Analysis and tips on how to trade EUR/USD:

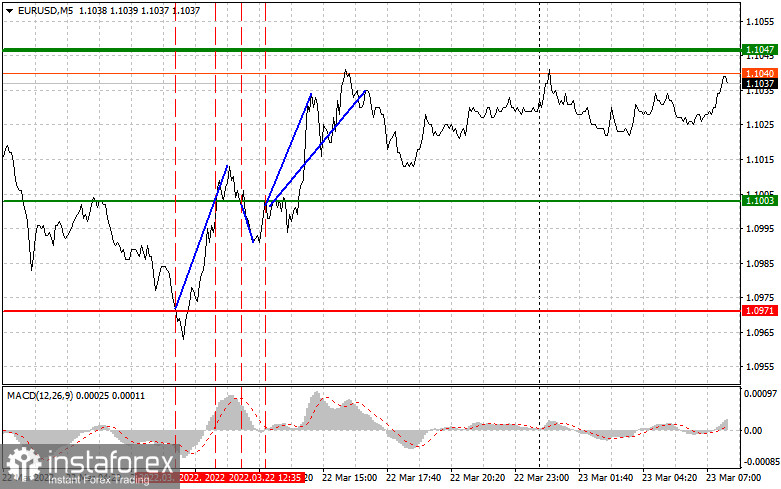

The price tested the 1.0971 mark when the MACD had been in the oversold zone for a long time. Eventually, Scenario 2 where you go long unfolded. The euro advanced by around 30 pips and tested the 1.1003 level. The MACD was far from zero when the test took place, limiting the pair's growth potential. So, I had to exit the market. The second test of the 1.1003 mark coincided with the MACD being in the overbought zone, which produced a sell signal according to Scenario 2. However, after falling by just 12 pips, demand for the euro increased. The final test of the 1.1003 mark took place when the MACD only started to move up from the zero level. As a result, I closed my short positions without making any profit and went long. Overall, the pair advanced by more than 30 pips.

Today, traders will focus on the eurozone consumer confidence for March. The reading may plunge even deeper than economists had expected due to the high inflation rate as well as soaring energy, food, and utility prices. This will come as a restraining factor in increasing the number of long positions on risk assets. Members of the US Fed will speak later today. They will continue to prepare markets for future rate hikes. On Monday, Chairman Powell said interest rates could be raised by 0.5% at the upcoming meetings. Data on US new home sales will be released today as well, and the Fed's Mary Daly and James Bullard will give interviews.

Buy signal

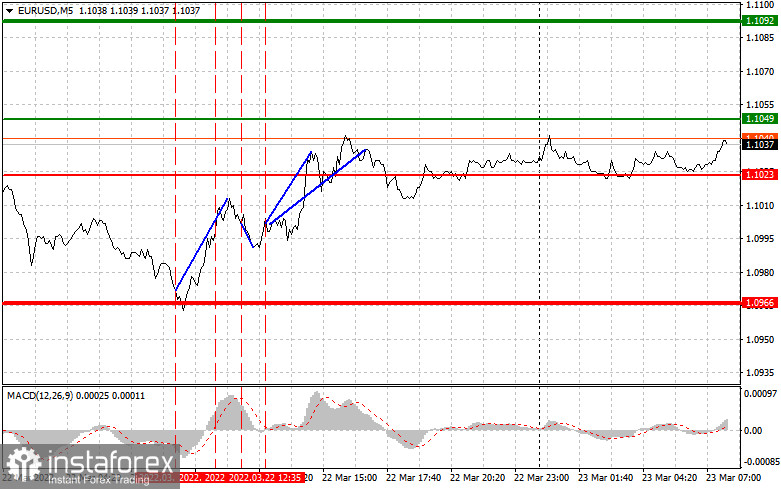

Scenario 1: You could go long today when the price reaches 1.1049 (the green line on the chart) with the target at 1.1092 where you should consider taking a profit and selling the euro, allowing a 20-25 correction. The euro may show steep growth today. However, amid the possibility of a more hawkish Fed, it is still hardly possible. If bullish activity decreases near the daily swing lows, you should better trade according to Scenario 2 where you sell the instrument. Important! Before buying the asset, make sure the MACD is above zero and just starts moving up from this level.

Scenario 2: Likewise, long positions could be opened today if the quote touches 1.1023 when the MACD is in the oversold zone. This could limit the pair's downside potential and lead to an upward reversal in the market. The price may either go down to 1.1049 or 1.1092.

Sell signal

Scenario 1: You could go short today when the price hits 1.1023 (the red line on the chart) with the target at 1.0966 where you should consider closing your short positions and buying the euro, allowing a 20-25 pips correction. Pressure on the euro could return at any time because market participants are likely to shift away from risk assets in the face of the hawkish Fed. Important! Before selling the instrument, make sure the MACD is below zero and just starts to move down from this level.

Scenario 2: Likewise, short positions could be opened today if the price reaches 1.1049 when the MACD is in the overbought zone. This could limit the pair's upside potential and lead to a downward reversal in the market. The quote may either go down to 1.1200 or 1.1138.

On the chart:

The thin green line indicates a buy entry point.

The thick green line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to grow above this level.

The thin red line indicates a sell entry point.

The thick red line is the estimated price where you should place a take-profit order or close positions manually since the quote is unlikely to fall below this level.

MACD. When entering the market, it is important to pay attention to the overbought and oversold zones.

Remember that novice forex traders should be very careful when deciding to enter the market. Before the release of important fundamentals, you should stay out of the market in order to avoid sharp fluctuations in the rate. If you decide to trade during news releases, make sure to always place a stop-loss order to minimize losses. Without it, you may quickly lose your entire deposit, especially if you do not use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română