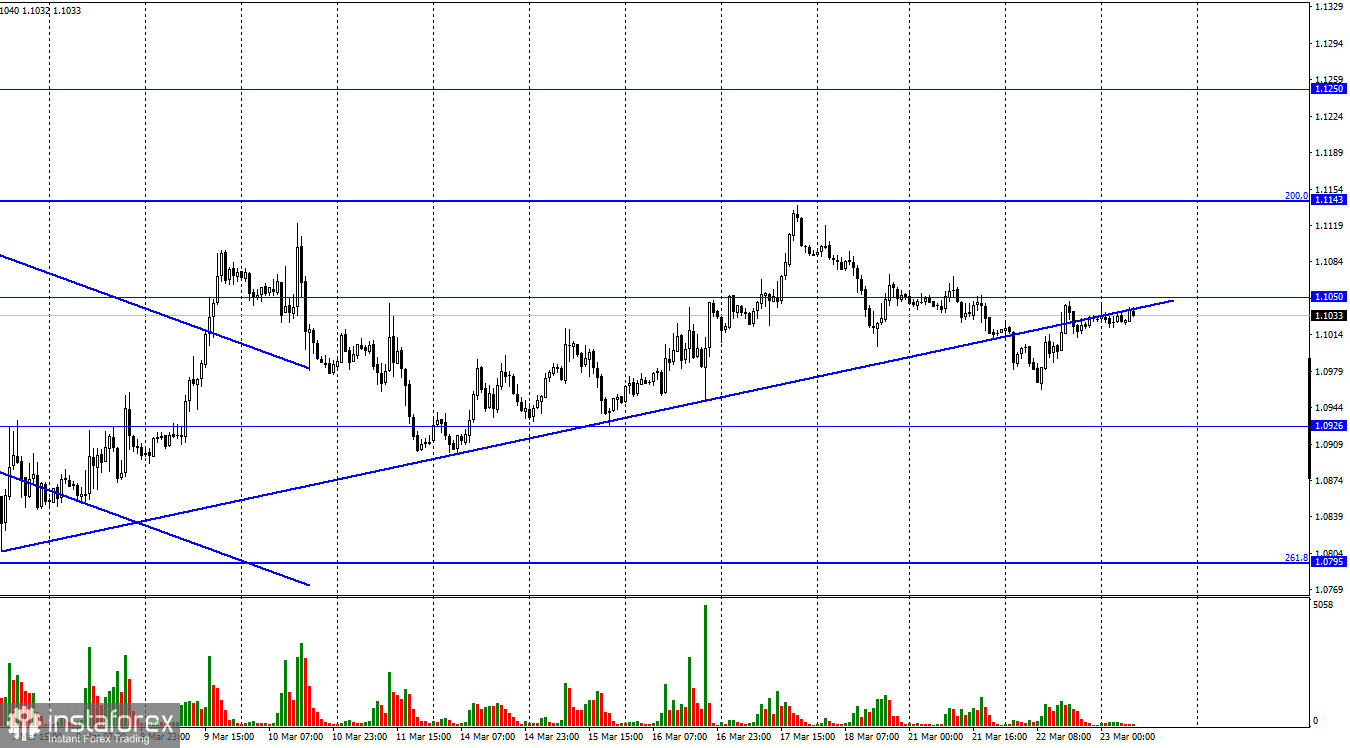

Hi everyone! The euro/dollar pair performed a downward reversal on Tuesday. After that, it returned to the level of 1.1050. A day earlier, it settled below the trend line. This is why analysts forecast a further fall to the 1.0926 level. If the quotes fix below 1.1050, there might be a chance for a rebound to 1,1143, the Fibonacci correction level of 200.0%. Yesterday, the economic calendar was uneventful. Trading volumes of the euro/dollar pair were low. There were no drivers that could have stirred up activity. Among more or less important events, I could emphasize two speeches by Christine Lagarde on Monday and Tuesday. She once again confirmed that the ECB was not going to raise the key rate. The watchdog will focus primarily on economic growth projections amidst the new reality, namely the geopolitical tensions and the sanction war with Russia.

Now, the EU is on the verge of an energy crisis due to the war in Ukraine. German Chancellor Olaf Scholz pushed back against calls for a ban on imports of Russian gas and oil. "At the moment, Europe's supply of energy for heat generation, mobility, power supply and industry cannot be secured in any other way. It is therefore of essential importance for the provision of public services and the daily lives of our citizens," Scholz said. He also added that such a move could deliver a severe blow to the EU economy. Christine Lagarde also stressed that the euro area is going through hard times right now. Scholz said that he supports the oil and gas embargo but Germany is unable to abandon Russian oil and gas quickly. The sanctions that have already been imposed against Russia are likely to cripple Russia's economy, Scholz believes. However, the new sanctions will have serious consequences for Europe as well. The German Chancellor pointed out that Germany and other EU countries are looking for ways to completely ditch imports of Russia's energy resources. Thus, there will hardly be new sanctions against Russia in the near future. This means that oil and gas prices may stop growing, which will lead to stabilization in the energy market. If so, global inflation may also slow down.

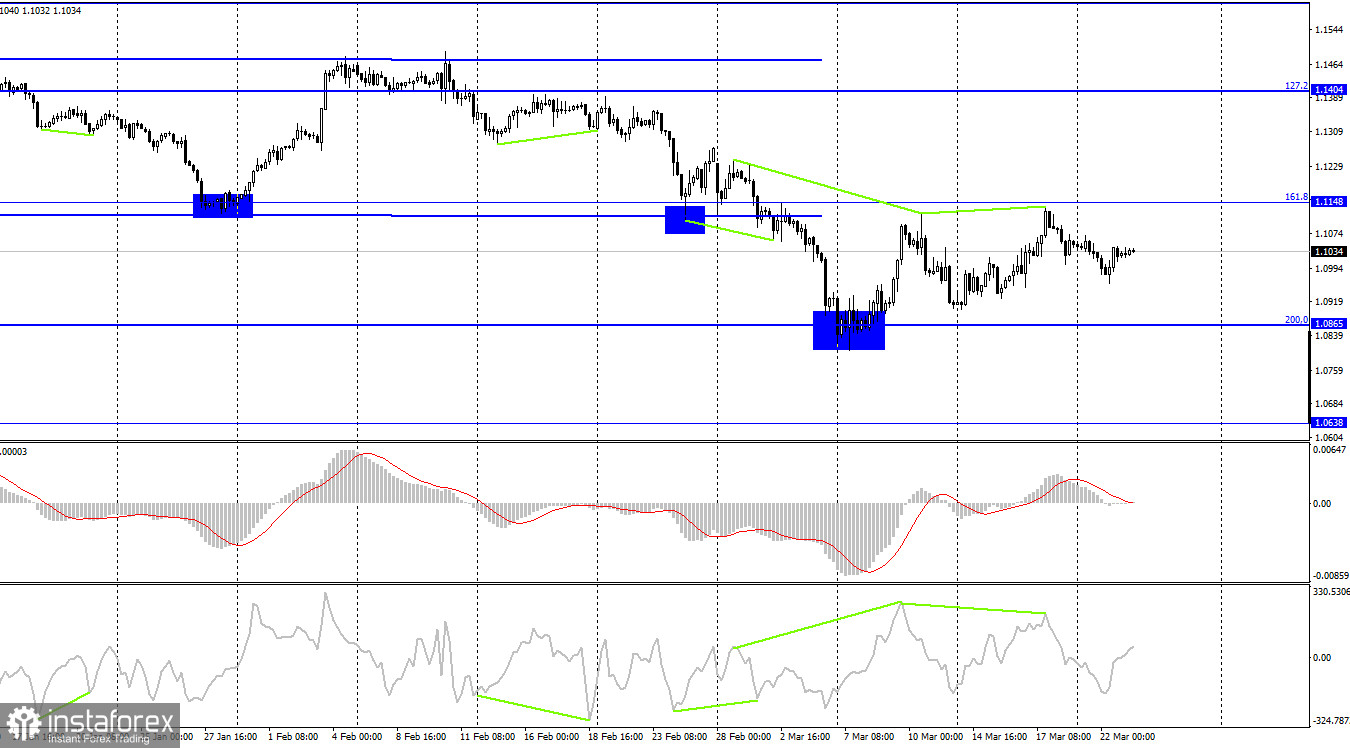

On the 4H chart, the US dollar strengthened against the euro. The euro/dollar pair is now falling. It is likely to approach 1,0865, which is the Fibonacci correction level of 200.0% after the formation of a bearish divergence in the CCI indicator. In case of consolidation above 1.1148, the quotes may appreciate to 1.1404, the next Fibo level of 127.2%. If the pair drops below 1.0865, it may move down to 1.0638.

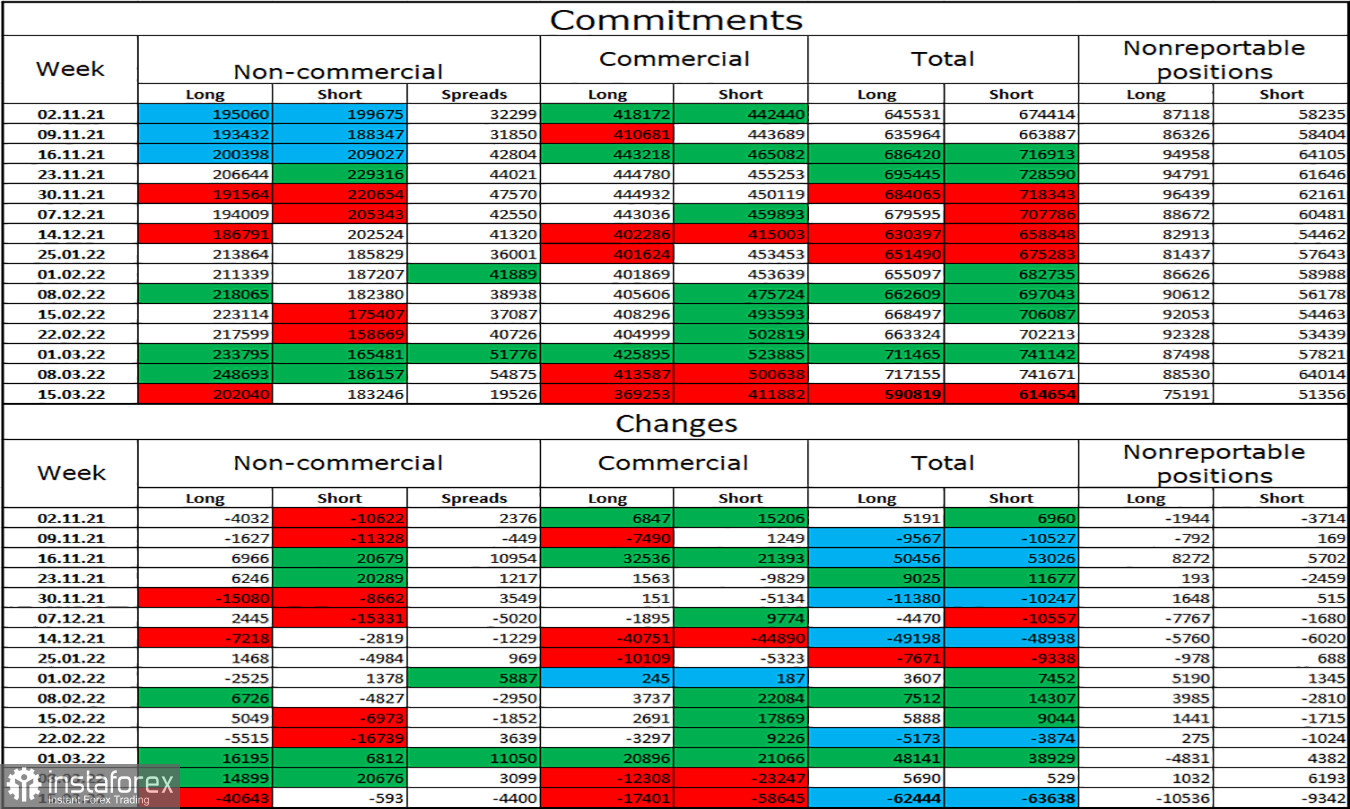

Commitments of Traders (COT):

Last week, speculators closed 40,643 Long and 593 Short contracts. It means that the bullish sentiment of the major market players has become weaker. The total number of long contracts in their hands totals 202,000 and the number of short contracts amounts to 183,000. Therefore, the mood of the "Non-commercial" category of traders is still bullish. The euro could even have had an opportunity to gain momentum if not for fundamental factors. They are now more favorable for the US dollar. Traders are now witnessing an odd situation. The bullish trend for the euro has remained strong since January 25 but the currency is falling rapidly. The only reason for such a strange movement can be geopolitical tensions.

Macroeconomic calendar for the US and the EU:

US – Fed chair Jerome Powell will deliver a speech at 12-00 UTC.

On March 23, Jerome Powell will make a new. Naturally, traders are anticipating this event. This week, Powell has already made several crucial statements. For this reason, investors are waiting for new clues on future plans for monetary policy.

Outlook for EUR/USD and trading tips:

It is recommended to open short positions at 1.0926 on the 1H chart if the pair drops below the trend line. Now, it is better to keep these positions open until the price rises above 1.1050. I would advise opening long positions if there is a rebound from the 1.0865 level on the 4H chart with the upward targets of 1.0926 and 1.1050.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română