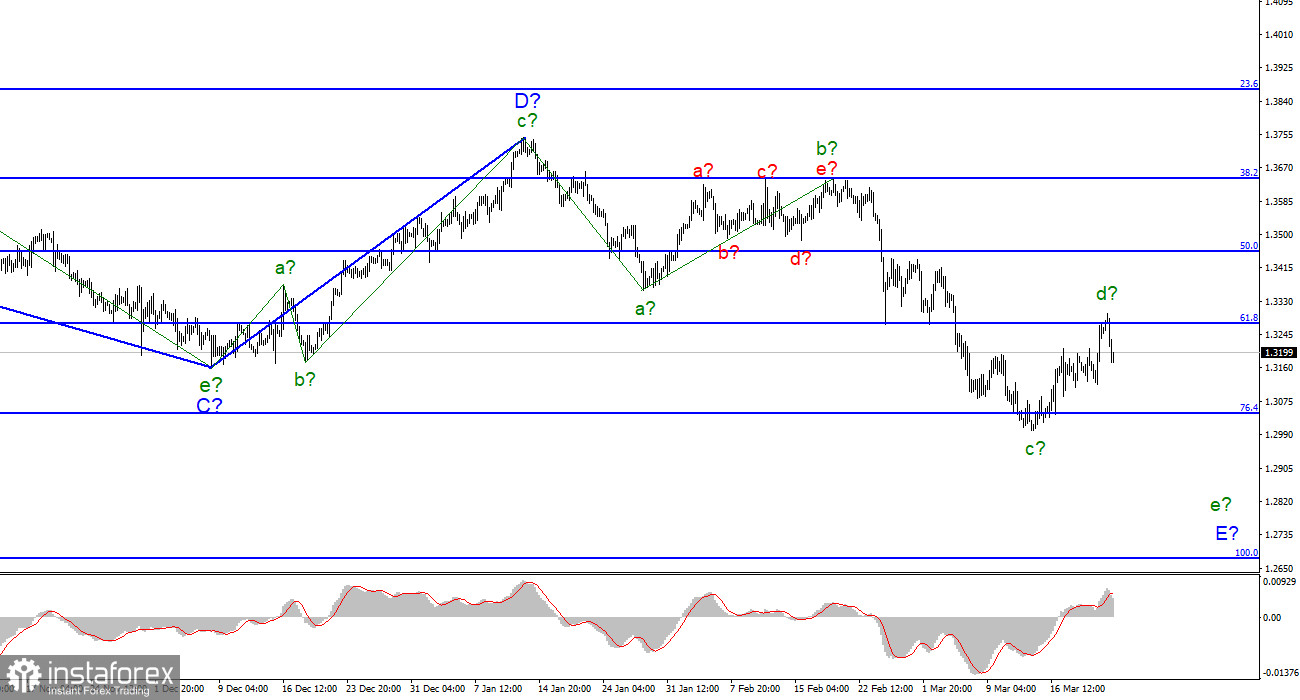

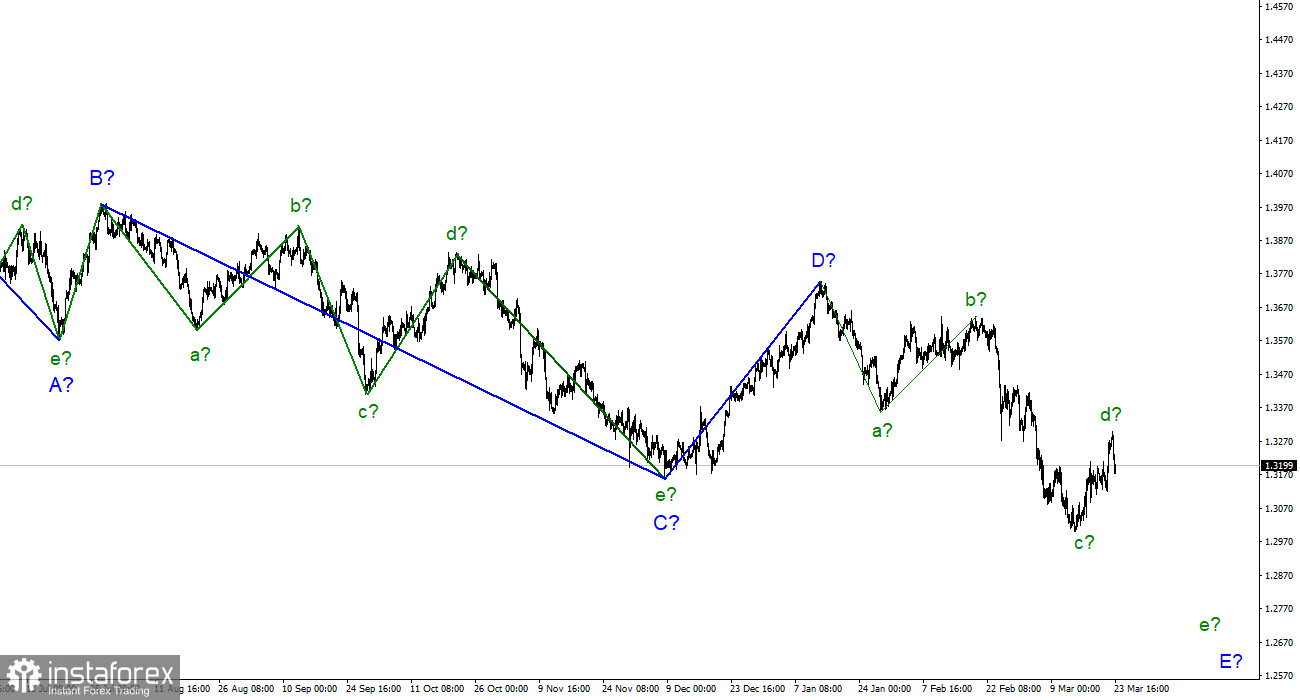

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The increase in the quotes of the British over the past week by all indications is a wave of d in E and it may be nearing its completion or it has already been completed. In total, there should be five waves inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction. At the moment, the British quotes have made an unsuccessful attempt to break through the 61.8% Fibonacci level, which may mean the completion of wave d. If this assumption is correct, then the decline in quotes will continue with targets located around the 27th figure within the wave e in E. I note that there are enough reasons for wave E to take an even more extended form. Or the entire downward section of the trend has taken a more extended form. It will depend on how bad the news background will be for the Briton. I have almost no doubt that the recent decline in the pound lies exclusively in the plane of the Ukrainian-Russian conflict.

The Bank of England has raised the rate for the third time, but inflation is still rising.

The exchange rate of the pound/dollar instrument decreased by 100 basis points during March 23. Recently, many analysts have been actively discussing an increase in the Fed rate, which by the end of the year could bring its value to 2-2.5%. This tightening of monetary policy is associated with high inflation in the United States. It is already 7.9% and continues to grow. However, we can observe right now how the dynamics of inflation in America will change with a rate increase in the example of the UK. Let me remind you that the Bank of England raised the rate by 25 bps at the last three meetings, which should have led to the fact that inflation would at least begin to slow down. However, instead, we saw today that it is not only not slowing down, but also accelerating. In January, it was 5.5% y/y, and in February, it was already 6.2% y/y. That is, it grew by 0.7% in a month with at least two interest rate increases. A month earlier, it grew by only 0.1%, and a month earlier - by 0.3%. We can see about the same thing throughout the current year in the USA.

Yesterday, the Briton was in high demand when there was no information at all that could be answered by a movement of 160 basis points. Today, it declined when a strong inflation report was released. According to the wave marking, all movements are logical, but at the same time, there is a feeling that the market does not quite understand what to do with the British. If the decline continues, it will be a fully expected movement. A successful attempt to break through the 61.8% Fibonacci level may disrupt the wave marking, although even in this case, wave d will simply lengthen slightly, which is not critical: the corrective wave b has also taken on a rather extended form.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. I continue to advise selling the instrument with targets located near the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave E does not look completed yet. I propose to consider the expected wave d in E completed until the instrument makes a successful attempt to break through the 1.3273 mark, which equates to 61.8% Fibonacci.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română