The pound, paired with the dollar, shot up today, updating the 2.5-week price high. Such an impulse growth coincided with a sharp decline in the US dollar index, which dived from 98.94 to an intraday low of 98.33.

There is no consensus among experts on the reasons for such a sharp decline in the greenback, and, accordingly, the sharp rise of the GBP/USD pair. Although in my opinion, there is no need to "dig deep" here: geopolitics still "rules" the situation, not allowing traders to gain a foothold. Even within the day, there are strong, but at the same time contradictory price fluctuations. For example, the pound-dollar pair managed to update the two-day low in the first half of today, marking 1.3119, and just a few hours later updated the 2.5-week high, reaching the target of 1.3273.

It is noteworthy that the 150-point price flight occurred against the background of an almost empty economic calendar - only data on the balance of industrial orders were published today (release of the Confederation of British Industrialists). It really came out much better than expected. Thus, the balance of industrial orders rose to 26 (a record value): expectations for prices jumped to the highest value since the beginning of observations (which have been conducted since 1975). It is reported that almost 80% of manufacturers this month raised prices for domestic orders for the next three months (last month this indicator was at 77%).

The result, of course, is impressive, but this report is not able to provoke such a violent reaction of traders. Therefore, the reason for the impulse growth of the GBP/USD pair is different.

In my opinion, the dollar has been hit by a wave of sales due to increased optimism about the prospects of the negotiation process between Russia and Ukraine. Yesterday, certain hints about this were voiced by Ukrainian President Vladimir Zelensky (stating that Kiev's non-aligned status is "beneficial to everyone"), and today certain signals were voiced by UN Secretary-General Antonio Guterres. He noted that there are elements of progress on a number of key topics related to the situation in Ukraine. The UN Secretary General added that "at the moment there are enough arguments on the table to start serious negotiations right now," meaning, apparently, a dialogue at the highest state level.

Such rhetoric allowed GBP/USD bulls not only to organize a large-scale upward attack, but also to stay within the 32nd figure.

It is also worth noting that key data on the growth of inflation in the country will be published in the UK on Wednesday. According to preliminary forecasts, all components of the release will show significant growth, thereby strengthening the hawkish sentiment. Thus, according to most experts, the overall consumer price index in February will increase to 0.6% on a monthly basis. It should be noted here that this indicator has been consistently declining for three months, and it fell into the negative area (reaching -0.1%) in January. Therefore, the February growth will have quite an importance. In annual terms, the CPI should update the next multi-year highs, reaching the 6% mark. This will be the strongest growth rate of the index since February 1992. Core inflation should also show a fairly strong dynamic. According to general forecasts, the main consumer price index will rise to 5% in February. For comparison, we can say that a year ago – in February 2021 - the core inflation index was at the level of 0.9%.

Other inflation indicators should also demonstrate positive dynamics. For example, the retail price index in monthly terms should rise from zero to 0.8% (in annual terms - to 8.2%), and the producer purchase price index should rise to 1.2% (m/m) and (13.9% y/y).

In other words, a fairly strong inflation release is expected tomorrow, which may strengthen the hawkish mood among the members of the British central bank. Let me remind you that at the March meeting, one of the Committee members (Cunliffe) spoke out against raising the interest rate. This fact put pressure on the pound, which reacted sharply to the manifestation of such "dissidence". If tomorrow inflation comes out at least at the forecast level (not to mention the green zone), the GBP/USD pair may receive an additional upward momentum. But on one condition – if the dollar continues to be under pressure from geopolitical stability, that is, if anti-risk sentiment in the market does not strengthen.

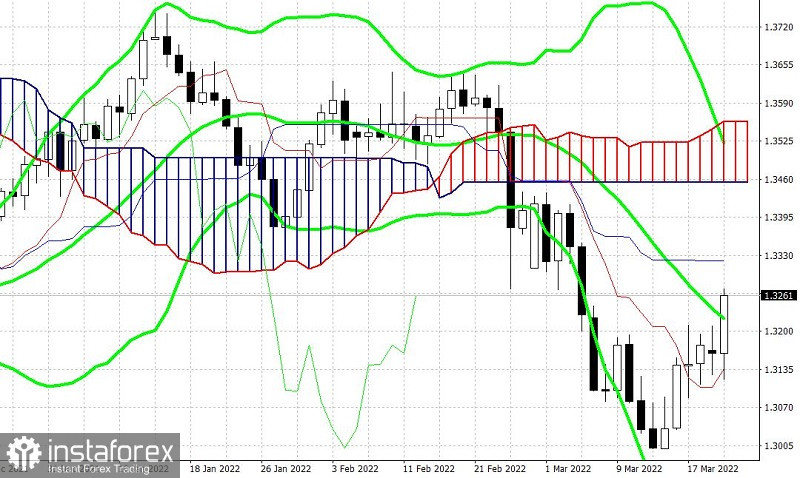

From a technical point of view, the situation is uncertain. The GBP/USD pair on the daily chart is located on the middle line of the Bollinger Bands indicator, under the Kumo cloud, but between the Tenkan-sen and Kijun-sen lines. In other words, trend indicators do not signal any priority: the pair is at a crossroads. Moreover, at the moment (and, obviously, in the near future), the tone of trading will be set by geopolitical factors, and not by "classic" macroeconomic ones. Therefore, today it is advisable to take a wait-and-see position on the GBP/USD pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română