GBP/USD

Analysis:

Since the beginning of last year, the pound sterling has been weakening against the US currency. There is an unfinished wave of the trend that started on January 13. Since the end of February, a hidden correction has formed on the chart. By now, its structure looks complete. The bearish section of the trend that originated on March 23 has a reversal potential.

Outlook:

Today, the pair may break out of the narrow range. It could also perform a downward reversal from the resistance level. After that, it is likely to resume the downward movement.

Potential reversal zones

Resistance:

- 1.3230/1.3260

Support:

- 1.3120/1.3090

Recommendations:

There are no entry points into long positions for the pound sterling today. It is recommended to focus on the resistance level and bearish signals forming at this level to open short positions.

AUD/USD

Analysis:

Since the end of January this year, an upward wave has been developing on the chart. Its structure has not been completed yet. In the last decade, the final part of the wave (C) is built in the form of an impulse. The AUD/USD pair is approaching the lower boundary of a powerful potential reversal zone of a large chart.

Outlook:

Today, the pair is likely to rise higher. In the first half of the day, the pair may be trading flat with a short-term decline to the support area. The price could resume an upward movement at the end of the day.

Potential reversal zones:

Resistance:

- 0.7570/0.7600

Support:

- 0.7500/0.7470

Recommendations:

It is better to stick to short-term purchases in the next sessions at the end of all counter-movements. Lock in profits in the resistance area.

USD/CHF

Analysis:

The wave construction of the Swiss franc has been unfinished since June last year. The price is approaching a strong weekly support zone.

Outlook:

In the coming days, the price is expected to move sideways between the nearest opposite zones. The USD/CHF pair is likely to be trading flat in the morning. A short-term price increase to the resistance zone also looks possible. The resumption of the downward movement may occur at the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 0.9290/0.93280

Support:

- 0.9230/0.9200

Recommendations:

Today, trading conditions for the Swiss franc are not favorable. It is better to refrain from opening positions until there are sell signals in the resistance area.

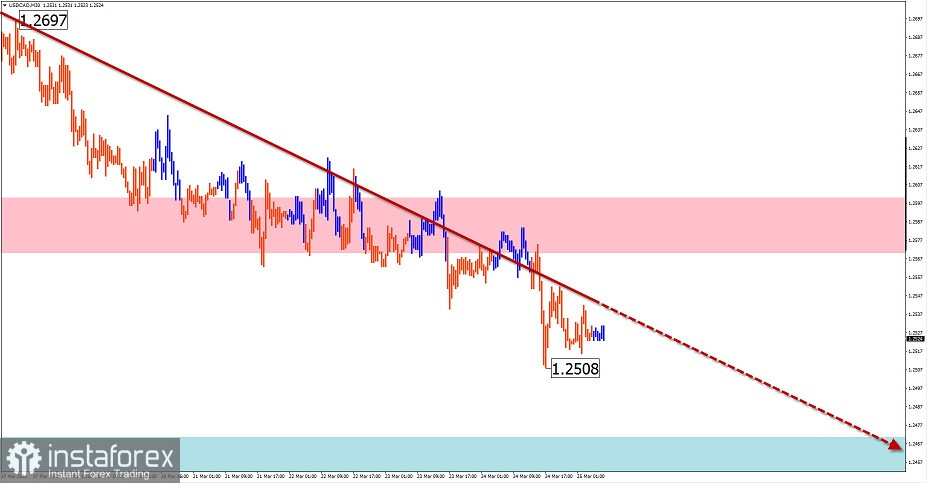

USD/CAD

Analysis:

One can see incomplete wave construction of the Canadian dollar's upward chart that originated on January 13. Since March 9, a downward correction has started, which has not been completed yet. The pair is approaching the upper limit of the strong support level of the weekly chart.

Outlook:

Today, the pair is excepted to move within the downward channel. In the next session, a short-term upward reversal is possible, not above the resistance zone. The support level passes along the upper boundary of the target levels.

Potential reversal zones

Resistance:

- 1.2570/1.2600

Support:

- 1.2470/1.2440

Recommendations:

Today, it is recommended to open short trades at the end of all counter-movements. When the price reaches the support level, it is better to lock in profits.

Explanation: In simplified wave analysis, waves consist of 3 parts A-B-C. The last incomplete wave is analyzed. The arrows show the formed structure, the dotted one demonstrates the expected movements.

Important: The wave structure does not take into account the duration of the movements of the instrument in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română