Last week was marked by a corrective growth for the EUR/USD pair. Trading started at 1.0912 on Monday, and ended at 1.1051 on Friday. The 150-point result was not easy for the bulls – we observed quite deep price pullbacks (for example, traders retreated by almost a hundred points on Tuesday), which said that the upward route is "thorny" and unreliable. Moreover, despite the attempt, the EUR/USD bulls could not gain a foothold within the 11th figure. Having marked the weekly high at 1.1138, they retreated to the base of the 10th price level. But the traders did not stay here either: at the end of the trading week, market participants began to take profits, closing short positions, thereby "lifting" the pair to the level of 1.1051.

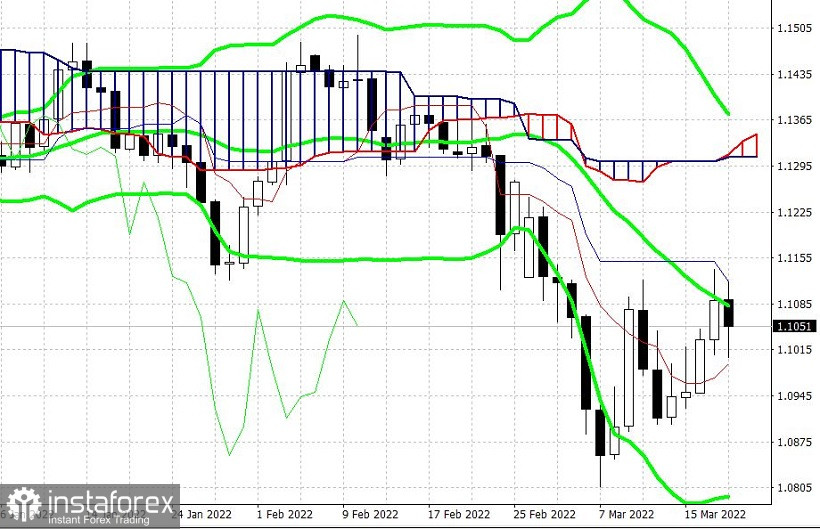

Evaluating the D1 timeframe, we can come to the initial conclusion that traders formed a price low at the base of the 9th figure, from which they pushed off and went on a counteroffensive. Here we can only agree that the 1.0900 mark has become a powerful price outpost, which will not be so easy for EUR/USD bears to overcome. But, in my opinion, it is impossible to talk about a trend reversal at the moment. The deep, almost 100-point price pullbacks that we observed this week eloquently indicate that bulls cannot count on a stable price movement in the upward direction. Moreover, if we switch to the weekly timeframe, we will see that the price is still located on the lower line of the Bollinger Bands indicator, as well as under all the lines of the Ichimoku indicator, including under the Kumo cloud. The weekly chart also tells us that the EUR/USD pair has been within the downward trend since the beginning of February (that is, even before the Ukrainian events). In particular, during the first week of February, the price dropped from the level of 1.1495 to the target of 1.1330. All subsequent events of a geopolitical nature only accelerated the downward trend, which reached its low on March 7 (then the pair dropped to the level of 1.0806 – this is the lowest value since May 2020).

Evaluating the weekly chart, it can also be concluded that the current price increase is just a corrective pullback after a multi-week, almost 700-point decline. The bears were unable to gain a foothold within the 8th figure, and eventually lost control of the ninth price level. EUR/USD bulls, taking advantage of the temporary decline in anti-risk sentiment in the market, seized the initiative and tried to make a march, but eventually got bogged down in positional counterattacks. As a result, they only held the 10th figure, although if it were not for the "Friday factor", the bears would have been able to push through the level of 1,1000 without any difficulty. By the end of last week, anti-risk sentiment increased again, supporting the safe dollar.

In addition, representatives of the Federal Reserve voiced rather hawkish rhetoric on Thursday-Friday, allowing dollar bulls to increase their pressure.

In particular, a member of the Fed's Board of Governors, Christopher Waller, said that the current macroeconomic conditions "allow us to raise the rate by 50 points in May," while "geopolitical risks require caution for now." Another representative of the US central bank, the head of the Fed of Minneapolis, Neil Kashkari, also took care of too high inflation. And although he does not have the right to vote this year, he supplemented the corresponding picture of "general concern" about increasing price pressure.

It should also be noted here that the results of the March meeting were by no means dovish. Yes, traders expected a more aggressive attitude from Fed Chairman Jerome Powell, but in general, the US central bank did not abandon its plans for a systematic tightening of monetary policy. At the same time, Christopher Waller made it clear that if the geopolitical situation stabilizes, the Fed is likely to consider the option of a 50-point increase at the May meeting. At least, such expectations will prevail in the market, supporting the US dollar.

Summing up, it should be said that at the moment there are no prerequisites for a reversal of the downward trend. The corrective price increase that we observed last week was primarily due to cautious optimism related to the negotiation process between Russia and Ukraine. However, to date, there are no results in this regard – the parties continue consultations. According to one of the representatives of the Ukrainian delegation, the negotiations may last "several weeks". It is obvious that on "naked optimism", bulls of EUR /USD will not be able to impose their game for a long time (Friday's rollback was eloquent evidence of this), so next week bears are likely to seize the initiative again.

Given the prevailing fundamental background, it is advisable to use any corrective price spikes to open short positions. The first target is the intermediate resistance level of 1.0990 (the Tenkan-sen line on the daily chart), and the main target is the psychologically important mark of 1.0900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română