EUR/USD

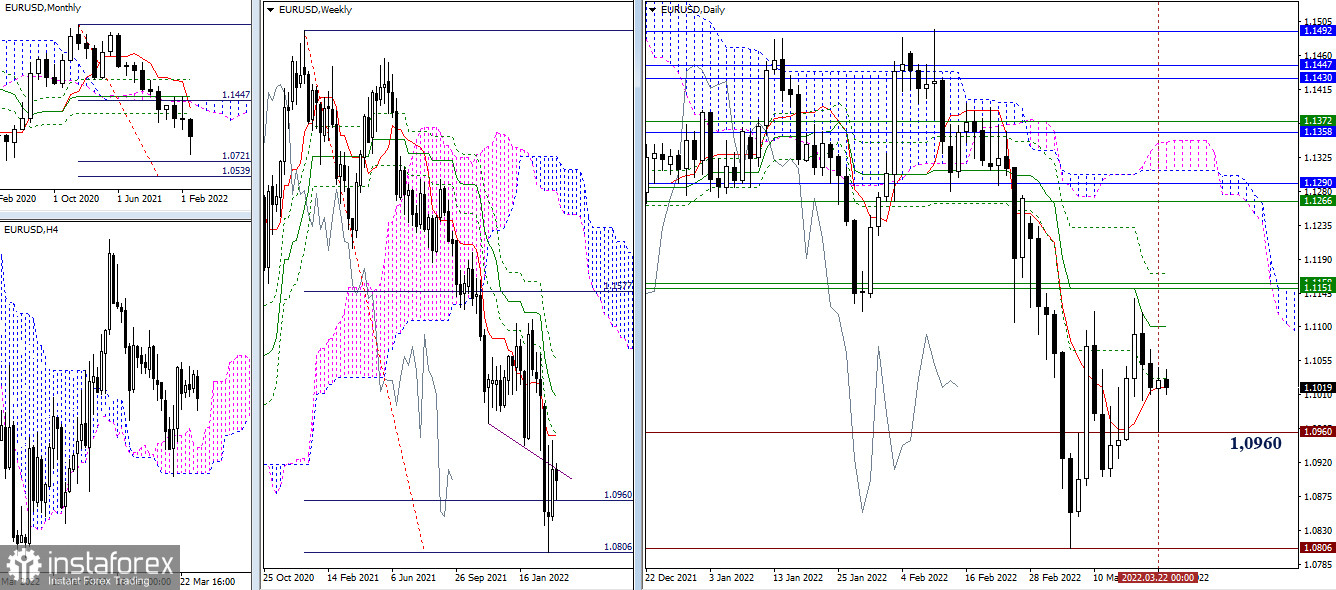

A rebound was formed from the met support at 1.0960 on the daily timeframe yesterday, while the pair regained its daily short-term trend. The confirmation and implementation of the rebound will allow bulls to return their activity to the market. In this case, the tasks set earlier remain relevant, which include the elimination of the daily death cross (1.1101 - 1.1171) and overcoming the resistance of weekly levels 1.1151–58, in order to achieve weekly short-term support.

The next slowdown and consolidation in the current environment will slow down the development of the situation, leaving in question the bullish targets in this area. The bearish targets today are at 1.0960 and 1.0806 (the levels of the weekly target for the breakdown of the Ichimoku cloud).

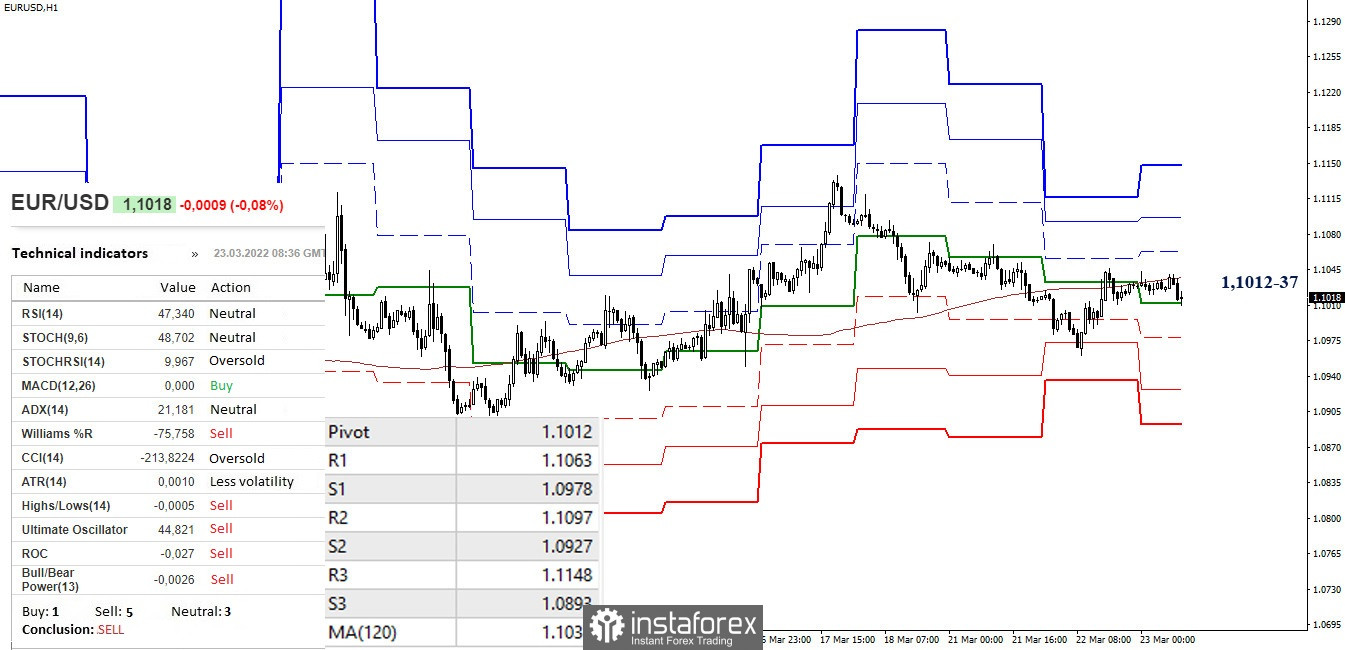

Sellers failed to increase their advantages yesterday, as a result, today the pair returned to the zone of attraction and influence of key levels, which are now consolidating their efforts in the area of 1.1012–37 (central pivot point + weekly long-term trend). Work in this zone creates uncertainty, again equalizing the capabilities of the warring parties. The upward targets within the day today are 1.1063 – 1.1097 – 1.1148 (resistance of classical pivot points), while downward targets are 1.0978 – 1.0927 – 1.0893 (support of classical pivot points).

***

GBP/USD

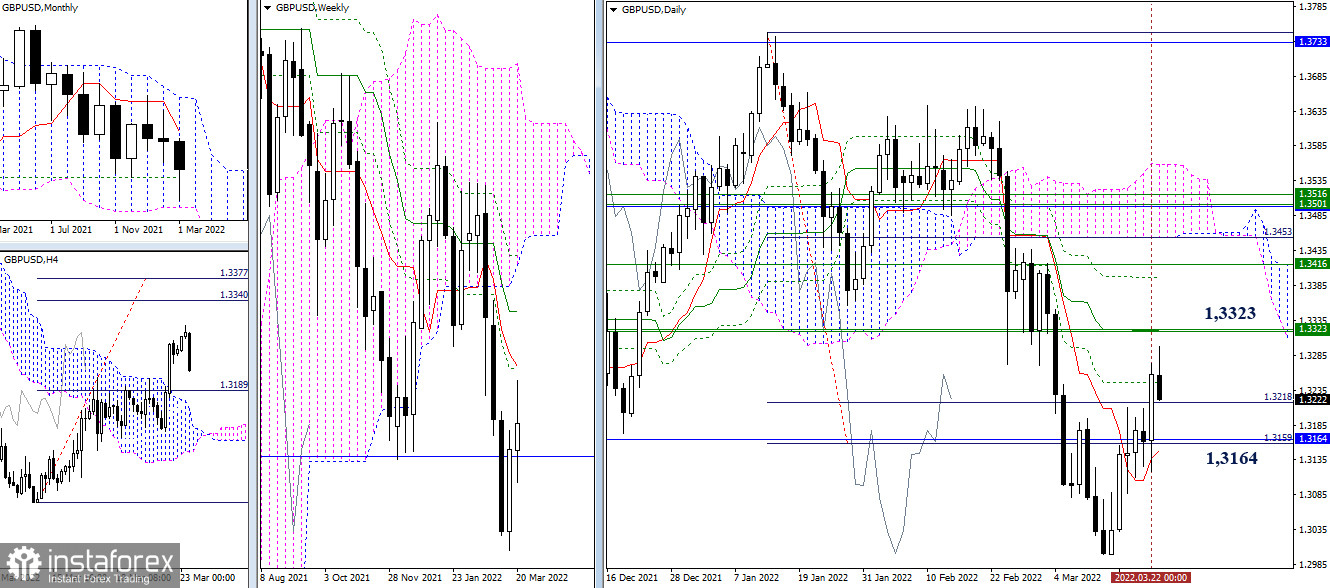

Yesterday, the bulls continued to rise. The nearest important upward targets in the current situation will be the weekly levels of 1.3319–23. The most significant supports, which retain their role and significance in the current situation, are located today in the area of 1.3164, where the levels of various timeframes have combined.

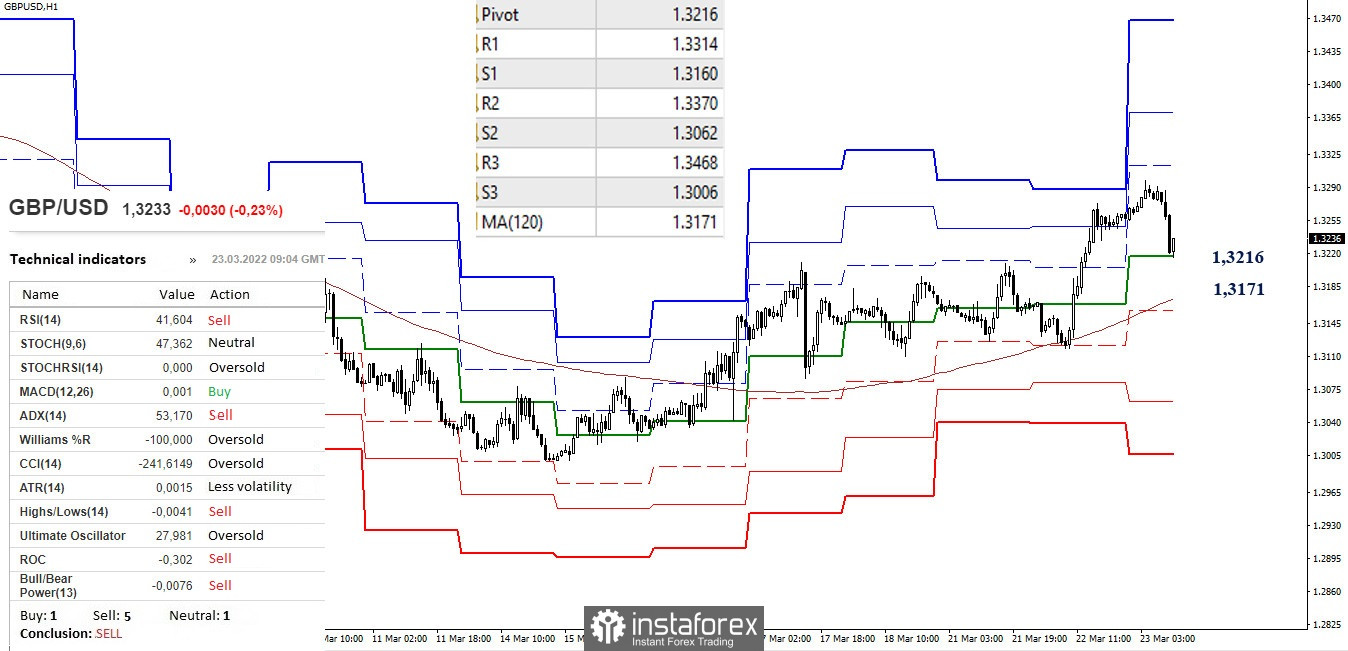

At the moment, there is a downward correction. The pound went down to the first key level 1.3216 (central pivot point). The next downward target that can affect the current distribution of forces is the weekly long-term trend (1.3171). The classic pivot points today are located at 1.3160 - 1.3062 - 1.3006 (support) and 1.3314 - 1.3370 - 1.3468 (resistance).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română