EUR/USD

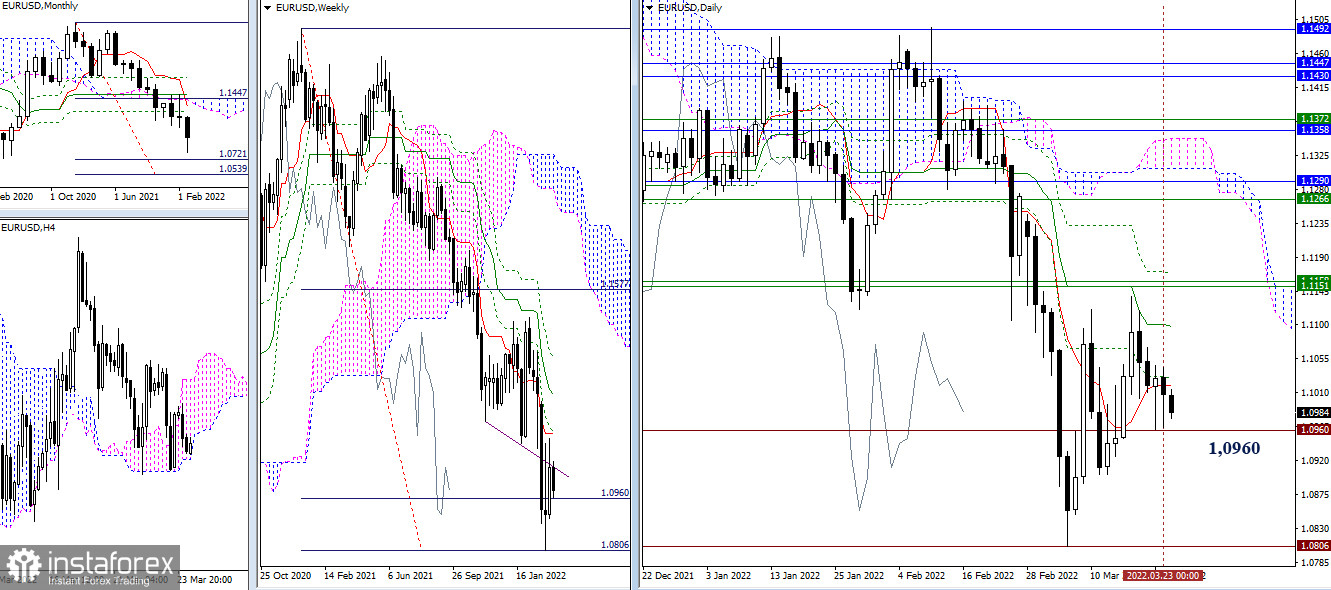

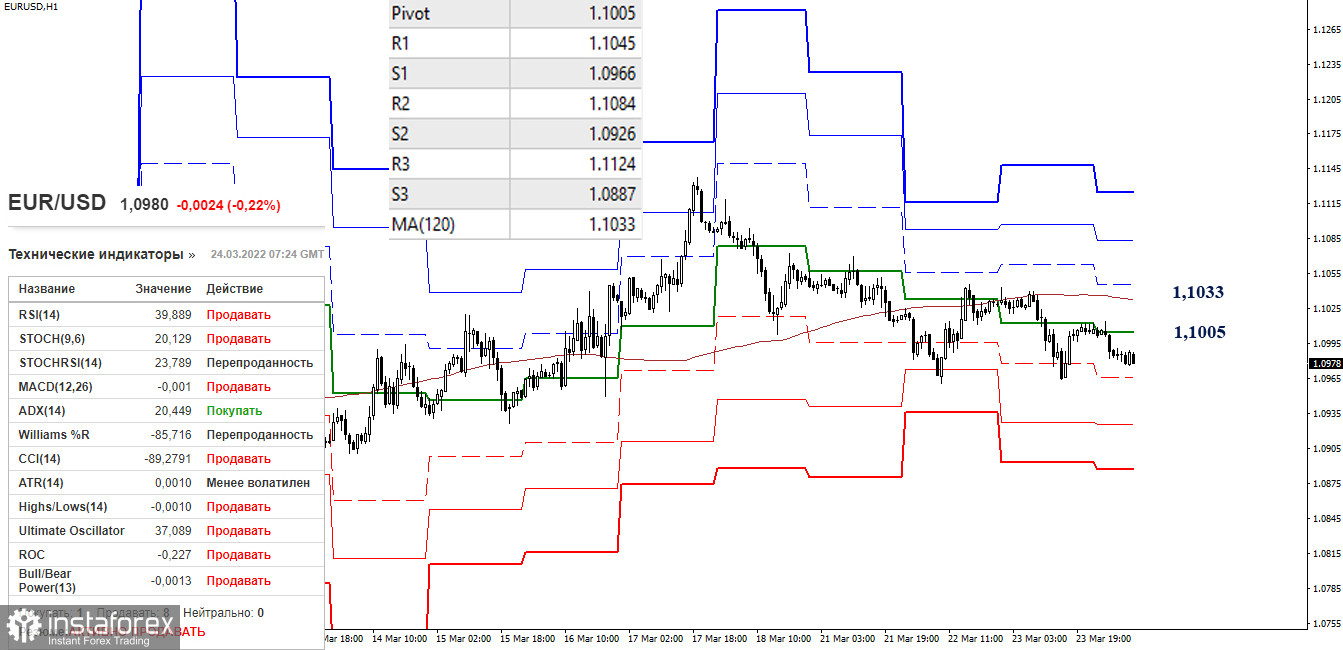

Bulls failed to confirm and continue the daily rebound from the support of 1.0960, started the day before. Consequently, the directional movement developed slowly. The daily levels of 1.1019-29 are currently more favorable. Today, all earlier specified reference points and tasks remain relevant. Bulls are targeting the liquidation of the daily dead cross (1.1101-1.1171) and overcoming the resistance of the weekly levels at 1.1151-58 to gain the weekly short-term support. Bears aim to break through supports at 1.0960 and 1.0806 (weekly target for breakdown of Ichimoku cloud).

Currently, bears have the main advantage in the smaller time frames. However, there is no development of the downward movement and increase in bearish sentiment for a long time. Today, bearish daily points are located at 1.0966 - 1.0926 - 1.0887 (classic pivot levels). In case of breakout of the key resistance around 1,1005-33 (central pivot level + weekly long term trend) and change of the current balance of forces, the daily focus will be shifted to the breakout of bullish reference points at 1,1045 - 1,1084 - 1,1124 (classic pivot levels).

***

GBP/USD

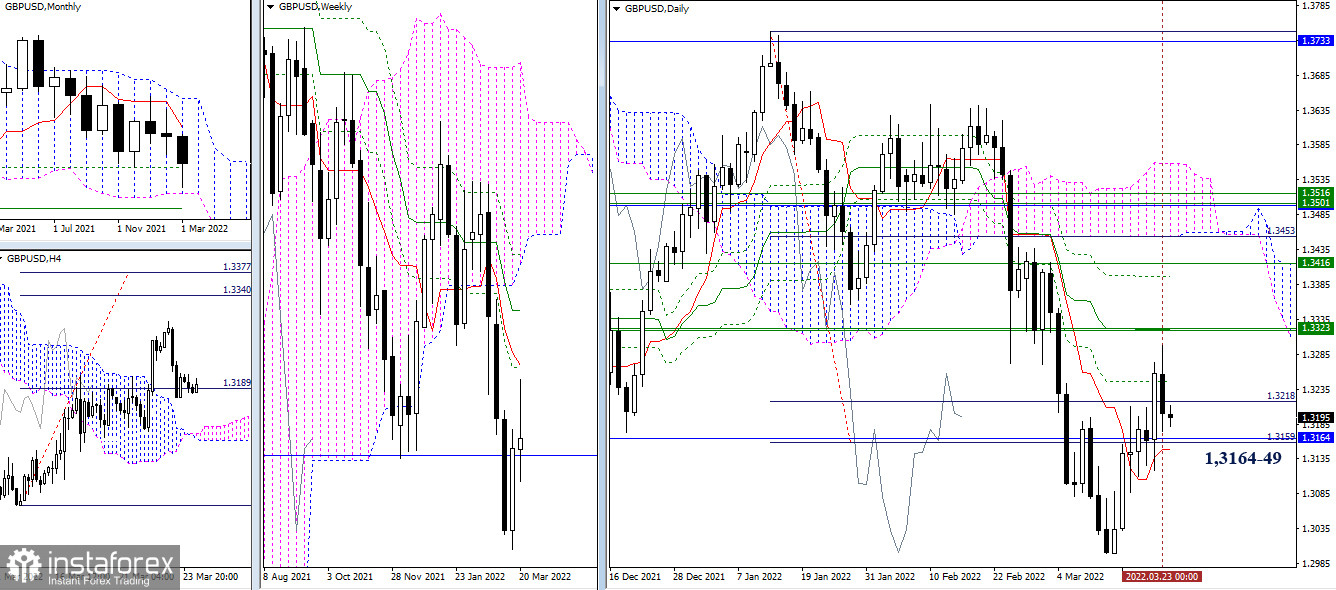

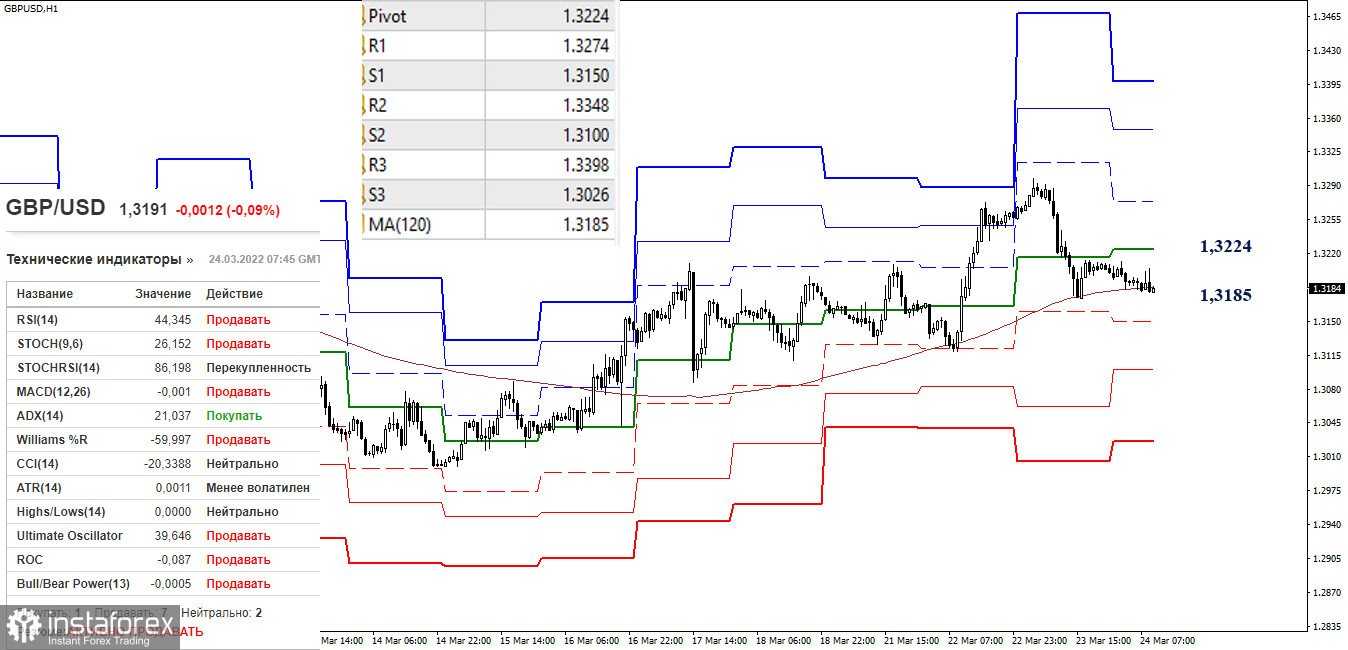

Yesterday, bears were dominant. They managed to return to the zone of influence with several strong levels at 1.3164 (monthly Fibo Kijun), at 1.3159 (100% breakout level of daily target), at 1.3149 (daily short-term trend). If bulls manage to consolidate above the support, they will try to rise and test the level of 1.3323 (weekly levels + daily medium-term trend). If bears can decline below 1.3164-49 and consolidate there, bearish sentiment will most likely strengthen. Moreover, the main target will be to resume the downtrend (1.3000).

In smaller time frames, support of a weekly long-term trend prevents the pair from changes in the current balance of forces (1.3185). The targets for further decline within the day will be the support of the classic pivot levels (1.3150 - 1.3100 - 1.3026). If bulls return to the key levels at 1.3185 - 1.3224 (weekly long-term trend + central daily pivot level), it will be another reason for strengthening bullish sentiment. Their bullish points within the day are the resistance of the classic pivot levels at 1.3274 - 1.3348 - 1.3398.

***

Technical analysis uses:

Senior timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română