To open long positions on EURUSD, you need:

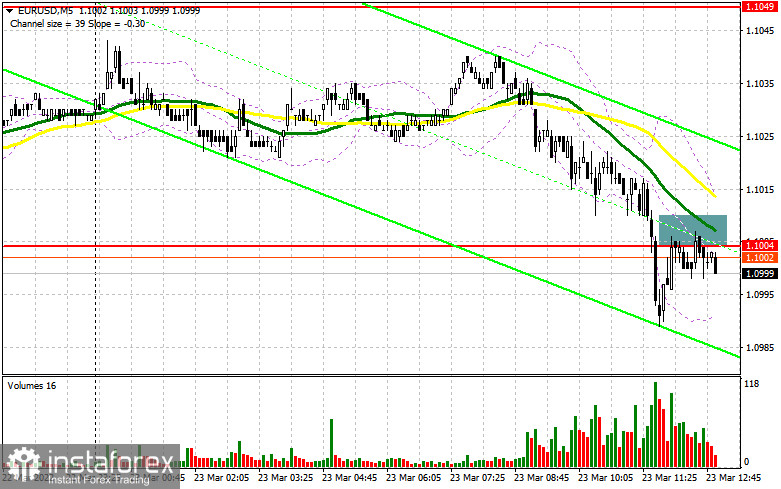

In my morning forecast, I paid attention to the 1.1004 level and recommended making decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened. In the first half of the day, the pressure on the euro returned, and we observed an active breakdown and consolidation below the support of 1.1004. A test of this level from the bottom up led to the formation of a signal to sell the euro, however, at the time of writing, it did not come to a major drop, and, likely, we will hardly see a major sell-off in the afternoon. From a technical point of view, nothing has changed much. And what were the entry points for the pound this morning?

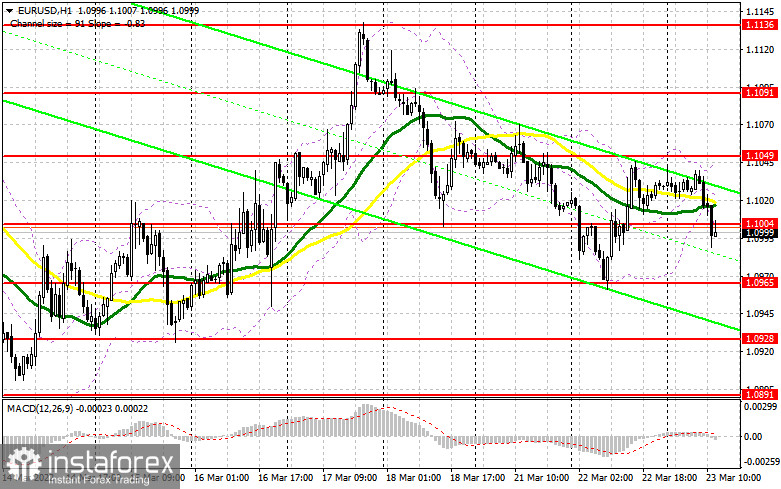

The lack of fundamental statistics on the eurozone and the focus on data on the consumer confidence indicator in the eurozone, which will be released in the afternoon, force buyers to hold a wait-and-see position, which puts pressure on risky assets, including the European currency. Only a report on the volume of home sales in the primary US market is scheduled for the afternoon, which may lead to a strengthening of the US dollar. However, more emphasis will be placed on the speech of representatives of the Federal Reserve System. More recently, Fed Chairman Jerome Powell announced a more aggressive increase in interest rates. Most likely, his colleagues will adhere to the same position. If the pair falls, only a false breakout at the level of 1.0965, which was formed following the results of yesterday, forms the first entry point into long positions. But to see a major upward movement in EUR/USD, active actions and a return of the resistance of 1.1004 are needed. There are moving averages that play on the side of the sellers of the euro. Given that we have no positive changes in the geopolitical situation in the world, the demand for risky assets will be limited. Only a breakout of 1.1004 and a top-down test will give a buy signal, which will open the possibility for the pair to recover to the area of 1.1049 - a large resistance formed yesterday. A more distant goal will be a maximum of 1.091, where I recommend fixing the profits. A breakdown of this range will reverse the bearish trend and hit the sellers' stop orders, even more, opening a direct road to the highs: 1.1136 and 1.1181. However, such a scenario can be counted on with the next good news on improving the geopolitical situation in Ukraine. If the pair falls and there are no bulls at 1.0965, it is best to postpone long positions. The optimal scenario for buying would be a false breakdown of the minimum in the area of 1.0928, but it is possible to open long positions on the euro immediately for a rebound only from 1.0891 with the aim of an upward correction of 30-35 points within a day.

To open short positions on EURUSD, you need:

The bears showed themselves today in the first half of the day, but it did not work out to achieve a serious change in the alignment of forces. Despite this, sellers need to continue to think about how to protect the resistance of 1.1004. Only in the case of another false breakdown formation at this level after an unsuccessful attempt to break 1.1004, short positions can be opened to reduce to the support of 1.0965. There, the bulls will again try to maintain control over this level, as it is their last hope for continued growth in the short term. The lower boundary of the ascending channel from March 4 also passes there. In the case of strong fundamental statistics and hawkish statements by FOMC members Mary Daly and James Bullard, a breakdown of this area may pull several stop orders from speculative buyers who gained long positions last week after the Fed meeting. The reverse test from the bottom up 1.0965 will give an additional signal to open short positions with the prospect of falling to the levels: 1.0928 and 1.0891. A further target will be a new low - 1.0855. If the euro rises and there are no bears at 1.1004, the bulls will again begin to build up long positions in the hope of maintaining an upward trend - which requires daily updating of the highs. In this case, it is best to take your time with sales. The optimal scenario will be short positions when forming a false breakdown in the area of 1.1049. You can sell EUR/USD immediately for a rebound from 1.091, or even higher - around 1.1136 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for March 15 recorded a reduction in both long and short positions. However, if you look at the figures, you can see that the reduction of short positions was minimal, unlike buyers, who became much smaller - it is not surprising, against the background of Russia's military special operation on the territory of Ukraine. The Federal Reserve meeting was the central event of last week. As a result, the committee raised interest rates by 0.25%, which did not lead to serious changes in the market, as many expected such decisions. Another thing is that Fed Chairman Jerome Powell took a wait-and-see attitude during his speech, without signaling a more aggressive policy, which was the reason for building up long positions in risky assets. However, at the beginning of this week, the head of the Fed changed his approach, noting in an interview a fairly high probability of an interest rate increase by 0.5% points at once at the next meeting of the Federal Reserve System - this is a strong bullish signal for the US dollar, which is sure to continue its growth against the euro. However, it is worth remembering that the European Central Bank also held a meeting recently, at which President Christine Lagarde announced plans to more aggressively curtail measures to support the economy and raise interest rates - this is good for the medium-term prospects of the European currency, which is now heavily oversold against the US dollar. The COT report indicates that long non-commercial positions decreased from the level of 242,683 to the level of 202,040, while short non-commercial positions decreased from the level of 183,839 to the level of 183,246. At the end of the week, the total non-commercial net position decreased to 18,794 against 58,844. The weekly closing price rose slightly from 1.0866 to 1.0942.

Signals of indicators:

Moving averages

Trading is below 30 and 50 daily moving averages, which indicates a bear market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of growth, the upper limit of the indicator around 1.1049 will act as resistance. A break of the lower limit in the 1.1004 area will lead to a larger sell-off of the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română