Euro bulls roused

Hi, dear traders!

First, let us have a look at the monetary policies of the Federal Reserve and the European Central Bank. The Fed's policies are undoubtedly hawkish - the US central bank is on course to tighten its monetary policy. The position of the ECB is vague, which is confusing investors. The COVID-19 pandemic has disrupted supply chains globally and caused a imbalance between supply and demand, leading to high inflation. One of the most effective tools for bringing soaring inflation under control is increasing interest rates. This is where the policies of the Fed and the ECB diverge. The Federal Reserve has adopted a clear hawkish stance and has begun hiking the Fed funds rate. The EU regulator expects inflation to decrease to 2% by 2024 on its own, according to ECB forecasts. The European Central Bank is hesitant to hike interest rates because of weak economic growth which has led to stagflation. However, Vice-President of the ECB Luis de Guindos has denied that the EU is experiencing stagflation. Guindos also admitted that high inflation has persisted and that soaring price growth could drag on.

Luis de Guindos considered high wages to be one of the main factors pushing up inflation. However, the only thing the ECB did was to hope for a faster wind-down of the asset purchase program. The indecisive position of the EU regulator resembles Christine Lagarde's period as head of the IMF. Market players barely react or completely ignore her statements, compared to her predecessor, Mario Draghi. While Draghi was not an inflation hawk, he stated the ECB's position more clearly and unambiguously. Downside risks for EUR/USD continue due to monetary policy divergence between the Fed and the ECB, as well as the war in Ukraine. The ongoing war is set to make an impact on European consumers of Russian oil and natural gas. US president Biden is trying to persuade European countries to halt oil and gas imports - it is expected to be the main agenda of Biden's trip to NATO and European Council summits in Brussels.

Daily

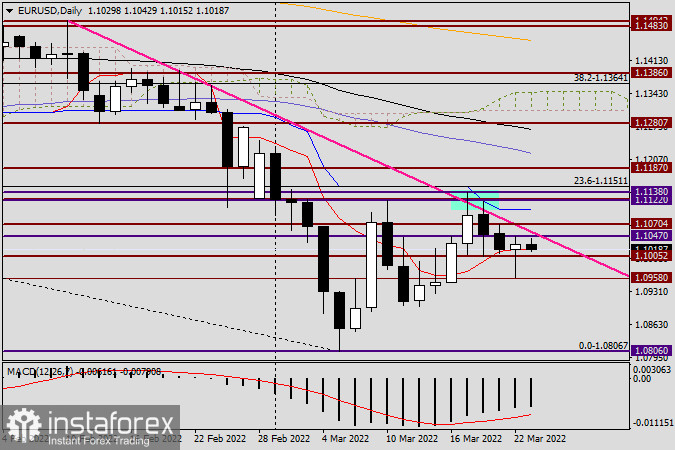

EUR/USD trajectory was mixed yesterday. The pair fell to 1.0958, reversed upwards and recovered its losses. EUR/USD made slight gains and closed above the key psychological level of 1.1000 and the red Tenkan-Sen line of the Ichimoku cloud. This rally and the very long lower shadow of the March 22 candlestick suggests bullish traders have roused themselves. EUR/USD has some upside potential and could test the pink resistance line at 1.1495-1.1358 for the third time. At the moment of writing, the pair was trading under slight pressure near 1.1017.

H1

According to the H1 chart, the pair dived below the black 89-day EMA, the blue 50-day MA, and 200-day EMA lines, which previously served as support for EUR/USD. Long positions with targets in the 1.1050-1.1070 area could be opened if the pair returns above the moving average lines and settles there. Traders with open short positions are recommended to take profit near 1.0970-1.0960.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română