In March 2022, the global community and financial markets experienced one of the most considerable shocks. Investors are trying to get used to the new realities, which are significantly influenced by two key factors. While the special military operation in Ukraine cannot be swayed, they can adapt to the new Fed policy.

As we expected, the Fed's accommodative tightening of monetary policy will be reversed because the body's strategy did not take full-scale military operations into account. This was implicitly confirmed by Jerome Powell, who said that the rate of inflation was still high. Similar statements can be heard from other members of the Fed, which seems quite consistent.

The regulator decided to stick to a planned rate hike so as not to stress already nervous investors. As a result, the market favorably reacted to the tightening of monetary policy. As a result, Bitcoin climbed to a new swing high of $44,000. Market players tuned in for nine mild key rate hikes in two years.

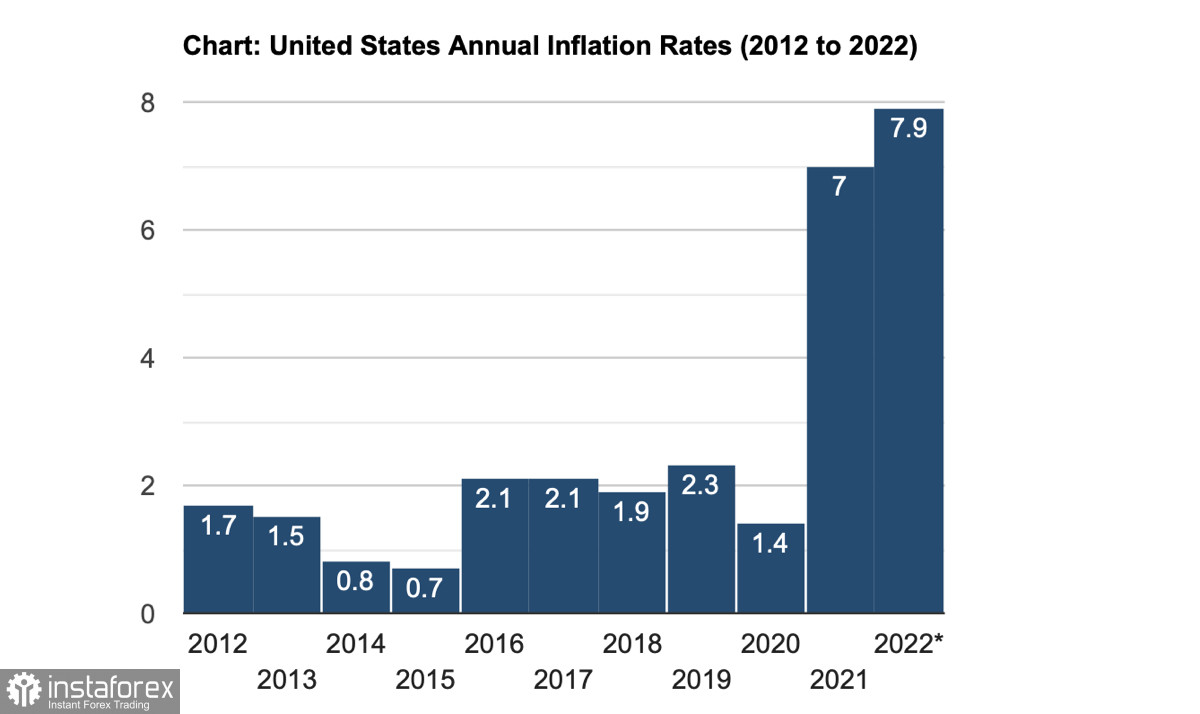

However, given the economic redistribution, imposed sanctions, and pressure on the US dollar, the monetary policy needed to be revised against the record 30-year inflation rate. It is likely that at the end of 2022 we may see the key rate at 2.5%-3.0%. Investors are gradually preparing for a sharper tightening of monetary policy due to geopolitical factors.

In such an environment, Bitcoin is likely to gain an advantage in the medium term. Investors understand that with each Fed meeting there will be less and less liquidity in the market. Therefore, Bitcoin may become a major risky asset. At this stage, the key rate hike has not been so hurtful, as you can see by the growth of the SPX and NASDAQ indices. Investors want to invest in high-risk assets again. In the near future, preserving current capital in the face of a tough key rate hike will come to the fore. Bitcoin may become the number one investment asset due to its deflationary component, the emergence of the draft of legal regulation, and the fade of the bear market.

Positive changes are already reflected on cryptocurrency charts. The asset is gradually approaching the key resistance at $44,500-$45,700 by small buying volumes. As we expected, there will be no growth momentum to this range. Instead, we see systematic upward growth based on accumulation and an increase in volumes. Technical indicators continue to confirm the bullish trend of the asset. Growing volumes of purchases and increased demand amid Fed's statements significantly increase the chances of BTC to go beyond the wide range of $32,000-$45,700.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română