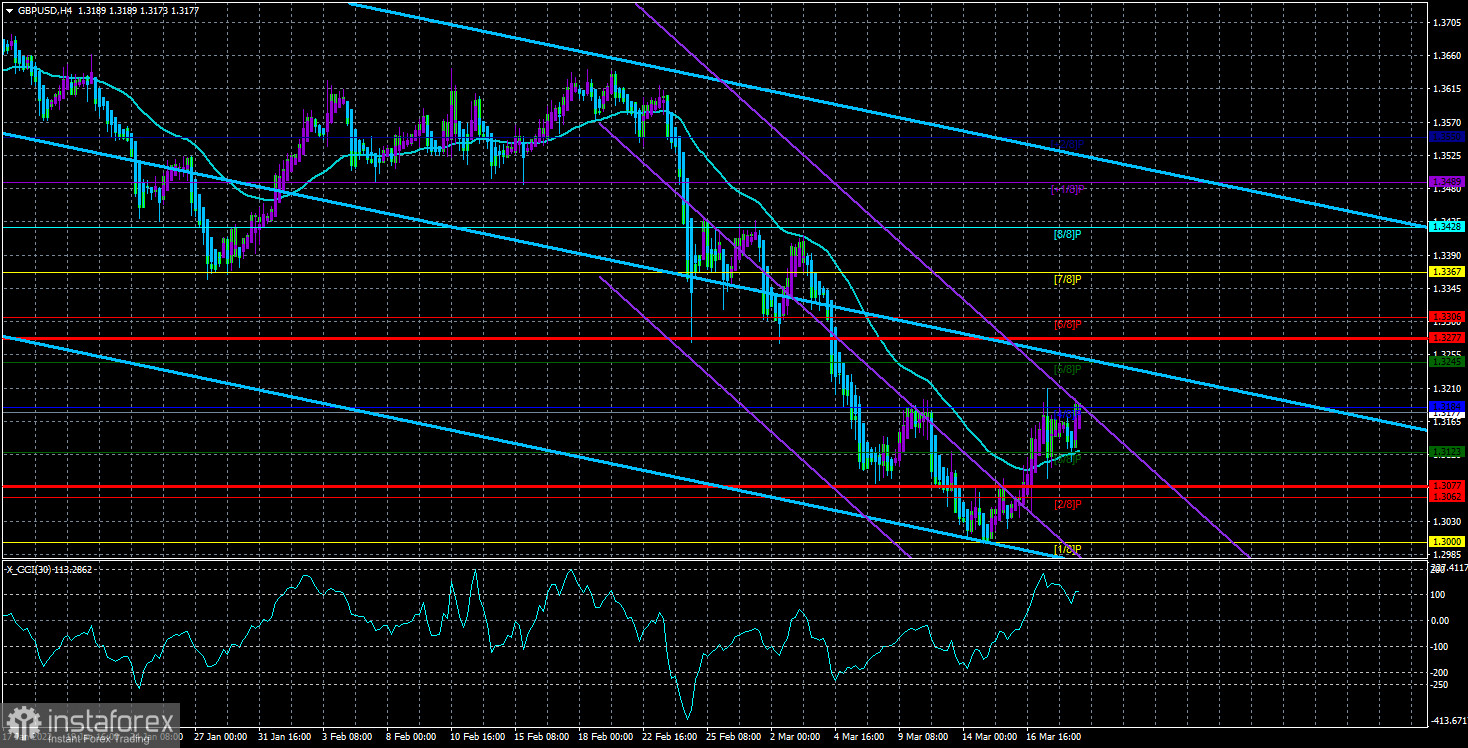

The GBP/USD currency pair tried to gain a foothold below the moving average line on Friday, but it failed. However, it also failed to move up. So now it is stuck below the Murray level of "4/8" - 1.3184, which is its previous local high. Consequently, even above the moving average, there are high chances of resuming the downward movement. As for the fundamental, macroeconomic and geopolitical background, the situation here is better for the British currency than for the European one. To begin with, the UK economy feels better than the EU economy right now. Not much, well, better. Firstly, Britain is not so dependent on Russian oil and gas and is ready to completely abandon them by the end of the year. Secondly, hundreds of thousands of Ukrainian refugees are not sent to the UK. Thirdly, the UK is, in principle, quite far from Russia, Ukraine and the military conflict. The fundamental background is also much better. The Bank of England has already raised the key rate three times and intends to do it at least once more this year. But if necessary, then more. Thus, Britain will struggle with rising prices, although they are confident that inflation will continue to rise in the coming months. As for the geopolitical background, everything is about the same as for the European Union. The pound and the euro look equally less stable than the dollar, so the difficult geopolitical situation in Eastern Europe will put the same pressure on both currencies.

From a technical point of view, the pound can now continue to grow, but for this it is necessary to confidently overcome the level of 1.3184. Both linear regression channels are directed downwards, but any trend starts with a small movement, and the channels turn in the right direction already "in the course of the play". Plus, the pound is still getting cheaper against the dollar much less willingly than the euro currency. Therefore, we would say that the British currency has a better chance of growth in the near future.

The macroeconomic background is unlikely to support the pound this week

There won't be many important events and publications in the UK and the US in the new week. In Great Britain, it will be possible to pay attention to the inflation report on Wednesday, business activity indices in the services and manufacturing sectors on Thursday and retail sales on Friday. Of course, the most important will be the inflation report. The forecast is 5.9-6.1% y/y against the current 5.5%. However, who can be surprised by another increase in inflation now, no matter where it is? Business activity indices are practically irrelevant now, as are retail sales.

In America, the week will begin with a speech by Federal Reserve Chairman Jerome Powell on Monday. Business activity indices for the service and manufacturing sectors will be published on Thursday, as well as a report on orders for long-term goods. The consumer confidence index from the University of Michigan will be released on Friday. All of the above reports are secondary and are unlikely to cause even an average market reaction. Moreover, it is unlikely that Powell will announce anything important and new for the market on Monday. Thus, the key will be the report on British inflation, but most of the week traders will have to rely on the geopolitical background and technique when making trading decisions.

And the technique is now such that there is no need to wait for a strong growth of the euro and the pound. Recall that on 24-hour TF, both pairs are in a state of weak correction and have not yet managed to overcome even the critical Kijun-sen lines of the Ichimoku indicator. If they manage to do this this week, then it will be possible to discuss a stronger appreciation of both currencies. If not, then, most likely, the quotes will resume to fall. Plus, both currency pairs cannot overcome their previous peaks, which provides additional resistance. In general, so far the euro and the pound do not look like currencies that are ready for a new upward trend.

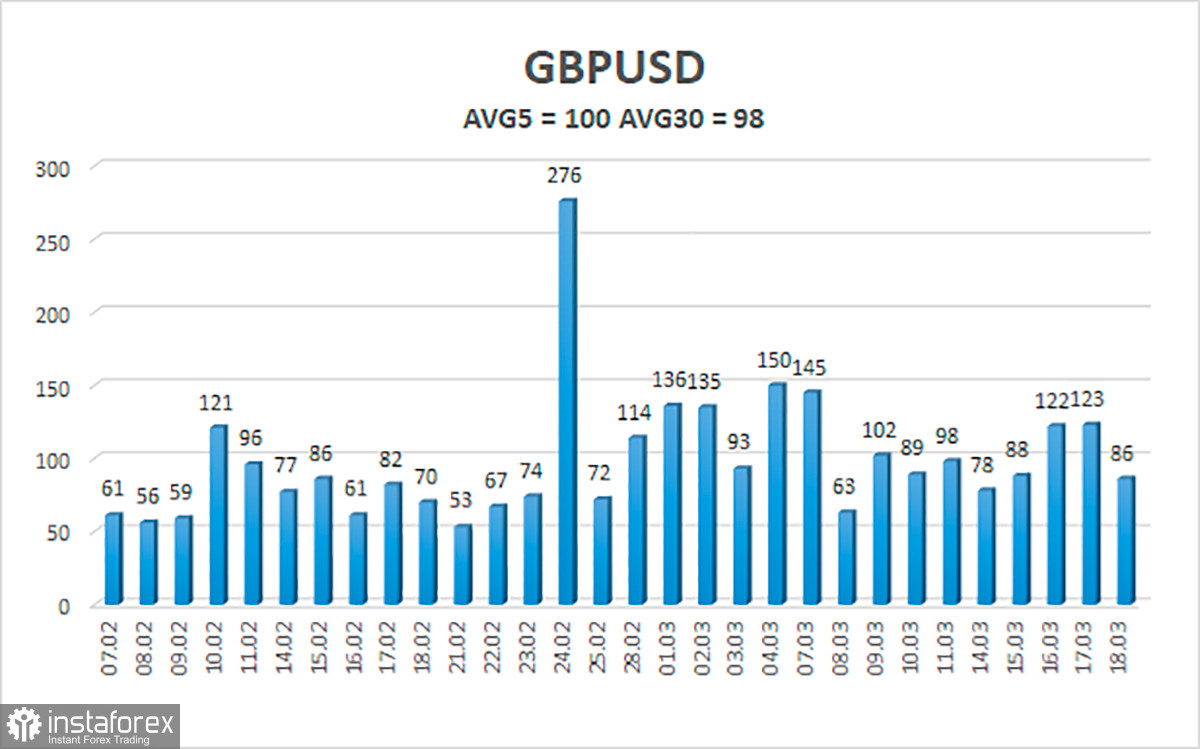

The average volatility of the GBP/USD pair is currently 100 points per day. This value is the "average" for the GBP/USD pair. On Monday, March 21, therefore, we expect movement inside the channel, limited by the levels of 1.3077 and 1.3277. The downward reversal of the Heiken Ashi indicator will signal a possible resumption of the downward movement.

Upcoming support levels:

S1 - 1.3123

S2 - 1.3062

S3 - 1.3000

Nearest resistance levels:

R1 - 1.3184

R2 - 1.3245

R3 - 1.3306

Trading recommendations:

The GBP/USD pair started moving up on the 4-hour timeframe, which can end very quickly, as the level of 1.3184 cannot be overcome. Thus, at this time, you should stay in long positions with 1.3245 and 1.3277 as the targets until the Heiken Ashi indicator reverses down. You can consider short positions only when the price settles below the MA with 1.3062 and 1.3000 as the targets.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. March 21. What does the new week have in store for us?

Forecast and trading signals for EUR/USD for March 21. Detailed analysis of the movement of the pair and trading transactions.

Forecast and trading signals for GBP/USD for March 21. Detailed analysis of the movement of the pair and trading transactions.

Explanations for the chart:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should now trade.

Murrey levels are target levels for movements and corrections.

Volatility levels (red lines) - a likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română