EUR/USD

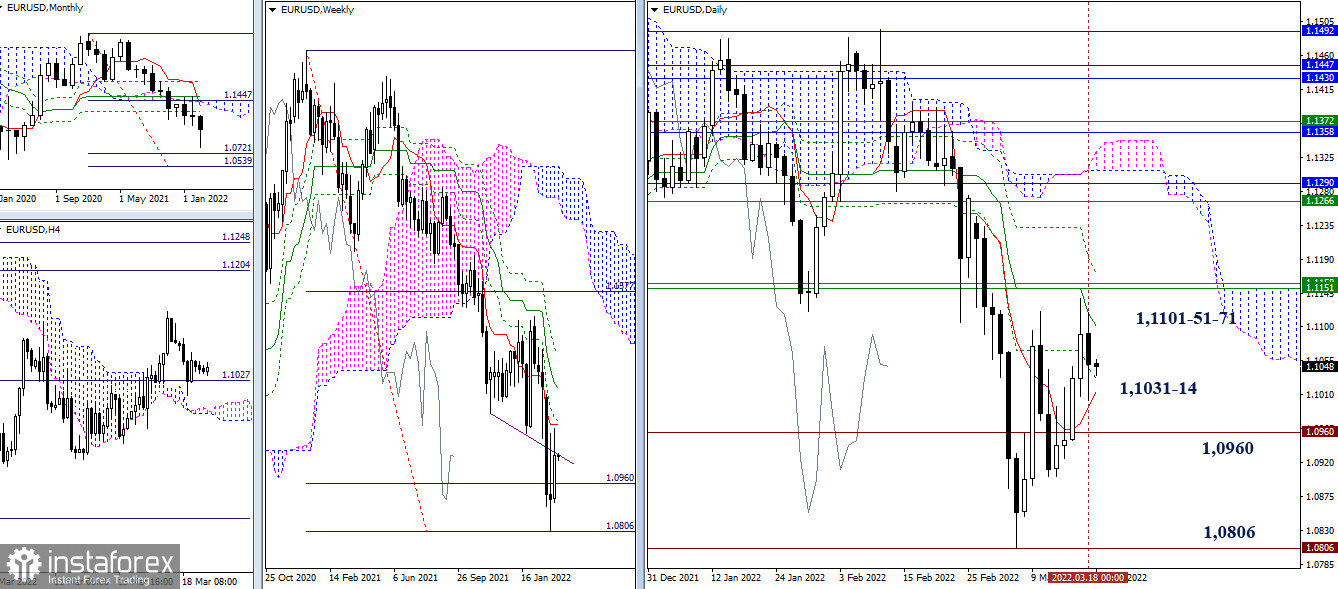

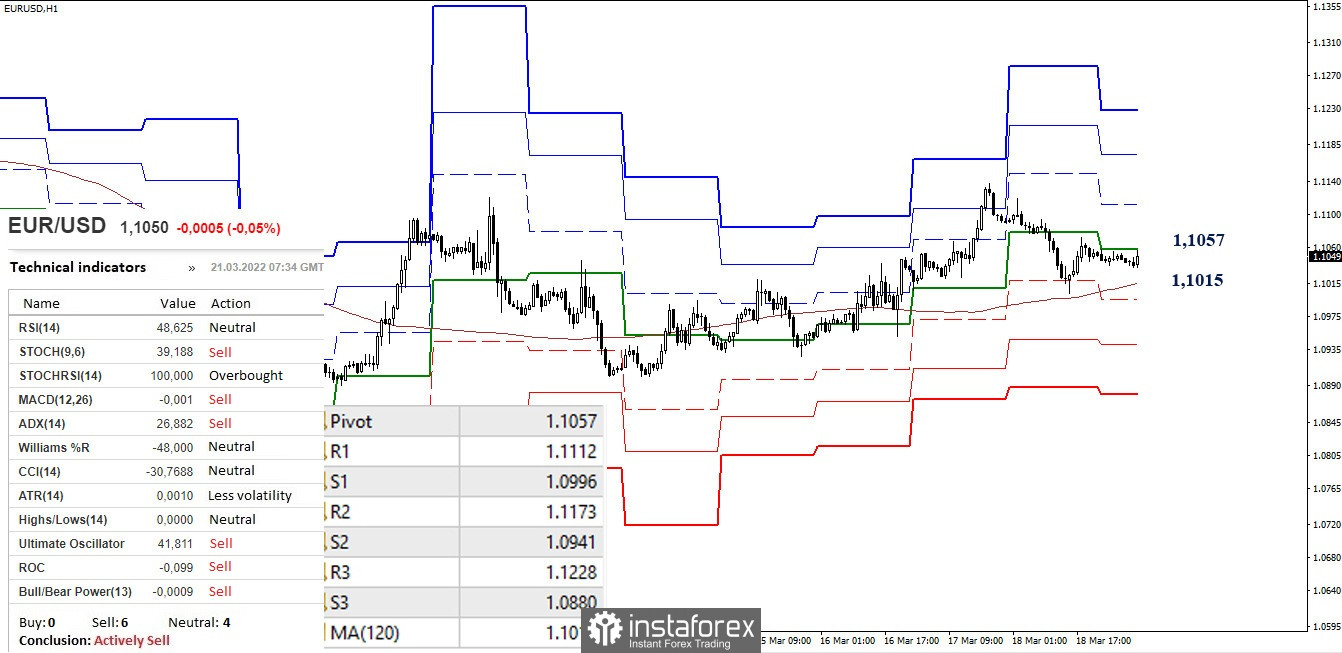

Last week closed with a fairly long upper shadow, as a result of which the most important resistance and upward tasks in this area have not lost their relevance. For bulls, the primary and closest targets in the current situation are the elimination of the daily death cross (1.1101 – 1.1171) and the overcoming of weekly resistances in the area of 1.1151-58. Last week, these milestones were tested, but the result, which allows us to talk about passing, was not achieved.

When solving the tasks that are indicated for the bulls, the next bullish targets will be the target for the breakdown of the H4 cloud (1.1204-48) and a wide resistance zone that combines many strong levels of the higher timeframes (1.1266 – 1.1290 – 1.1308 – 1.1348 – 1.1358 – 1.1372). The nearest supports at the moment are 1.1031 – 1.1014 (daily levels), and then it will be important to go beyond the target for a breakdown of the weekly cloud (1.0960 – 1.0806).

In the lower timeframes, despite the duration of the decline, the main advantage remains on the side of the bulls. The breakdown of the weekly long-term trend (1.1015) and the reversal of the moving average may again change the balance of power. However, it is worth noting that the resultative advantage has not been on the market in recent days, and the weekly long-term trend is almost horizontal for a long period of time. Supports of the classic pivot points today are located at 1.0996 – 1.0941 – 1.0880, and resistances are at 1.1212 – 1.1273 – 1.1328.

***

GBP/USD

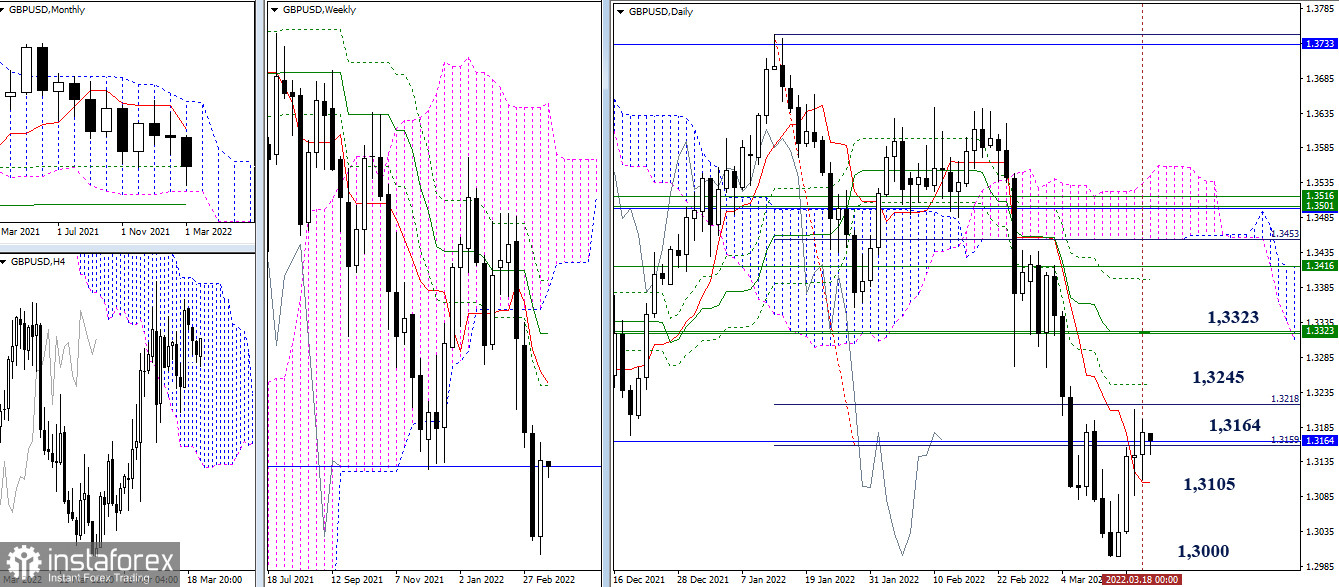

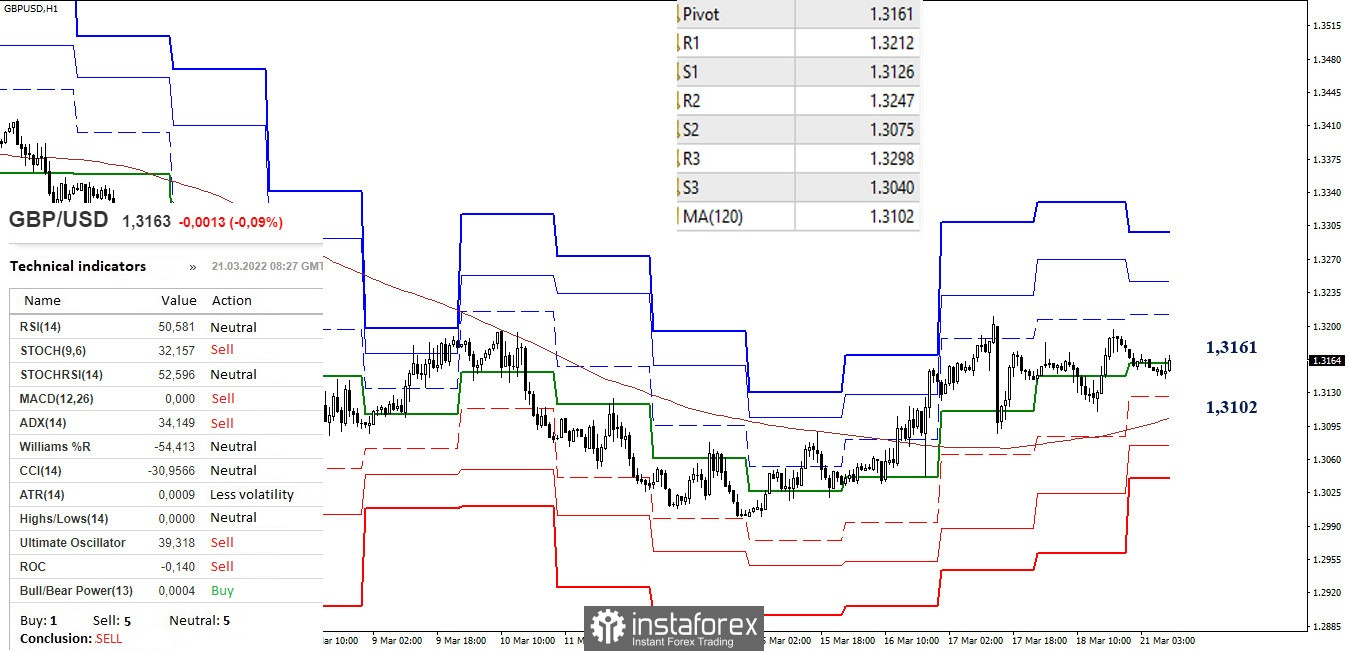

The bulls managed to close last week effectively, regaining the monthly level of 1.3164, which is a good potential for a continuation of the rise. Will the bulls take advantage of this and continue the corrective rise to the nearest daily and weekly reference points 1.3245 (daily Fibo Kijun) and 1.3323 (weekly levels + daily medium-term trend)? Support in the current situation can be indicated at 1.3105 (daily short-term trend) and 1.3000 (minimum extremum).

On the lower timeframes, the pair has been working within the candle of a large-scale fall for March 17 for two days already. The current sideways movement is concentrated near the central pivot point of the day, located at 1.3161. The most important support, which is the weekly long-term trend, is at 1.3102. Consolidation below could change the current balance of power and redirect the market's attention. To continue the rise within the day, the resistance of the classic pivot points (1.3212 – 1.3247 – 1.3298) can be noted as reference points.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română