To open long positions on GBP/USD, you need:

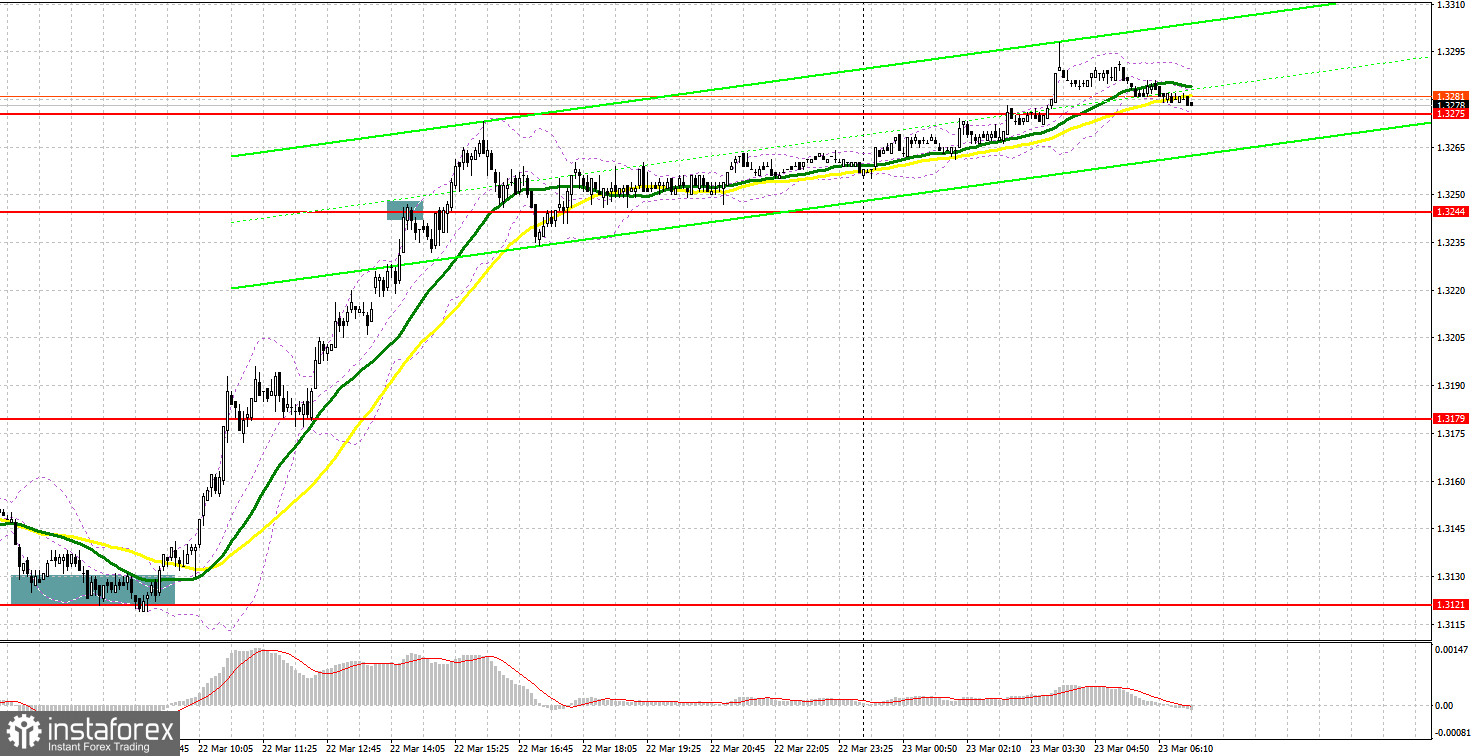

Yesterday, several signals were formed to enter the market. I suggest we take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the level of 1.3129 and advised you to make a decision on entering the market. The decline of the pound in the area of 1.3129 and the formation of a false breakout there resulted in creating an excellent entry point into long positions. As a result, the bulls broke above 1.3169 without any problems, but before the reverse test of this level from top to bottom, literally a couple of points were not enough, so it was not possible to enter the market. In total, the pair went up more than 150 points, but some problems were observed among bulls in the 1.3244 area - there I advised selling immediately on a rebound, which brought about 20 points of profit.

The pound rose quite a lot against the US dollar after the news that the UK budget deficit is 26 billion pounds less than official forecasts. In other words, in the first 11 months of the fiscal year, the government spent less money than allocated, which will allow the Treasury to more competently form a new annual budget, which will be published today. It also gives Finance Minister Rishi Sunak additional space to address the deepening crisis in the economy.

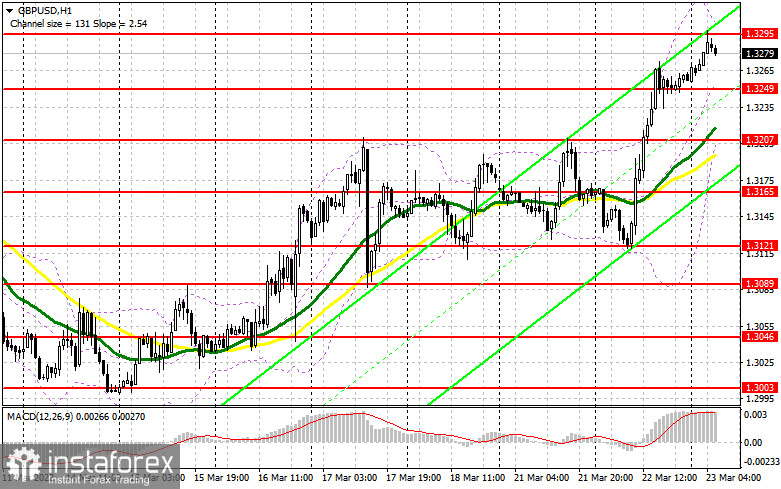

To continue the growth, it is important to protect the support of 1.3249 (a new level) during the European session, which, it seems to me, is of great interest to both sides now. A fall to this range may occur immediately after the release of UK inflation data for February this year. An annual jump to 6.0% is expected, but most likely the final figures will exceed economists' forecasts. We can expect the pound to rise after forming a false breakout at 1.3249. In this scenario, the bulls will tighten the pair to the resistance of 1.3295 formed by yesterday's results. A breakthrough and a reverse test of this area from top to bottom, together with a positive reaction to the speech of the Governor of the Bank of England Andrew Bailey and Finance Minister Rishi Sunak - all this will lead to the demolition of a number of bears' stop orders, allowing the bulls to get out to the area of new highs: 1.3340 and 1.3390. The 1.3435 area will be a more distant target, but access to it will open only in case we receive good news on the negotiations between Russia and Ukraine. I recommend taking profits there. In case GBP/USD falls during the European session and the absence of bulls at 1.3249, and just below this level there are moving averages playing on their side, it is best to postpone long positions until the next support of 1.3207 – this is a more reliable level, additionally acting as the lower boundary of the new ascending channel. I also advise you to open long positions there only when a false breakout is formed. You can buy GBP/USD immediately on a rebound from 1.3165, or even lower - from a low of 1.3121, counting on a correction of 30-35 points within the day.

To open short positions on GBP/USD, you need:

Yesterday, bulls very much followed the bears' stop orders, so it would not be quite right to count on their active return to the market without some fundamental support. Much will depend on the statements after the announcement of the UK's annual budget. Until then, bullish sentiment will be visible in the market. The main goal for today is to support 1.3249. A breakthrough and a reverse test from the bottom up of this range will form a sell signal, which will open a direct road to the lows: 1.3207 and 1.3165, where I recommend taking profits. However, there will be such a major downward movement in the case of slower-than-expected inflation, and the dovish rhetoric from Bailey. A more distant target will be 1.3121. In case GBP/USD grows in the first half of the day, which can be counted on, especially after yesterday's positive news, only a false breakout at 1.3295 will lead to a signal to sell the pound with the prospect of a new decline in the pair. With bears not being active at this level, it is best to postpone short positions until the next major resistance at 1.3340. I also advise you to open short positions there in case of a false breakout. It is possible to sell GBP/USD immediately for a rebound from 1.3390 or even higher - from a high of 1.3435, counting on a correction of the pair down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for March 15 showed a steep fall in the number of longs and a slight change in the number of shorts. The BoE's meeting has had a harmful effect on the pound. In spite of the expected rate hike, the regulator showed no signs of taking a more aggressive stance on monetary policy. It chose to stay dovish despite the record inflation rate in the United Kingdom. Although the British are clearly dissatisfied with the current state of affairs, aggressive actions could be harmful to the economy. The central bank is now thinking about how to cause less harm to it as the fight against rising inflation has just begun. In this light, traders are hesitant to invest in the British pound, which is getting weaker versus the US dollar. Likewise, the FOMC meeting was at the center of attention last week. The Committee raised the interest rate by 25 basis points. However, it did not cause turbulence in the market as traders had expected such a decision. In this light, it is wiser to buy the dollar, while GBP/USD is still bearish. High inflation in the UK is the only reason why the pound hasn't been sold off yet. The COT report for March 15 revealed a decrease in long non-commercial positions to 32,442 versus 50,982 and a drop in short non-commercial positions to 61,503 from 63,508. The total weekly non-commercial net position increased to -29,061 versus -12,256. The weekly closing price fell to 1.3010 from 1.3113.

Indicator signals:

Trading is conducted above the 30 and 50 moving averages, which indicates the continuation of the bull market in the short term.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case the pair falls, the lower limit of the indicator in the area of 1.3210 will act as support. In case of growth, the upper limit of the indicator around 1.3295 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română