Analysis of Friday's deals:

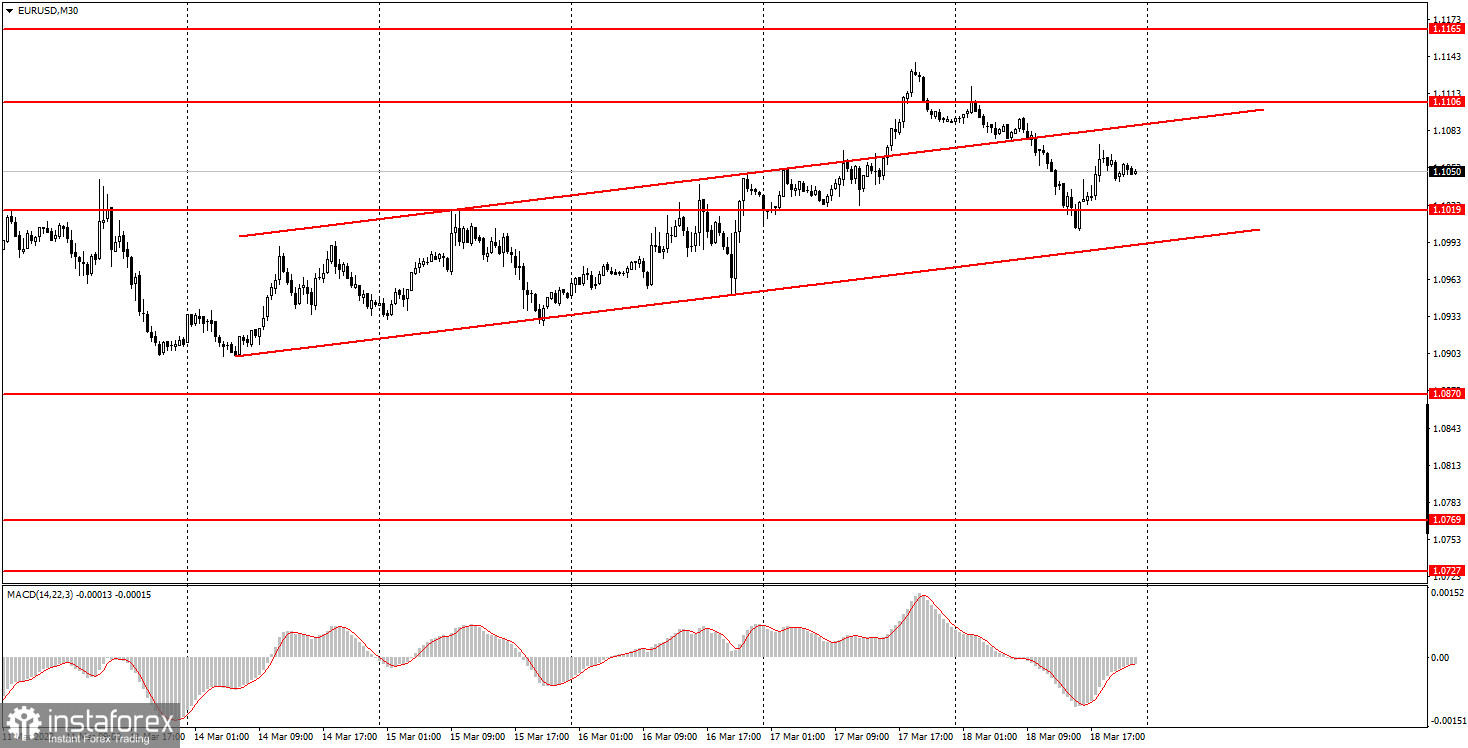

30M chart of the EUR/USD pair.

The EUR/USD currency pair on Friday began a new round of corrective movement within the framework of the upward trend that has formed over the past week. Thus, the growth prospects for the European currency are still preserved, but at the same time, the upward movement itself is rather weak. If you look at the longer-term chart (the older timeframe), it is clear that the current upward movement is most likely also a correction against a downward trend. But one way or another, the upward trend is still maintained, therefore, it is still possible to count on the growth of the euro. We remind novice traders that the growth of the European currency began quite unexpectedly. Then, when the Fed raised the key rate, which should have provoked the growth of the US currency, and not vice versa. Moreover, the euro rose, even more, the next day. Thus, this movement may be logical from the point of view of technical analysis (the pair should be adjusted from time to time), but from a fundamental point of view, the movement is now illogical and we expect its completion in the near future. There were no important macroeconomic events on Friday in either the European Union or the United States, but volatility was high again (more than 100 points), so we conclude that the market remains very excited.

5M chart of the EUR/USD pair.

There were very few trading signals on the 5-minute timeframe during Friday and, unfortunately, they did not allow novice traders to earn. Let's start with the fact that the pair moved mainly between the levels of 1.1106 and 1.1019 all day, and the first sell signal was formed at night and it could not be worked out. Therefore, traders missed almost all the downward movement. But near the level of 1.1019, where one could count on a good buy signal, the pair inexplicably began to "dance" and managed to form two false signals before forming a strong signal. At first, the price bounced from 1.1019, then overcome it and in both cases could not even pass 15 points in the right direction. Therefore, when a really strong buy signal was formed (consolidation above the level of 1.1019), it should not have been worked out, since two signals before that were false and brought a small loss. The level of 1.1003 on Friday was not yet on the chart. This level is Friday's minimum.

How to trade on Monday:

A new upward trend has been formed on the 30-minute timeframe, but it may be short-term. We believe that the euro currency currently has no strong grounds for long-term growth, so the pair's decline may resume in the coming days. It will be possible to identify a new fall of the pair by fixing the price below the channel. On the 5-minute TF tomorrow, it is recommended to trade by levels 1.0932, 1.1003-1.1019, 1.1106, 1.1136, 1.1165. When passing 15 points in the right direction, you should set the Stop Loss to breakeven. New speeches by Fed and ECB head Jerome Powell and Christine Lagarde are scheduled for Monday in the United States and the European Union. We doubt that they will report anything important that the market does not know yet, because meetings of both central banks have just recently taken place and everything that should have been announced has already been announced. It is unlikely that anything will change in the rhetoric of Powell and Lagarde in a week. But still, you need to be ready for the market reaction.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to generate the signal (rebound or overcoming the level). The less time it took, the stronger the signal.

2) If two or more trades were opened near a certain level on false signals, then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the period between the beginning of the European session and the middle of the American session when all transactions must be closed manually.

5) On a 30-minute TF, signals from the MACD indicator can be traded only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as a support or resistance area.

What's on the charts:

Price support and resistance levels - target levels that are the targets when opening purchases or sales. Take Profit levels can be placed near them.

Red lines - channels or trend lines that display the current trend and show in which direction it is preferable to trade now.

MACD indicator (14,22,3) is a histogram and a signal line - an auxiliary indicator that can also be used as a signal source.

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp price reversal against the previous movement.

Beginners to trade in the forex market should remember that every transaction cannot be profitable. Developing a clear strategy and money management is the key to success in trading for a long period.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română