The GBP/USD pair rebounded after reaching the 1.2055 level yesterday. Now, it is trading at 1.2120 at the time of writing. It has bounced back as the Dollar Index remains under pressure. You already know from my analyses that the DXY is in a major corrective phase.

Fundamentally, the US and UK data came in mixed yesterday. Today, the UK Final GDP could drop by 0.2%, the Current Account could be reported at -20.0B, while Revised Business Investment may report a 0.5% drop.

On the other hand, the US Final GDP could report a 2.9% growth, the Final GDP Price Index may register a 4.3% growth, CB Leading Index is expected to drop by 0.5%, while the Unemployment Claims indicator could increase from 211K to 221K.

GBP/USD Rebound!

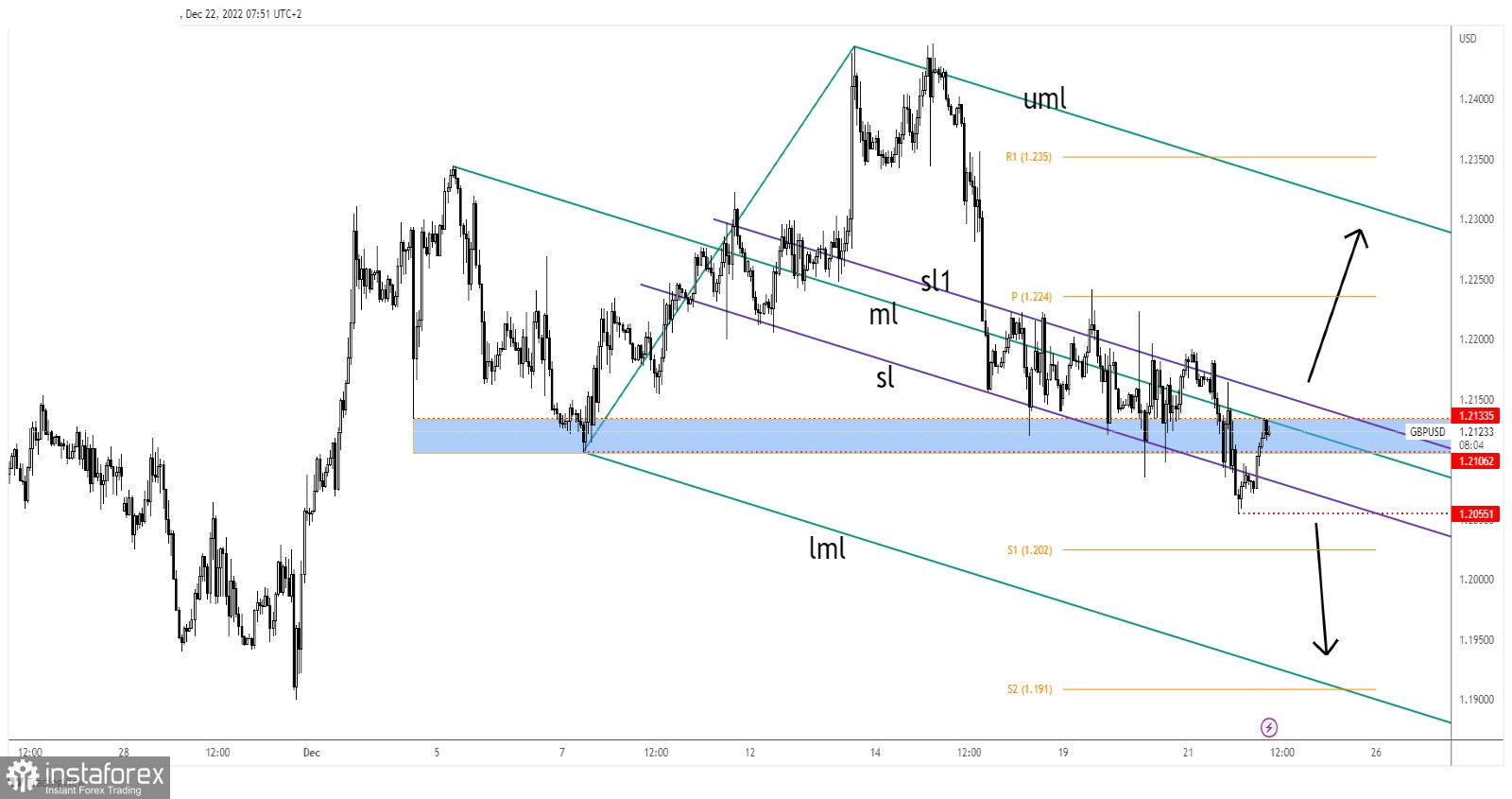

The instrument is challenging the descending pitchfork's median line (ml). This stands as a dynamic resistance. As you can see on the H1 chart, the rate drops along the median line. It has failed to stabilize above or below the sliding lines (sl, sl1).

Yesterday's low of 1.2055 represents a static downside obstacle. The rate could slip lower as long as it stays below the 1.2133, median line, and under the upside sliding line (sl1). A valid breakout above the upside sliding line (sl1) could invalidate a deeper drop and could announce a potential lege higher.

GBP/USD Forecast!

Testing and retesting the resistance levels, registering only false breakouts could announce a new potential drop. Still, only a new lower low, a valid breakdown below 1.2055 confirms a deeper drop. This scenario could announce a potential drop toward the lower median line (lml).

Jumping and stabilizing above the sl1 could bring new long setups.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română