The USD/CAD pair drops at the time of writing. It's located at 1.3593 and it seems very heavy as the Dollar Index is still under downside pressure. As you already know, the Canadian and US data came in mixed yesterday.

Today, Canada reported higher inflation than expected. The CPI rose by 0.1% versus the 0.0% expected. Still, the indicator reported lower inflation compared to the 0.7% growth in the previous reporting period.

On the other hand, the US CB Consumer Confidence and the Current Account came in better than expected, while Existing Home Sales came in worse than expected. Tomorrow, the Unemployment Claims and the Final GDP could have an impact.

USD/CAD Drops Post Canadian CPI!

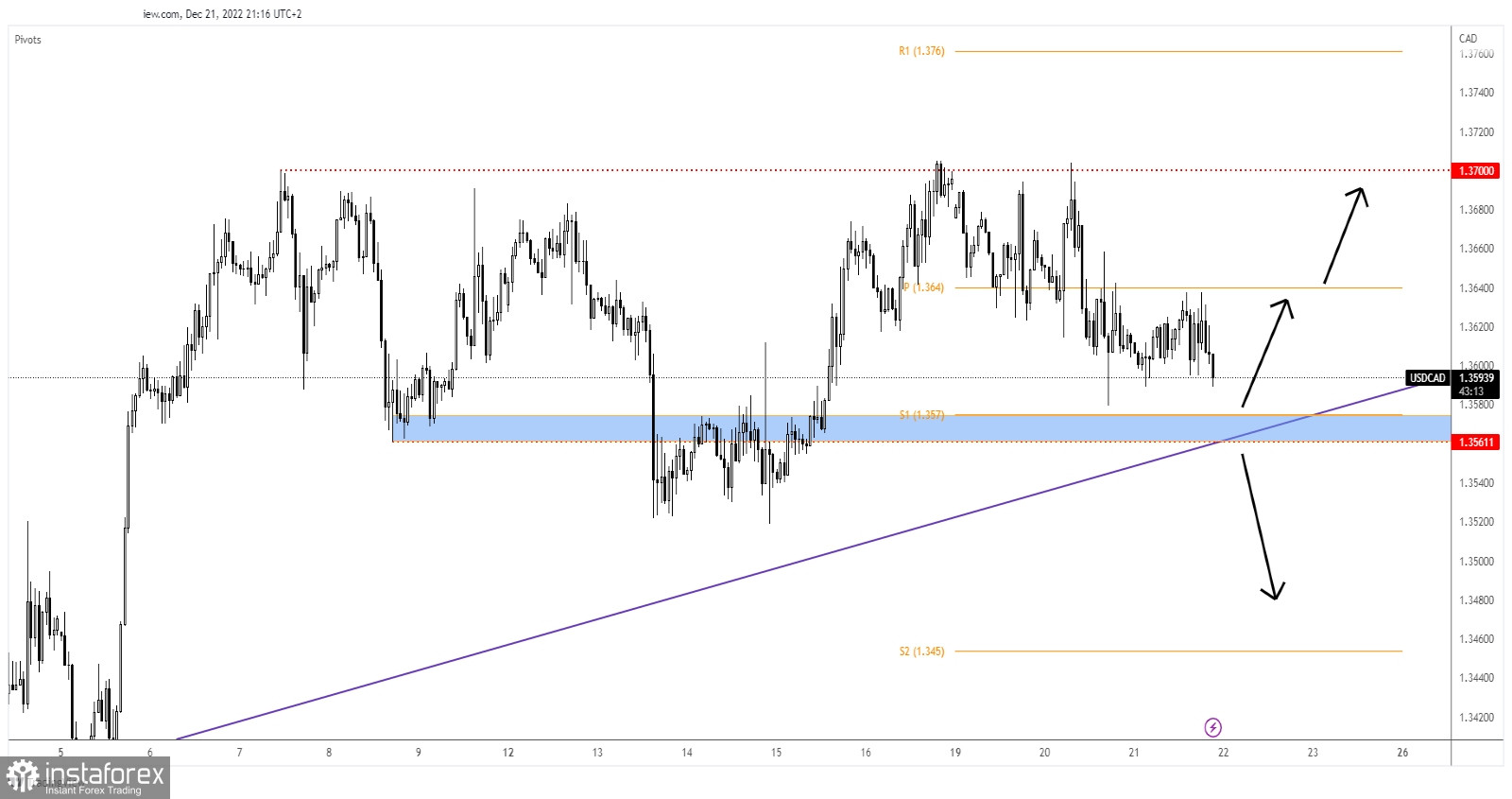

Technically, the USD/CAD pair is moving somehow sideways between the 1.3700 and 1.3561 levels. The weekly S1 (1.3570) and the uptrend line represent downside obstacles as well.

The weekly pivot point of 1.3640 represents the first upside obstacle. In the short term, it could continue to move sideways before developing a strong movement in one direction.

USD/CAD Forecast!

Testing and retesting the uptrend line, registering only false breakdowns may announce a new leg higher. This could represent a new buying opportunity Also, failing to reach the support levels could announce strong upside pressure. A new higher high, a valid breakout above the pivot point of 1.3640 activates further growth.

Dropping and closing below the uptrend line and under 1.3561 activates more declines and bring selling opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română