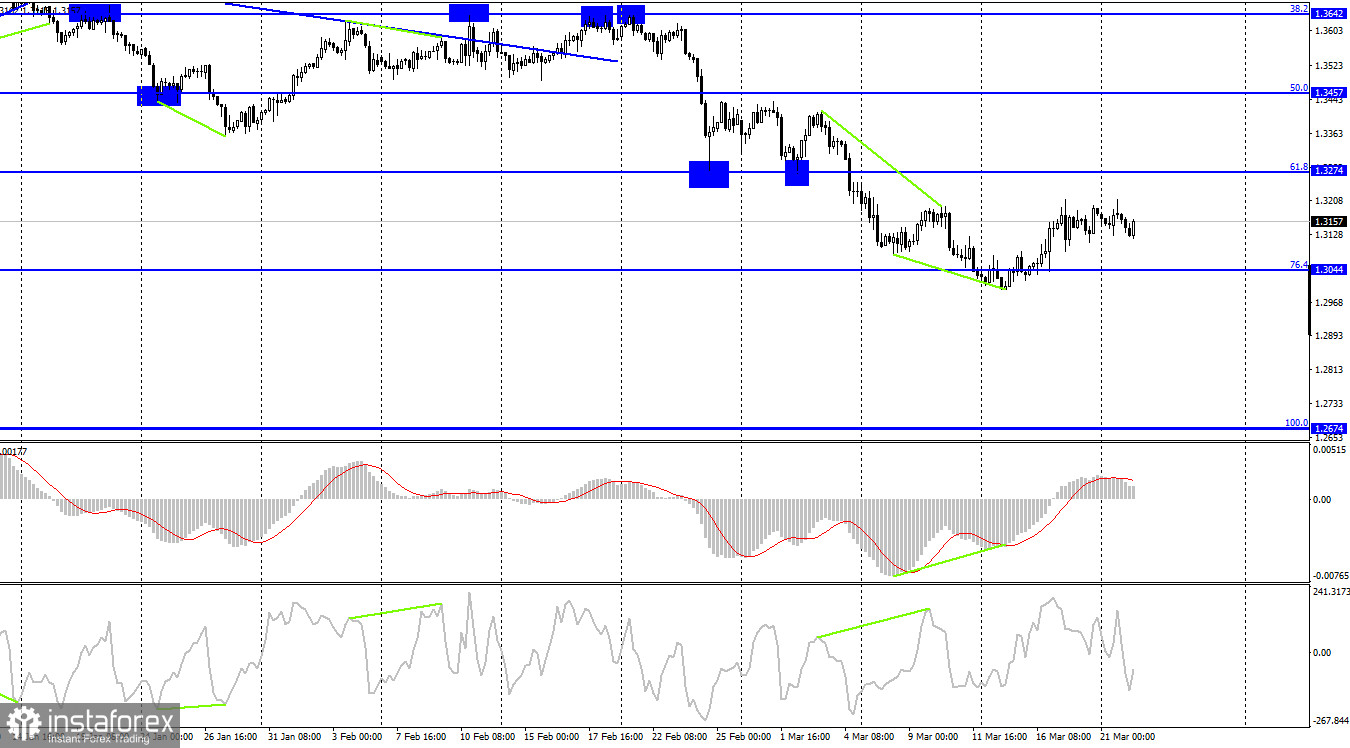

According to the hourly chart, the GBP/USD pair overcame the corrective level of 161.8% (1.3181) during Monday, but after a few hours, the pair began to fall again. This morning, history repeated itself. The quotes of the British have again performed an increase to the Fibo level of 161.8% and are currently trying to consolidate above it. If this time the attempt to consolidate above the level turns out to be successful, then the growth process can be continued in the direction of the next corrective level of 127.2% (1.3279). A new rebound is a new fall in the direction of the corrective level of 200.0% (1.3071). However, in the last few days, the persistence of the bulls is respected and the level of 1.3181 may still not stand. Yesterday, in addition to Christine Lagarde's speech, Jerome Powell also gave a speech. Powell's rhetoric has changed dramatically compared to his previous speeches, but so far I cannot say that this has somehow affected the movement of the pound/dollar pair. There was a drop in quotes last night and overnight, but it could have been stronger, given what Powell said.

The bulls are stronger now and are trying to consolidate the success of the last week. Returning to Powell, he said that price stability is now the main task of the Fed. The regulator is ready to raise the rate as long as it takes until inflation returns to the target level. The Fed President noted that, if the situation requires it, the rate may be raised by 0.5% at one or more meetings. At this time, it is generally assumed that the neutral rate level, at which the economy does not accelerate or slow down, is about 2.5%. However, many economists already believe that to repay inflation, it will be necessary to raise the rate to at least 5%. The Fed itself partially agrees with this, not excluding the option of raising the rate above 2.5%. Of course, much will depend on economic conditions at the time of decision-making at each Fed meeting. After all, even if the regulator raises the rate at all remaining meetings in 2022, by the end of the year it will come out only by 2-2.5%. This is not enough for inflation to start slowing down actively.

On the 4-hour chart, the pair performed a reversal in favor of the British currency after the formation of a bullish divergence at the MACD indicator and continues the process of growth in the direction of the Fibo level of 61.8% (1.3274). The rebound of quotes from this level will allow us to expect a reversal in favor of the US currency and a slight drop in the direction of 1.3044. There are no new brewing divergences now.

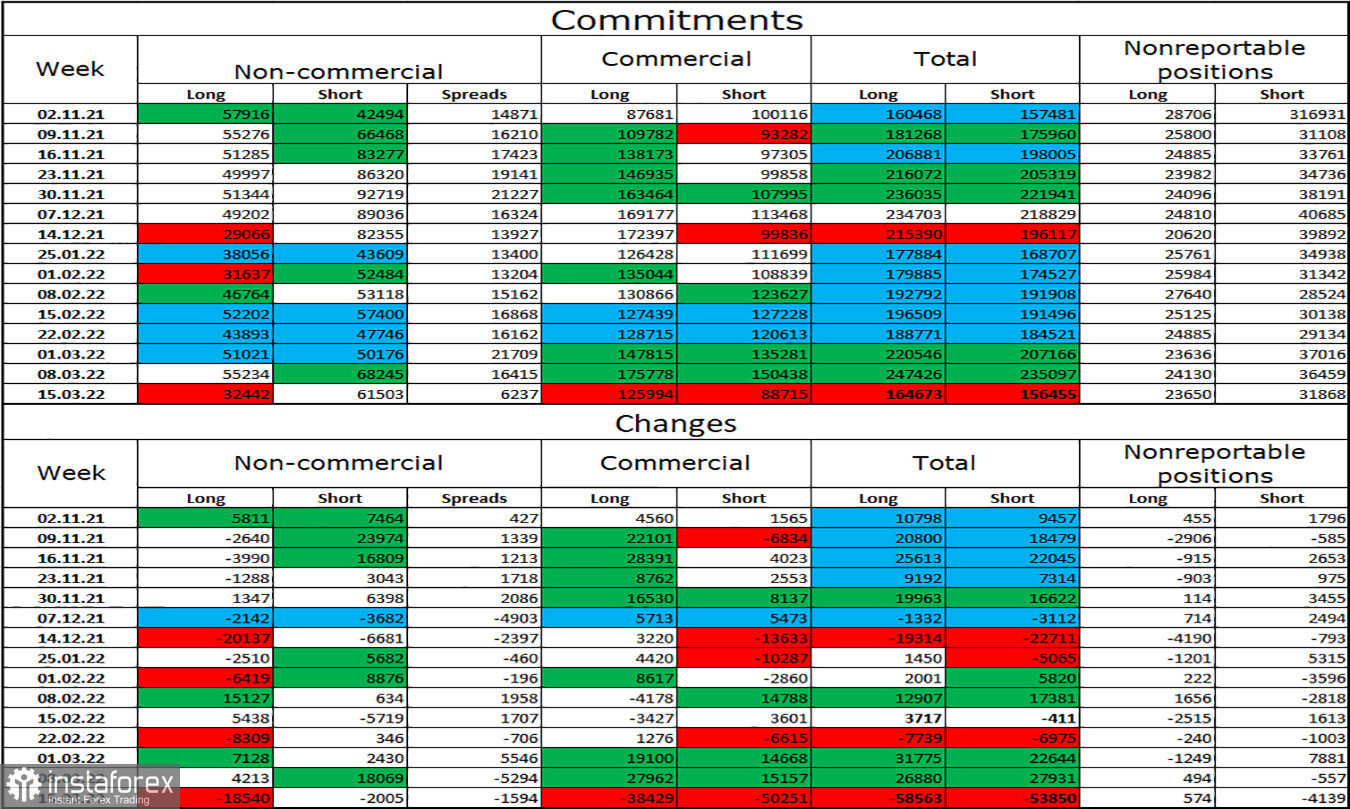

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts decreased in the hands of speculators by 18,540, and the number of short - by 2005. Thus, the general mood of the major players has become even more "bearish". Thus, everything is in order now, and the ratio between long and short contracts for speculators corresponds to the real state of things. The British dollar is falling, and the big players are selling the pound more than buying it. At this time, the difference between the number of long and short contracts for speculators is twofold. Thus, I expect the pound to continue its decline.

News calendar for the US and the UK:

On Tuesday, the calendars of economic events in the United States and Great Britain do not contain a single interesting and important entry. Thus, the influence of the information background on the mood of traders today will be absent.

GBP/USD forecast and recommendations to traders:

I recommend selling the British at a new rebound from the level of 1.3181 on the hourly chart with a target of 1.3071. I recommend new purchases of the British above the level of 1.3181 with a target of 1.3279.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română