Conditions for opening long positions on EUR/USD:

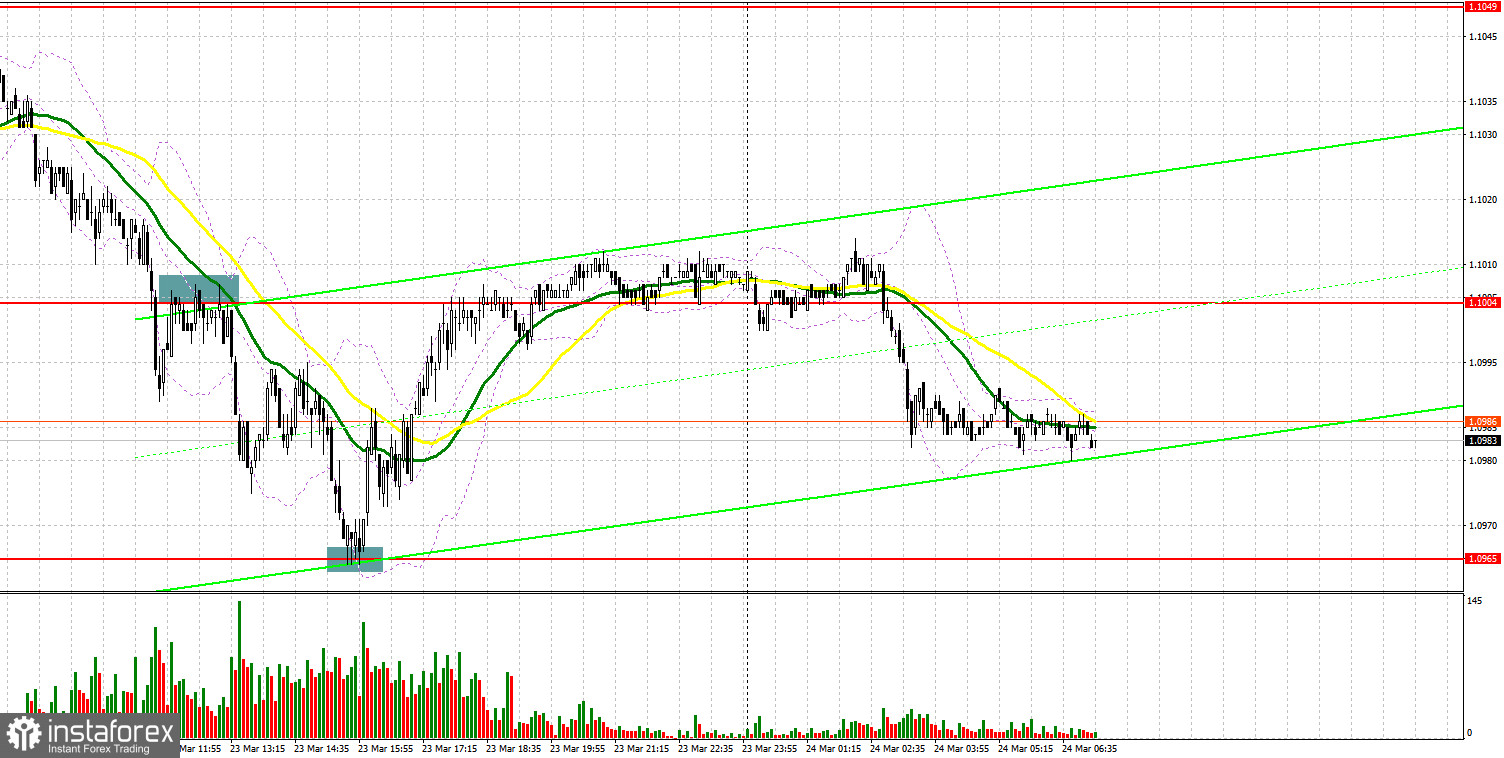

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to analyze the market situation. Sideways trading is always profitable in case of high volatility and good price ranges. Yesterday, a sideways movement created favorable trading conditions. Earlier, I asked you to focus on the level of 1.1004 to decide when to enter the market. In the first part of the day, the euro was under pressure. As a result, it broke the support level of 1.1004 and settled below it. This action provided traders with a sell signal. The pair lost more than 50 pips. A false break of 1.0965 caused a good buy signal. As a result, the pair rebounded to the middle of the sideways channel, allowing traders to benefit from a 40-pip jump.

Yesterday, the Fed's representatives and its Chair Jerome Powell said almost the same things. They all emphasize the necessity of a stronger reaction to inflation that has already spiraled out of control. Curiously, at the previous meeting, their attitude to the issue was slightly different. Early today, the ECB will publish only its economic bulletin that will hardly attract traders' attention. That is why the euro/dollar pair is likely to continue trading within the range of 1.0965-1.1049. Now, sellers are in a more beneficial situation than buyers are since the pair is hovering near the lower limit of the range. That is why bulls should do their best to protect the support level of 1.0965. Only a false break of the level will provide traders with a long signal. However, to surge, the euro/dollar pair should break the middle of the sideways channel located at 1.1010. Since the geopolitical situation is the same, demand for risk assets will hardly increase. In addition, yesterday, Vladimir Putin announced that all payments for gas would be made in rubles. Only a downward test of 1.1010 will give a buy signal, thus allowing the pair to climb to 1.1049, the upper limit of the range. A farther target is located at the high of 1.1091, where it is recommended to lock in profits. A break of the level will stop the bearish trend, allowing the price to jump to the highs of 1.1136 and 1.1181. However, the scenario will become possible amid positive news about the geopolitical situation. If the pair drops and bulls fail to protect 1.0965, traders should avoid long positions. It will be possible to buy the euro after a false break of the low of 1.0928. Buy positions could be also initiated at 1.0891 with the target located 30-35 pips higher.

Conditions for opening short positions on EUR/USD:

Demand for the US dollar remains high even amid the expectations of a more aggressive stance of the Fed. Today, sellers should protect the nearest resistance level of 1.1010. A false break of the level will give a sell signal with the target at the support level of 1.0965. However, the pair will hardly break this level due to the absence of important macroeconomic reports. Fixation below 1.0965 may affectstop orders of speculative buyers. A downward test of the range will provide an additional signal to open short orders with the target at 1.0928 and 1.0891. A farther target is located at the fresh low of 1.0855, where it is recommended to lock in profits. If the euro goes on gaining in value and bears fail to protect 1.1010, bulls will continue opening long positions, expecting a return to the upper limit of the range and a revival of the uptrend. In this case, traders should remain cautious. It will be wise to open short positions after a false break of 1.1049. It is also possible to sell the euro/dollar pair from 1.1091 or higher from 1.1136, expecting a decline of 20-25 pips.

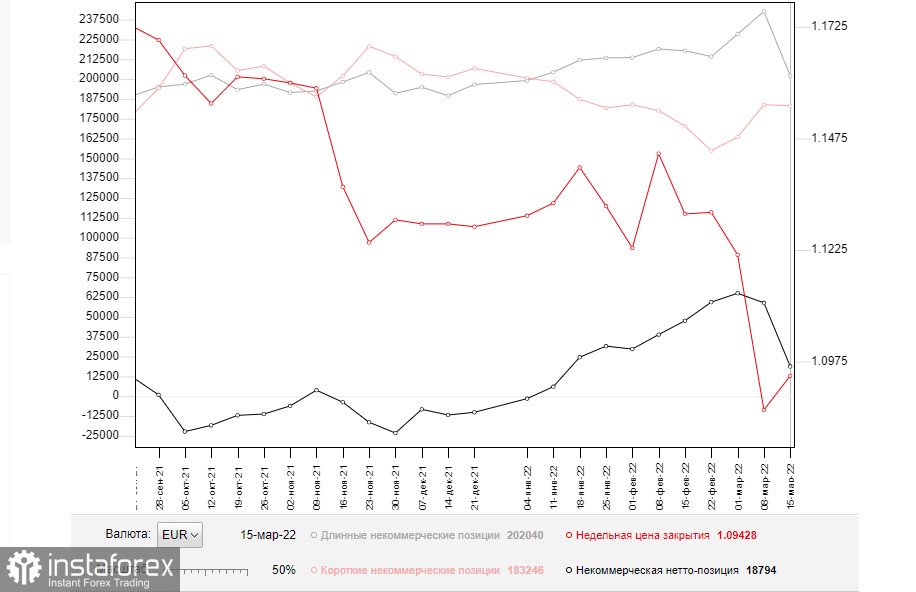

Commitment of Traders Report

According to the COT report from March 15, the number of long and short positions dropped. However, a decline in the number of short positions was insignificant, whereas the number of long positions slumped. Such a considerable decrease was mainly caused by the special military operation in Ukraine. The Fed's meeting was the main event of the previous week. The regulator raised the benchmark rate by 0.25%. However, the decision did not affect the market since traders had priced in such a result long ago. Notably, Fed Chair Jerome Powell took the wait-and-see approach during the press conference. He did not announce a more aggressive approach, thus boosting the number of long positions on risk assets. However, early this week, the Fed Chair changed his approach, emphasizing that the key interest rate could be raised by 0.5% at the following meeting. It is a strong bullish signal for the US dollar, which is highly likely to go on climbing against the euro.

Not so long ago, the ECB also held a meeting, where Christine Lagarde announced the central bank's plans for a faster QE tapering and key interest rate hike. It is good for the euro's mid-term future since the currency is significantly oversold against the greenback. According to the COT report, the number of long non-commercial positions declined to 202,040 from 242,683. Meanwhile, the number of short non-commercial positions dropped to 183,246 from 183,839. The weekly close price inched up to 1.0942 from 1.0866.

Signals of indicators:

Moving Averages

Trading is conducted just below the 30- and 50-day moving averages, which indicates that bears are still controlling the market. .

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the price rises, the upper limit of the indicator located at 1.1020 will act as a resistance level. In case of a decline, the lower limit of 1.0965 will act as a support level.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total long position opened by non-commercial traders.

- Short non-commercial positions is a total short position opened by non-commercial traders.

- The total non-commercial net position is a difference between the short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română