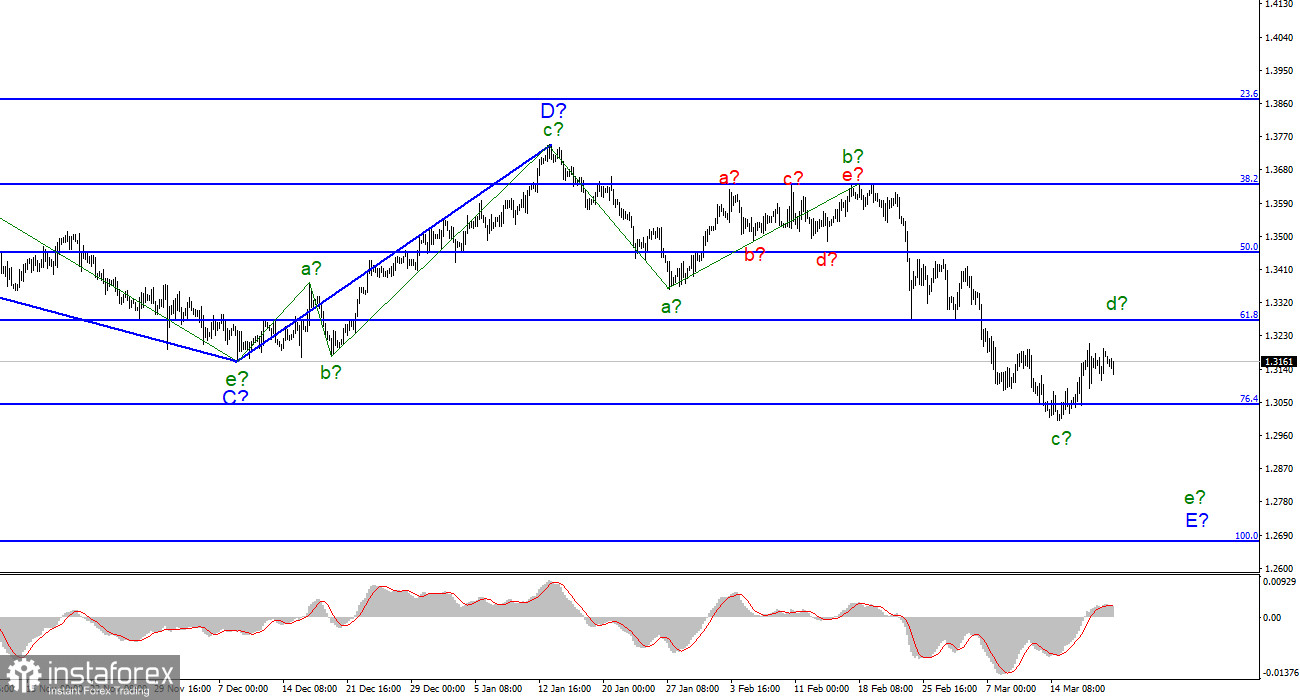

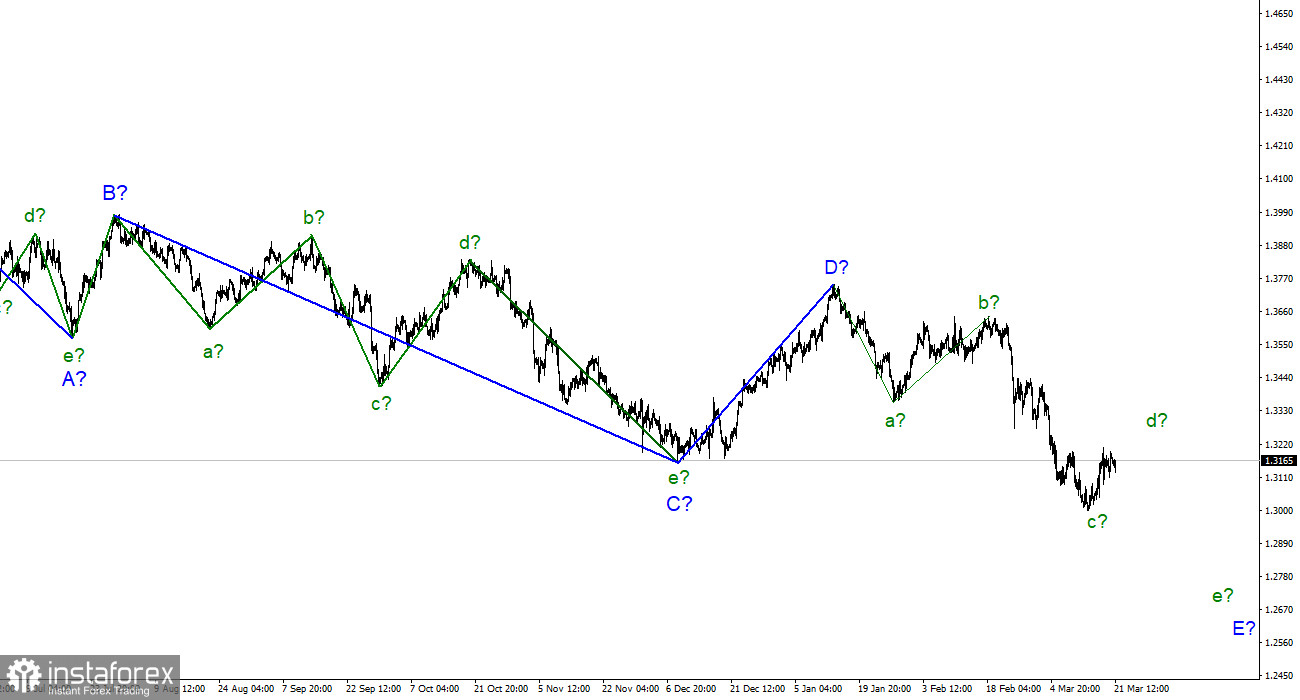

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require any additions. The increase in the quotes of the British dollar in recent days may be a corrective wave d in E, and it may be nearing its completion. In total, there should be five waves inside the wave E, respectively, as in the case of the euro/dollar instrument, the downward trend section can continue its construction. At the moment, the quotes of the British are only slightly below the low of wave C. This indirectly suggests that the decline has not yet been completed, and the last descending wave E may turn out to be more extended. A successful attempt to break through the 1.3041 mark, which equates to 76.4% by Fibonacci, may lead to an increase in demand for the US currency. However, most likely, this option should be counted on already with the beginning of the construction of the wave e in E. I don't see any alternative options for wave marking yet. Everything is quite unambiguous. Geopolitical information has a devastating effect on the British, but this influence fully corresponds to the current wave markup.

The first consequences of abandoning oil from the Russian Federation

The exchange rate of the pound/dollar instrument decreased by 50 basis points during March 21, but in the afternoon, it very quickly managed to recover morning losses. The Briton does not want to give up without a fight and wants to continue building the corrective wave d. In fairness, it should be noted that this wave now looks very short compared to the last corrective wave b. Thus, it may well take on a more extended form, and this will not have a destructive effect on the current wave marking. There was no news background for the pound/dollar instrument on Monday. Fed President Jerome Powell's speech will take place only in a couple of hours, but I'm not counting on him too much. The Briton received market support simply with the opening of the American session. This suggests that the Americans themselves are not yet considering new purchases of the dollar.

At the same time, in the UK, gasoline prices have increased by 16 pence over the past month, and now the average price is 1.67 pounds per liter. Diesel fuel has risen to 1.79 pounds per liter. Let me remind you that earlier the UK decided to abandon the import of oil, coal, and gas from Russia until the end of 2022. With the beginning of Russia's special operation in Ukraine, the cost of oil and gas has jumped, and when the countries themselves begin to abandon the already expensive oil, this also leads to strong internal inflation. Now in all countries of the world, they talk exclusively about inflation. The UK is no exception. The Bank of England expects the consumer price index to jump to 8% in the coming months. However, what he expects and what may happen are different things. Let me remind you that Jerome Powell for a long time refused to admit at all that the rise in inflation would last for a long time. How everything turned out in the end, we all see now. Well, the more expensive oil becomes, the more expensive gasoline becomes. And gasoline participates in the formation of prices for almost all goods and services. Thus, the forecast for further inflation growth is 100% correct.

General conclusions

The wave pattern of the pound/dollar instrument assumes the construction of wave E. I continue to advise selling the instrument with targets located around the 1.2676 mark, which corresponds to 100.0% Fibonacci, according to the MACD signals "down", since the wave E does not look completed yet. The proposed wave d in E may already be completed, or it may take a more extended form. But we are still only interested in selling signals since there are no grounds for making adjustments to the markup yet.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the decline of the instrument to continue with targets well below the low of wave C. Wave E should take a five-wave form, so I expect to see the British quotes around the 27th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română