Jerome Powell's hawkish comments seemed to have had a negative impact on gold prices. However, analysts are certain that gold will take advantage of rate hikes in the long term as it has already happened before.

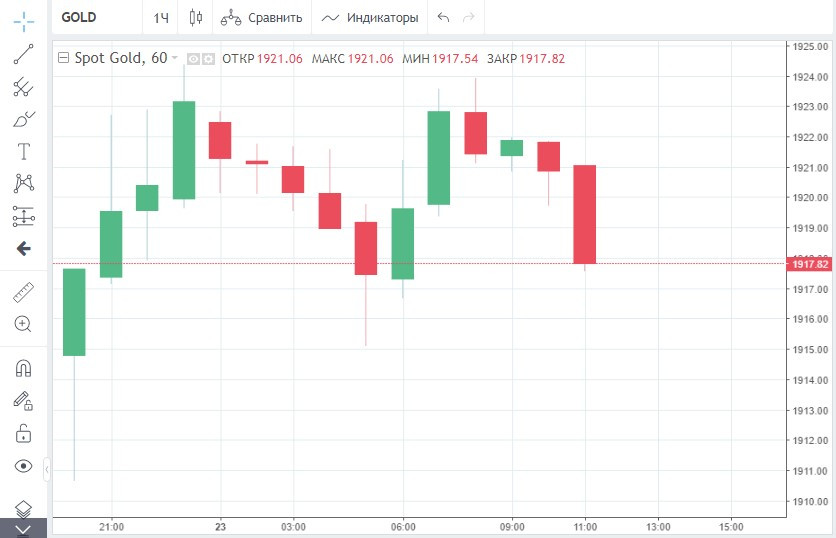

On Tuesday, gold fell by 0.4% or $8. At the close of the session, the precious metal was trading at $1,921.50 per ounce.

Gold nosedived following the Fed's chair speech on Monday. Speaking at an economic conference in Washington, Jerome Powell stressed that the central bank would take a more hawkish stance on monetary policy to combat rising inflation.

After this speech, market participants are anticipating the central bank to hike the interest rate by as much as 50 basis points at its next meeting in May.

Last week, for the first time in 4 years, the regulator raised rates by a quarter of a percentage point. However, the readiness of the Fed to raise the key rate by 50 basis signals a more aggressive stance. It was bearish for gold.

Usually, such hawkish rhetoric could trigger a significant drop in gold, for example by $50. However, in the current situation, when the conflict between Russia and Ukraine is in the spotlight, the decline was rather small, market strategist Bob Haberkorn said.

The tense geopolitical situation continues to facilitate the growth of precious metals. Peace talks between the conflicting parties have not yet brought any results. Meanwhile, Kiyv said it would be ready to discuss the status of Crimea and the eastern Donbas region only after the ceasefire.

Despite the lack of signs of de-escalation of the confrontation, demand for safe-haven assets has noticeably decreased, while government bonds have picked up steam.

Powell's hawkish statements caused a jump in demand for 10-year US government bonds. On Tuesday, their yield reached 2.375%, the highest level since May 2019.

Meanwhile, Wall Street also showed spectacular growth yesterday following the Fed char's speech although analysts had expected a completely different reaction from investors.

Economists warn about the risk of recession as the rate hike by 50 basis points is dangerous at a time when the American economy may be severely hurt by sanctions against Moscow.

If the watchdog takes more aggressive measures to curb inflation, it will eventually lead to a decline in the US stock market, Bloomberg analyst Mike McGlone pointed out.

He also reckons that if this scenario comes true, it will be the only chance for gold to rise above the resistance level of $2,000 and consolidate there. There have been precedents when the precious metal benefited from a sharp increase in the key rate.

A similar situation occurred in 2011. Back then, gold climbed to a high of $1,920 per ounce from about $250, logged in 1999. At that time, traders also flocked back to the volatile stock market against the background of the Fed's rate hike, McGlone pinpointed.

Based on the past performance of gold, the economist draws attention to the fact that currently, gold has all the chances to start a rally.

Traders should focus their attention on the US stock market ahead of the FOMC meeting in May, he stressed.

.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română