards a military conflict of the "Donbas 2.0" type.

There are many experts, there are even more different opinions. Many believe that the military operation will end within a couple of weeks or a couple of months. Some believe that the military conflict will persist for many years. Anyway, there is no question of a ceasefire in the near future. But at the same time, markets cannot be constantly in fear and panic because of geopolitics. The markets have already experienced the first avalanche of fear and fully realized that if everything continues in the same direction, the European Union will face an energy and food crisis. The longer the conflict drags on, the higher the probability of the outbreak of World War III or, at least, the accession of other countries to the conflict. It should be understood that the difference between the Ukraine-Russia military conflict and, for example, the Russian Federation-Chechnya military conflict is that in the second case, the operation was conducted on its territory. Now half the world stands for Ukraine, which actively supplies weapons, finance, and humanitarian aid. And sanctions, sanctions, and more new sanctions are being imposed against the Russian Federation. Thus, this situation does not even have a purely theoretical quick way out.

Friday should be "explosive"

However, let's return to the economy. Next week, we expect that a flat will be observed for the pair. Or a rather weak movement. If we analyze all timeframes, then the fall of the European currency seems to continue. Almost all factors speak in favor of the dollar's growth now. But the market may still take a timeout for a while. In principle, you need to be ready for a flat right now, and the resumption of a strong movement is determined by the growth of volatility. This week, the chances of a strong movement due to macroeconomic events will be only on Friday. It is on this day that reports on European inflation and the American labor market will be published. Both reports are of great importance in the current circumstances. However, even the consumer price index in the EU is probably more important. Recall that the European Union and the ECB have nothing to fight high inflation with. The state of its economy does not allow raising the key rate, which means that inflation can grow almost unhindered. Christine Lagarde still hopes that inflation will begin to slow down by itself, but so far she sees only oil and gas rising in price, provoking an increase in prices for all other goods and services. Thus, inflation in the EU does not correlate in any way with the probability of an increase in the key rate. Nonfarm in the States is just a very important report. The greater the discrepancy between the forecast and the actual value, the higher the probability of a strong movement on Friday afternoon. However, we would like to warn you that volatility may be high on Friday, but this does not mean that it will be the same before Friday or after Friday. Now the market has calmed down with a high degree of probability and will trade less actively.

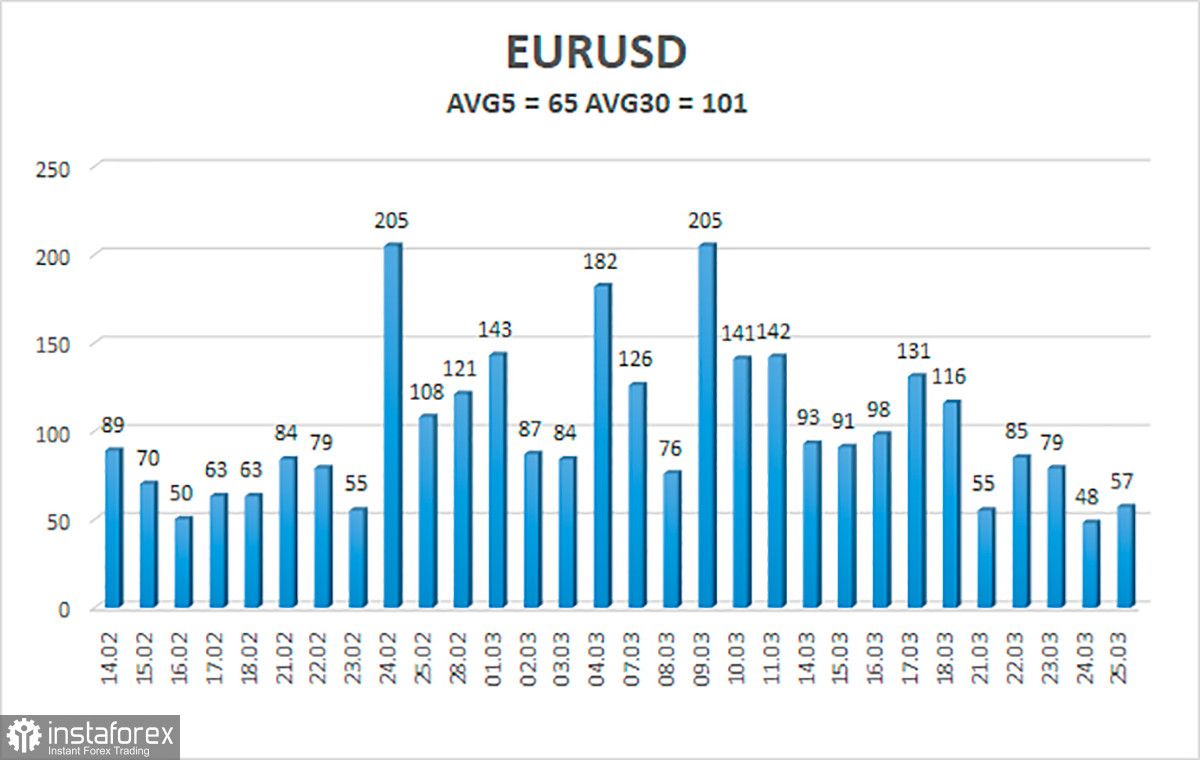

The volatility of the euro/dollar currency pair as of March 28 is 65 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0917 and 1.1047. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues to be located near the moving average. Thus, it is now possible to consider long positions with targets of 1.1047 and 1.1108 if the price is fixed above the moving average. Short positions should be maintained with targets of 1.0917 and 1.0864 until the Heiken Ashi indicator turns upwards. In both cases, there is a high probability of a flat.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română